Croatian euro accession: still some way to go

25 February 2019

Despite already meeting most of the accession criteria, significant reform progress may be necessary to secure support from existing members of the single currency.

By Goran Vuksic

- The Croatian government is aiming to join the euro, although no target accession date has been set.

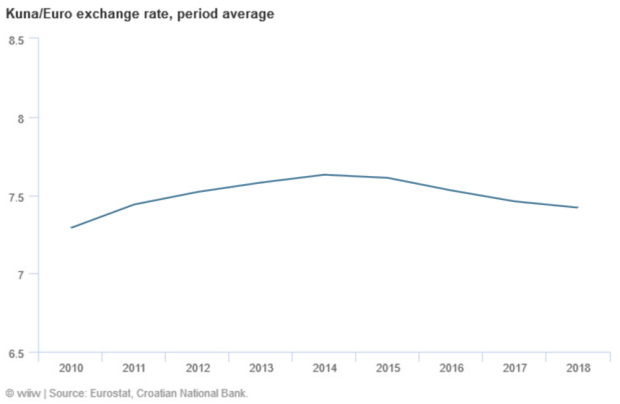

- Croatia meets most of the criteria for euro accession, and it makes complete sense for Croatia to join the euro, given its high degree of economic and financial integration with the single currency area, and the fact that the kuna is already heavily managed against the euro.

- There are, however, risks to Croatia’s euro accession. The economy has experienced large macroeconomic imbalances in the recent past, and remains vulnerable to a renewed downturn in the euro area.

- Moreover the economy faces major medium- and long-term challenges, including low productivity and dire demographic trends.

- The Croatian government is likely to have to demonstrate a strong commitment to delivering necessary structural reforms in order to secure the political support of existing eurozone members for entry to the ERM II mechanism.

In October 2017, the Croatian government and the central bank (CNB) announced the 'Strategy for the adoption of the euro in Croatia' (Eurostrategy). The document evaluates the costs and benefits of euro adoption, but does not set a target date, as the latter depends not only on Croatia.

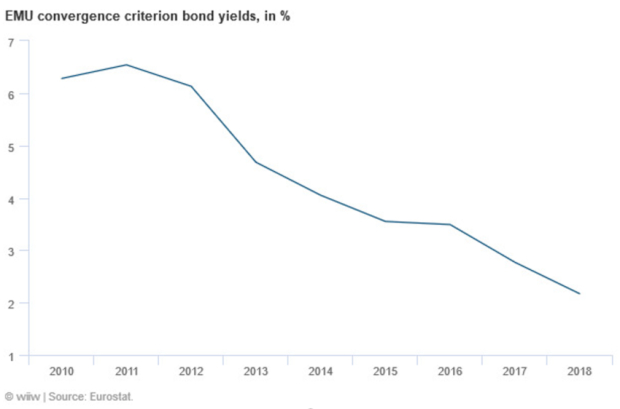

The overall assessment is that the benefits outweigh the costs. According to the document, the largest benefits are expected from currency risk elimination that should reduce the likelihood of banking and balance of payments crises. Medium-sized positive effects should come about through a reduction in interest rates and via investment and trade boosts. On the cost side, the loss of monetary independence is considered a small cost, given the already limited room for manoeuvre for monetary and exchange rate policy, resulting from high exposure to currency risk and strong financial links to the euro area. It is further estimated that a euro adoption will lead to a (one-off) very mild increase in consumer prices amounting to 0.2 percentage points, while the risk of excessive capital inflows and accumulation of imbalances is expected to be mitigated by the mechanisms of EU economic policy coordination.

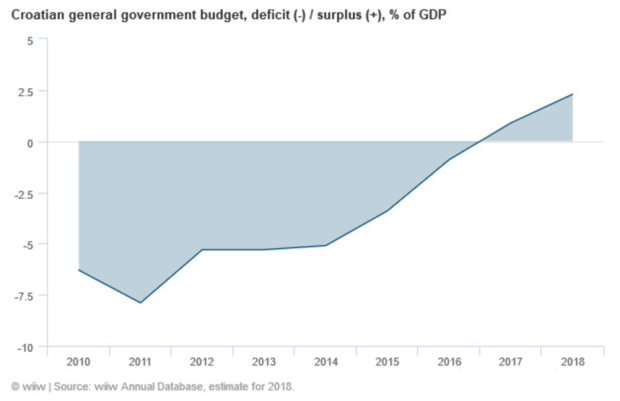

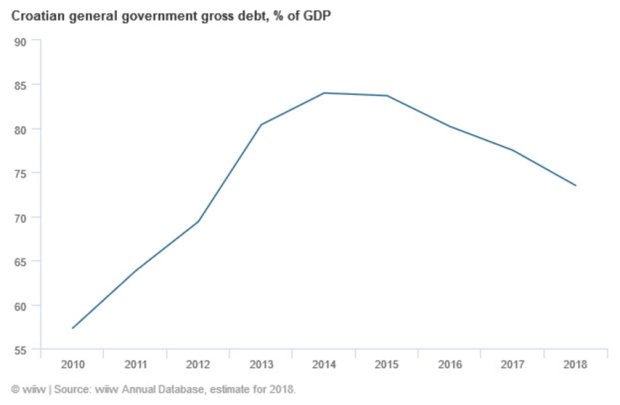

According to the latest ECB Convergence Report (May 2018), consumer price inflation, long-term interest rates, and the general government balance in Croatia are currently within the limits defined by the economic convergence criteria. The general government debt/GDP ratio still exceeds 60%, but has been declining towards the reference value in accordance with the Stability and Growth Pact’s debt reduction benchmark. While the kuna exchange rate against the euro has been quite stable over the last two years, Croatia still did not participate in the exchange rate mechanism (ERM II), which is a required stage in the euro adoption process, and which will last for at least two years once it begins.

Economy faces major challenges, and reform progress is not encouraging

Thus, at first glance, the prospects of Croatia successfully completing the euro adoption process in the medium term do not look that bad. There are, however, some serious risks. The Croatian economy has experienced excessive macroeconomic imbalances, such as high unemployment or a strongly negative international investment position. Despite some recent improvements, the impression is that, similar to positive fiscal developments, these have largely been driven by the comparatively favourable external economic conditions over the recent years. It is likely that, barring a considerable deterioration of these conditions, Croatia’s macroeconomic imbalances will improve, and the public debt to GDP ratio will further decline. In order to achieve better resilience to potential shocks and medium- and long-term convergence sustainability, wide-ranging structural reforms are needed to address the issues of low productivity and potential growth, as well as demographic challenges.

The reform performance of Croatian governments since the country’s EU accession in 2013 has been disappointing, with very slow progress in the implementation of EU policy recommendations, that are deemed to be helpful in achieving a more resilient economy and addressing the aforementioned issues, and which have largely been included in the reform plans of Croatian governments. For example, the assessment of the 2018 National Reform and Convergence Programmes in the 2018 Country-Specific Recommendations by the European Commission noted that “the planned adoption of key legislation to improve Croatia's fiscal framework is long overdue” and that “the introduction of a property tax already legislated was postponed with no indication of whether and when it would be implemented”.

The report also emphasised long-standing problems such as lengthy court proceedings and the inefficiency of the justice system, or administrative burden and parafiscal charges, which “continue to weigh on the business environment”. Moreover, the Commission’s recommendations regarding some of the above issues, as well as for example on the reform of the pension and health care systems, wage-setting mechanisms, or the liberalisation of regulated professions and professional and business services, have been repeated year after year.

Current eurozone members still need to be convinced

This is not to say that no reform progress is being made. The new Fiscal Responsibility Act and the Amendments to the Pension Insurance Act were adopted in December 2018, for example. However, the advances have been very slow. As a result, the recent improvements in macroeconomic stability and growth may turn out to be quite fragile. This is, of course, well known to the current eurozone members (and the EU institutions) that need to decide on the entry of Croatia into the ERM II mechanism. It seems reasonable to assume that the existing euro area members would expect that the newcomers implement the reforms needed to ensure long-term convergence prior to euro adoption (in addition to fulfilling the convergence criteria), as the incentive to reform may weaken once the euro is introduced, and the budget constraints are loosened.

Given that Croatia committed to the euro introduction at the time of joining the EU (like all the other EU members except for Denmark and the UK), the explicit announcement and public presentation of the Eurostrategy (with extensive media coverage) may be seen as an attempt to mobilise public support for the reforms. However, following the announcement of the Eurostrategy, which itself emphasised the need for comprehensive reforms, the percentage of those in favour of euro adoption fell by 5 percentage points to 47% between 2017 and 2018. For the first time (surveys have been conducted since 2014), the proportion of those against the introduction of the euro reached 50%. Despite this decline in public support, it might still be (politically) worthwhile to relate the reform efforts to the goal of euro adoption.

Thus, it seems that the speed and success in the implementation of the planned reforms will determine the success and the timing of the euro adoption process in Croatia. Those reforms can ensure that the preconditions for long-term convergence and stronger resilience to shocks are existent at the time of euro adoption. Croatia would also demonstrate its readiness to undertake further reforms if required by the circumstances, so that also the aforementioned expectation can be fulfilled – namely, that the mechanisms of EU economic policy coordination will mitigate the risk of excessive capital inflows and accumulation of imbalances. This seems crucial in the context of convincing the other euro area members that they will not be threatened by spill-overs if (or when) risks of negative shocks materialise, and ensuring their political support for the entry of Croatia into the ERM II mechanism. In this respect, it will be difficult to be optimistic, in the short and medium term, if the slow progress with economic reforms in Croatia that we have witnessed since its EU accession were to continue.