How much space for fiscal expansion? Germany falls victim to 'output gap nonsense'

04 December 2019

Miscalculations of Germany’s output gap may lead to an excessively pessimistic view about how much the German government could spend without violating the fiscal rules.

- The German economy is currently in a downturn.

- There is a vital debate about the extent to which expansionary fiscal policy can support the recovery of the domestic economy and trigger positive spillover effects in other parts of Europe.

- The German government’s space for fiscal action, however, is restricted by the European Commission’s controversial estimates concerning the amount of slack in the German economy.

- What the international debate has dubbed “output gap nonsense” implies that miscalculations of Germany’s output gap are threating to lead too an excessively pessimistic view about how much the German government could spend to boost the economy without violating the EU’s fiscal rules.

- Current debates about reforming the EU’s fiscal rules and the German debt brake should urgently take current indications of “output gap nonsense” into consideration.

The German economy is in a downturn. The growth rate is currently among the lowest in the euro area, and numerous economic research institutes have revised their forecasts downwards. German industry is already in recession. In the third quarter of the year 2019, growth was very low at 0.1%, and high frequency indicators so far suggest flat growth in the fourth quarter.

What can economic policy-makers do to counter the economic downturn? The scope for monetary policy to stimulate the economy is very much constrained. So even if the European Central Bank (ECB) continues its low interest rate policy, it will not be able to fight the economic downturn on its own.

Calls for expansionary fiscal policy

Prominent international economists and institutions such as the IMF have been calling for Germany to abandon its "black zero" fiscal policy, especially by increasing public investment. The argument is that expansionary fiscal policies in Germany would not only benefit the German economy, but would also have positive indirect effects for the euro area as a whole due to strong economic interdependencies in Europe.

Within Germany, too, there are increasing demands to use the existing fiscal policy space to support the economy – with different emphases on tax cuts and additional government spending. Some of the voices calling for more fiscal action come from rather unexpected sources. For example, the Federation of German Industries (BDI) has recently openly questioned the "black zero" by arguing that – in view of the deteriorating economy –, fiscal policy stimulus is needed. The publication of the latest joint diagnosis was also linked to the assessment that it would be counterproductive for the German government to stick to the black zero in view of the economic situation. And, significantly, German employers and trade unions are now joining forces to push for more public investment and a modification to the debt brake - based on a common study by the research institutes IW (which is close to the German employers) and IMK (which is close to the trade unions).

How much space would Germany have for more expansionary fiscal policy?

The ball is now in the court of the Grand Coalition: will it summon up the political will to break with the "black zero" and accept a (substantial) budget deficit? But even if the federal government were to rethink its policy, the question still remains as to how much room for fiscal manoeuvre the government has at the moment and will have in the future.

Both the EU fiscal rules and the German debt brake restrict the scope for fiscal policy. The central control indicator in this context is the "structural" budget balance. The core of the EU fiscal pact stipulates a maximum annual "structural" budget deficit of 0.5% of GDP (with some exceptions and additional provisions). For countries whose public debt ratio is below 60% of GDP (such as Germany), a "structural" deficit of 1% of GDP is allowed.

In theory, the structural balance is the part of the actual budget balance that is not due to cyclical fluctuations and, therefore, affects long-term fiscal sustainability. From a practical point of view, however, the “structural” budget balance is anything but easy to determine.

The "structural" deficit target is also anchored in the national legislation of numerous EU member states. In Germany this is the case in the context of the controversially discussed debt brake.

If fiscal targets based on the "structural" deficit are breached, the government concerned must impose fiscal consolidation measures (i.e. tax increases and/or expenditure cuts) to reduce the “excessive” deficit. The basic idea is: economic ups and downs have an impact on tax revenues and government expenditures - but these effects are only temporary and should therefore be excluded from the budget deficit in order to get a clearer - "structural" - view of government finances.

The debt brake in the German constitution essentially limits the federal government's borrowing to a structural deficit of a maximum of 0.35% of GDP per year (again with several additional provisions that may become relevant in extraordinary situations). The "structural" deficit is calculated by using a macroeconomic model developed at the European Commission, and this model’s estimates are also used to assess compliance with the relevant EU fiscal rules by the other EU member states. The Commission’s model for estimating the “structural” budget balance is thus an essential component of the policy process.

"Output gap nonsense" in the German debt brake

The European Commission's model, on which the relevant calculations for the German debt brake are based, has recently come under increasing criticism. This is because the "structural" deficit is not directly observable, but must first be calculated using a model. If we disregard possible exceptions, it is precisely this model that determines the scope for fiscal policy action of the states involved; and it is therefore obvious that the quality of fiscal policy decisions depends on the viability of the relevant model.

At its core, the Commission’s model attempts to determine how far the real gross domestic product (GDP) of a certain country is above or below the potential output that would be attainable if the production factors labour and capital were used at “normal” capacity utilization, implying that there is no upward pressure on inflation. The difference between real GDP and potential output gives the so-called “output gap”. The output gap is an economic concept that – at least in theory – provides information on where an economy is in the business cycle.

The central criticism of the estimated output gaps developed by Jakob Kapeller and myself is that the Commission’s estimates are procyclical. During an economic upswing they tend to underestimate the extent of the boom, while in the downturn they systematically underestimate the extent of economic underutilisation. This is reflected in the pro-cyclical fiscal policy mentioned above: If the model interprets a cyclical economic downturn as "structural" – and underestimates the extent to which production factors are subsequently underutilised – then this creates a pessimistic view of the "structural" budget situation. This in turn restricts the respective government's room for fiscal manoeuvre and ultimately puts the pressure on national policy-makers to impose fiscal consolidation measures even during an economic downturn. The additional fiscal consolidation measures then trigger a deepening of the macroeconomic slump. The economic researcher Adam Tooze coined the term "output gap nonsense" to describe the distortion of budgetary policy decisions caused by technical misjudgement of the output gap.

The negative effects of this "output gap nonsense" in recent years have mainly affected the more crisis-ridden EU countries (see in particular the case of Italy, where the Commission currently estimates that the Italian economy is running close to its potential despite the fact that the unemployment rate remains at about 10%, while inflation rates over recent months have been dangerously close to zero). Germany, on the other hand, had been largely spared from the negative consequences of “output gap nonsense” so far because the German economy had recovered from the financial and economic crisis more quickly than other EU countries and had not experienced an economic downturn in recent years.

However, the current economic downturn is the first real test when it comes to applying the EU’s fiscal rules and the debt brake with regard to the possibilities of a fiscal policy tailored to the economic situation. And current data show that Germany is now also being negatively affected by “output gap nonsense”, which is leading to a reduction of the Federal Government's space for fiscal manoeuvre.

The output gap strikes: downward revisions in Germany’s potential output

The figure below shows the calculation of the German "potential output" based on the European Commission’s model. As a reminder: the potential output is an estimate of the level of output that can be achieved with a "normal", i.e. inflation-neutral, utilisation of the production factors. The figure compares the estimation of potential output at two forecast dates: The most recent official estimate based on the Commission's autumn 2019 forecast is compared with the estimate produced in autumn 2018.

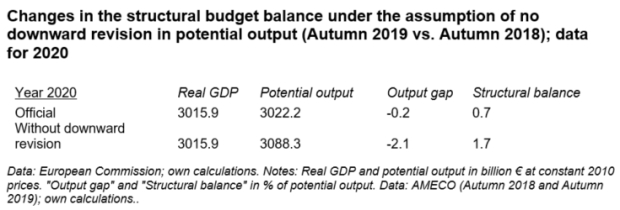

The underlying model has not changed, but the general economic conditions have deteriorated significantly between the forecast dates considered here. In the Commission model, the downturn coincides with a substantial downward revision in potential output: For the year 2020, the European Commission revised potential output downwards by €66 billion. As a result, the Commission is forecasting only a tiny negative output gap of -0.2% of GDP for 2020, despite the economic slowdown. Without the downward revision, the Commission would have estimated the output gap at -2.1%, which would indicate a more severe underutilisation of economic resources.

The next figure illustrates the procyclical nature of the downward revision mentioned above. Within six months, the EU Commission lowered its forecast of Germany's real (i.e. inflation-adjusted) GDP for 2020 by 2.3%. At 2.1%, the downward revision for the estimate of potential output was almost of the same magnitude - the downturn is thus primarily interpreted as a "structural" deterioration. In view of the downward revision in potential output, the output gap hardly changes despite the downturn.

The problems caused by this are now being felt in Germany for the first time since the beginning of the financial and economic crisis ten years ago. After all, what structural deteriorations should have occurred in the German economy within the last year that could explain and justify such a marked downward correction in potential output? Neither is it clear why the productivity of German companies should have slumped in this short time, nor have problems become apparent on the German labour market or in German institutions that would suggest an increase in "structural" labour market problems. To reinterpret the economic downturn as a "structural" deterioration in potential output seems problematic

The following table shows to what extent the pro-cyclical downward correction within the framework of the European fiscal rules and the German debt brake (for both the calculations based on the Commission model are relevant) has an impact on the assessment of the scope for fiscal policy action:

In view of a very small estimated output gap, according to current Commission estimates the structural budget surplus of around 0.7% in 2020 will be almost as high as the Maastricht budget balance.

But what would be the result if we assumed that there had been no downward revision in potential output in autumn 2019 compared with autumn 2018? In this case, potential output would be around €66 billion higher, the output gap would be -2.1%, which would indicate a more severe underutilisation of economic resources - and the structural budget surplus of 1.7% of GDP would be more than twice as high as in the official estimate of the European Commission. It is quite obvious that a less pro-cyclical estimate would leave greater (additional) scope for expansionary fiscal policy for the German state as a whole, to the tune of around 30 billion euros in the year 2020 alone.

Reforming the fiscal rules or: getting rid of “output gap nonsense”

Should the economic downturn in Germany deepen, further downward revisions in the output of potential are to be expected beyond 2020, which will successively further restrict the scope for fiscal policy action – just as has often been the case in Italy, Spain and some other euro area countries over the last decade.

The German government will thus lack room for fiscal manoeuvring because fiscal policy must be compatible with the "structural" deficit limits of the EU’s fiscal rules and the national debt brake. This also undermines the increasing demands of numerous experts for more expansionary fiscal policies.

The debt brake follows a mechanistic approach that forces the federal government to translate the "output gap" nonsense into concrete fiscal policy measures. The reform proposals currently under discussion should take this into account.

It would be important for the German government to advocate a change in the European Commission's pro-cyclical cyclical adjustment method, which forms the basis for calculating the "structural" budget balance. In September, leading economists working for the European Commission on the relevant estimation procedure published a response to the criticisms of the 'campaign against nonsense output gaps', in which they defend the Commission’s cyclical adjustment method. Although the article represents an important contribution to the debate, the responses provided by the Commission’s economists concerning the criticisms they considered are questionable. Most importantly, the Commission has not overlooked serious problems in terms of the pro-cyclicality of its estimates.

A pragmatic reform approach would be, as Daniel Seikel and Achim Truger propose, to update the estimation of potential output only every three to five years – and not two to three times a year as is currently the case, as the status quo implies that cyclical data revisions within the framework of the Commission’s model calculations can rapidly grow into new "output gap nonsense" and corresponding problems for fiscal policy.

Another option would be to develop a different model for calculating potential output that is less vulnerable to output gap nonsense. And the most radical option would ultimately be to reform the EU rules and the German debt brake in such a way that they do entirely without reference to unobservable control variables.

All these reform options have their pitfalls – but they must be discussed in order to arrive at an improved institutional framework for a fiscal policy that takes the macroeconomic context into account. In addition to the federal government, half of the German states will also be directly dependent on the results of the problematic Commission calculation procedure from 2020 onwards – and thus threatened by being drawn into a pro-cyclical policy. The problems caused by the Commission's underlying model should therefore be urgently considered in the current debate on the direction of fiscal policy in Germany and also be taken into account when it comes to reforming the EU’s fiscal rules and the debt brake.