How 'output gap nonsense' endangers Germany's recovery from the Corona crisis

02 July 2020

Miscalculations of Germany’s output gap may lead to an excessively pessimistic view on how much the German state can spend.

by Philipp Heimberger and Achim Truger.

- Output gap estimates – used as measures of economic slack – are the technical core of the EU’s fiscal rules and they are also relevant in the context of national “debt brakes”.

- As the COVID-19 shock hit and actual output declined, the European Commission revised output gap estimates so that they indicate a smaller degree of economic slack.

- This implies larger ‘structural’ deficits, so that fiscal consolidation pressures on national governments will increase once the currently activated escape clauses of the fiscal rules are lifted.

- In Germany as well as in other EU countries, applying the fiscal rules could become a self-fulfilling prophecy: pessimistic revisions of output gap estimates require more fiscal consolidation, which reduces output and causes long-term economic scars, leading to further rounds of revisions in the underlying model estimates of economic slack, which partly validate the original pessimistic model forecasts.

The economic impact of the COVID 19 pandemic in Europe is severe. The immediate response of national EU governments has been to introduce fiscal policy measures to mitigate negative macroeconomic consequences. On the basis of a recommendation by the European Commission, the European Council activated the general escape clause in the Stability and Growth Pact.

This step temporarily provides both the German and other governments in the EU with additional fiscal space for temporarily running higher budget deficits. However, there are open questions concerning the fiscal policy stance and the coordination of fiscal policies across countries once the suspension of fiscal rules is lifted. Then the key issue will be to prevent a counterproductive shift towards fiscal consolidation, which would stifle economic recovery from the Corona recession.

However, as we will show in this article, such a shift will unfortunately be promoted by allegedly purely technical specifications of the cyclical adjustment procedure used in the fiscal rules. Avoiding a pro-cyclical fiscal policy bias that undermines the economic recovery will require that policymakers' hands are not tied by "output gap nonsense".

The role of the output gap in fiscal rules

The output gap is the technical core of the EU’s fiscal rules, and its estimation influences the fiscal policy space of the respective EU member state: the medium-term budgetary targets (MTOs) in the European fiscal rules refer to the "structural deficit", the size of which is directly dependent on estimating the output gap.

In theory, the "structural deficit" is the part of the actual fiscal deficit that weighs on long-term debt sustainability, since it is not attributable to cyclical fluctuations. In essence, the EU’s fiscal rules stipulate a maximum annual "structural" fiscal deficit of 0.5% of GDP (with some exceptions and additional provisions). For countries whose public debt ratio is below 60% of GDP, a "structural" deficit of 1% of GDP is permitted. However, as the Corona crisis has pronounced effects on public finances, public debt ratios below 60% of GDP will in any case move into the more distant future.

The "structural" deficit target is also enshrined in the national legislation of many EU member states under the EU Fiscal Compact of 2012 in the context of so-called "debt brakes". In Germany, this has already been the case since 2009 within the framework of the controversially discussed debt brake that is part of the German constitution.

If fiscal targets based on the "structural" deficit are breached, the government concerned must take fiscal consolidation measures (i.e. tax increases and/or spending cuts) to reduce the ‘excessive’ deficit. The basic idea here is that cyclical ups and downs affect tax revenues and government expenditures. However, these effects are only temporary and must therefore be removed from the fiscal deficit in order to obtain a clearer - "structural" - view of public finances.

The debt brake in the German constitution limits the federal government's borrowing essentially to a structural deficit of no more than 0.35% of GDP annually (again with several additional provisions that may become relevant in special situations). For the federal states, there is even a ban on “structural” new borrowing. The calculation of the "structural" deficit for the federal government and many federal states is based on the model of the European Commission, which is also used for the other EU member states to assess compliance with the EU’s relevant fiscal rules. This model is thus an essential component of the political process, as it is used to answer the question: Where does the "structural" fiscal balance actually stand?

"Output gap nonsense" before the Corona crisis

Pessimistic assessments based on the Commission model imply that even in times of a severe economic downturn only relatively small negative output gaps are estimated - indicating a small degree of resource under-utilisation in the respective economy. Even in an economic upswing, the extent of overheating may be underestimated based on biased real-time output gap estimates. In this context, the economic historian Adam Tooze coined the term "output gap nonsense".

Especially over the years 2010 to 2014, pessimistic output gap estimates promoted a pro-cyclical stance of fiscal policy with negative effects on economic growth and employment. The output gap nonsense became a self-fulfilling prophecy: fiscal consolidation caused long-term economic scars (hysteresis effects), leading to further rounds of downward revisions of potential output, which partly validated the original pessimistic forecasts of potential output and in turn led to increased fiscal consolidation pressures.

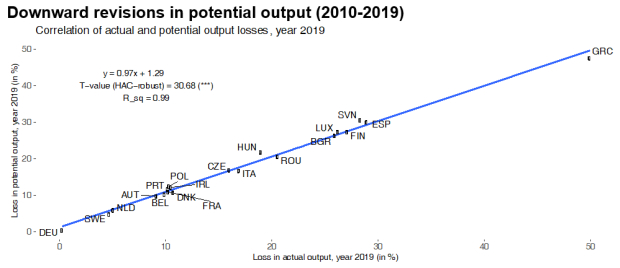

Losses in potential output over the period 2010-2019 ranged from 47.6% in Greece and 30.0% in Spain to negligible losses in Germany (0.4%). As the chart below shows, there is an almost perfect positive correlation between losses in potential output and losses in actual output for the EU27 countries. The potential output model actually provided systematic pro-cyclical estimates in the ten years before the corona crisis.

(For details on the calculation method of losses in potential output and real GDP: see Heimberger, P.; Kapeller, J. (2017): The performativity of potential output: Pro-cyclicality and path dependency in coordinating European fiscal policies, Review of International Political Economy, 24(5), p. 917. Six EU27 countries could not be included due to data limitations.)

In the ten years preceding the start of the corona pandemic, the negative effects of "output gap nonsense" hit the more crisis-ridden EU countries particularly hard (see in particular the case of Italy). Germany, on the other hand, was largely spared because the German economy recovered from the financial and economic crisis more quickly, more strongly and more persistently than those of other EU countries.

"Output gap nonsense" in times of the Corona crisis

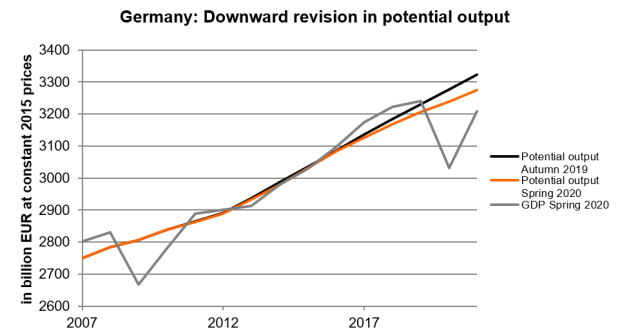

But with the economic slump in the context of the Corona crisis, Germany is now also affected by the "output gap" nonsense. To provide a first analysis of the impact of the economic slump on estimates of potential output in the context of the COVID 19 crisis, we compare the estimates from the European Commission's Autumn 2019 Forecast, published before the outbreak of the COVID 19 pandemic, with the Spring 2020 Forecast, which provides first estimates after the outbreak of the pandemic. The Commission model used has not changed, but the macro-economic data have changed due to the economic impact of the COVID-19 pandemic.

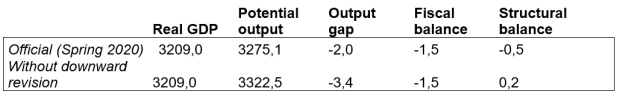

Applying the Commission’s potential output model leads to a substantial downward revision for Germany: For the year 2021, the forecast of the EU Commission revises potential output by almost EUR 47.4 billion downward. As a result, the Commission forecasts an output gap of only -2.0% of GDP for 2021 – despite the economic slump. Without the downward revision, the EU Commission would have estimated the output gap at -3.4%, which would correspond to a much higher underutilisation of economic resources.

As soon as the fiscal rules are again activated, the downward revisions in potential output will make it more difficult for Germany to achieve its medium-term budgetary targets. This is because the "structural" deficit - estimated on the basis of the Commission's potential output model - not only plays a key role with regard to the fiscal control indicators of the EU’s fiscal rules, but is also at the heart of Germany's constitutional "debt brake". As soon as the escape clauses temporarily suspending the "structural" deficit limits cease to apply, a more pessimistic view of potential output will systematically limit the space available to German fiscal policy when it comes to supporting the recovery.

The extent to which the pro-cyclical downward revisions affect the assessment of fiscal policy space is illustrated by the following comparison: in view of a smaller estimated output gap, Germany will, according to the latest Commission forecasts, record a "structural" fiscal deficit of 0.5% of GDP in 2021, which is one third of the actual fiscal deficit of 1.5%.

But what would be the result if we assume that there had been no downward revision in potential output in spring 2020 compared with autumn 2019? In 2021, potential output would be around EUR 47.4 billion higher, the output gap would be -3.4%, indicating a more severe underutilisation of economic resources - and the German government would not run a "structural" fiscal deficit but even a "structural" surplus of 0.2% of GDP. Obviously, a less pro-cyclical estimate would leave more (additional) space for expansionary fiscal policy, amounting to roughly EUR 25 billion in 2021 alone.

Premature turn to fiscal consolidation?

At present, the problems caused by the "output gap nonsense" are even more serious in the context of the German debt brake. This is firstly because the structural deficit under the German constitution's debt brake is a more binding constraint than at the EU level: the federal and state budgets must comply with the structural deficit requirements in the process of planning and implementation. At the EU level, by contrast, there is more discretionary space within the EU’s fiscal framework. Second, the application of the EU Commission method for calculating potential output by the federal government leads to even more serious downward revisions of potential output.

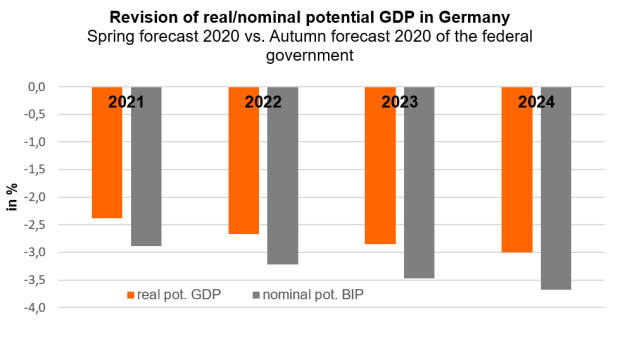

In the federal government's forecasts, potential output for the year 2021 was revised downwards by 2.4% in real terms and 2.9% in nominal terms from autumn 2019 to spring 2020. In the years 2022 to 2024, which are relevant for the financial planning of the federal and state budgets, the deviation becomes increasingly larger and increases to 3.0% in real terms and 3.7% in nominal terms.

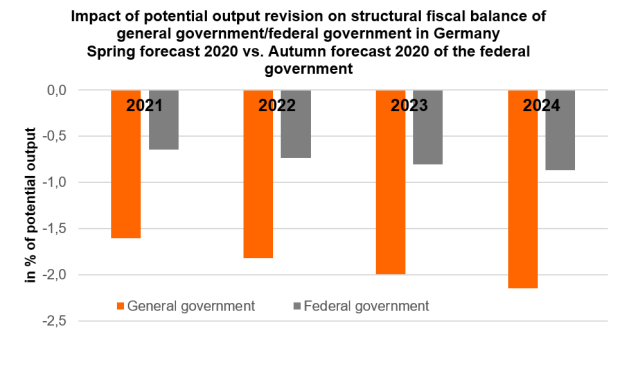

As a result, the structural fiscal balance deteriorates by 1.6 percentage points in 2021, due to the potential output revision, and by 2.1 percentage points in 2024. For the federal government alone, the revision-induced deterioration will amount to 0.6% of GDP in 2021 or about EUR 20 billion; in 2024 it will already be 0.9% of GDP.

If the structural fiscal balances calculated in this way are used in the financial planning processes of the federal government and the states concerned, fiscal policy could become more restrictive than appropriate as early as 2021. In addition, the smaller output gaps calculated may make it more difficult to activate the exemption clause of the debt brake again in subsequent years in order to be able to take out higher loans in response to a macroeconomic emergency. Added to this are the repayment obligations that the Federal Government and the Länder have entered into for the additional debt taken up under the exemption clause of the debt brake. If the cyclical adjustment procedure is not changed and if the repayment periods of less than 10 years are not significantly extended, German fiscal policy is threatened by a drastic fiscal consolidation stance in the near future.

Conclusions

Should the economic situation in Germany deteriorate more than currently forecast, further downward revisions in potential output are to be expected beyond 2021, which will gradually further restrict fiscal space – just as was often the case in Italy, Spain and some other euro zone countries over the past decade. As soon as the fiscal rules are again activated, Germany will thus also be affected by the "output gap nonsense", which produces additional fiscal consolidation pressure at the wrong time. German fiscal policy will lose room for manoeuvre, because it will have to align itself with the "structural" deficit limits of the EU’s fiscal rules and the national debt brake.

So what can be done? First, if the fiscal rules are reactivated, downward revisions in potential output should remain suspended. A pragmatic solution would be to use the estimates from autumn 2019 (before the outbreak of the Corona pandemic). It is well known that real-time estimates of potential output pose a major problem even for the smartest economic minds. Particularly in times of extraordinary uncertainty about future economic developments, the hands of fiscal policy makers should not be systematically tied by extremely revision-prone model estimates.

In the long term, it would be important for the German government to advocate a change in the European Commission's pro-cyclical cyclical adjustment method, which is the basis for calculating the "structural" deficit. Recently, it seems that space has opened when it comes to critically thinking about reforming the underlying estimation procedure. Although the potential output model has been slightly adapted in several steps in recent years and the problem of pro-cyclical estimation problems has been known for some time, the need to reform the underlying estimation procedure is more urgent than ever.

An evaluation of the EU's fiscal rules and debates on technical reform options were already underway at the beginning of 2020. In a document accompanying the evaluation process, the European Commission states: "[T]he framework relies heavily on variables that are not directly observable and are frequently revised, such as the output gap and the structural balance, which hampers the provision of stable policy guidance.”

Avoiding pro-cyclical policies in the coming months and years requires a reform of the estimation model underlying the cyclical adjustment of fiscal indicators in the EU’s fiscal rules, but also in the German debt brake. There are numerous technical papers working towards better real-time estimates that would be less susceptible to systematic procyclical revisions.

The underlying estimation model of the European Commission would have to take into account the existence of hysteresis effects - i.e. long-term damage (scars) as a result of cyclical economic downturns. A correct consideration of hysteresis effects in the modelling would point to the need for very aggressive expansionary fiscal policy in times of crisis, especially during major negative cyclical events such as those experienced by the euro area in 2008-2014.

And we can already see today that the COVID 19 crisis also falls into the category of major negative cyclical events. Therefore, more flexibility will be needed to avoid negative feedback effects arising from the application of EU fiscal rules, where downward revisions in potential output require stronger fiscal consolidation, which – in turn – undermines the economic recovery and ultimately also has a negative impact on the sustainability of public debt.

Note: Translated and adapted from an article that first appeared in “Makronom”. The original article is here (in German).