The push for a global minimum corporate tax rate

12 April 2021

There is political momentum in the debate over changing the global corporate tax system after recent announcements by the US government.

By Philipp Heimberger

Photo credit: iStock.com/Antonbr Anton

- The US administration has put forward its corporate tax plans, including a global minimum corporate tax rate.

- The US plan poses a threat to tax havens, because its implementation would strongly reduce incentives for companies to shift profits to low tax jurisdictions.

- There will now be further negotiations within the OECD-G20 framework. The details of the agreement will determine how much bite a global minimum tax would have.

The new US administration has recently announced tax plans consisting of a global minimum corporate tax rate of 21% calculated on a country-by-country basis, which would reduce incentives for companies to shift profits to low tax jurisdictions.

As Treasury Secretary Yellen is now actively arguing for coordinated measures against a “race to the bottom” in global corporate taxation, France, Germany and the IMF have all voiced basic support for a minimum tax. The recent political push will now need to be translated into detailed agreement, which will determine how much bite a minimum tax rate actually has.

The two pillars of the OECD-G20 proposals

There is now certainly hope for progress in the negotiations based on the OECD-G20 proposals on improving international tax coordination. These proposals consist of two pillars: First, individual governments would be given some rights to tax the profits of multinational corporations. The tax rights would be partly shifted to where the consumers are. This would apply, for example, to the foreign operations of US tech giants, some of which could be taxed in Europe.

The second pillar is a global minimum tax rate for companies – that’s where the US administration is now making a big push. This minimum tax rate aims to ensure that corporate profits - regardless of the jurisdiction in which they were earned - can no longer be taxed below a certain minimum rate. In doing so, countries would be allowed to tax the income of domestic companies earned abroad if the foreign tax rate is below the agreed minimum tax rate.

This would make tax avoidance through profit shifting more difficult. And it would also reduce the incentives for governments to reduce corporate tax rates below the minimum tax rate in order to attract corporate domiciles to their country.

Tax competition has pushed tax rates downwards

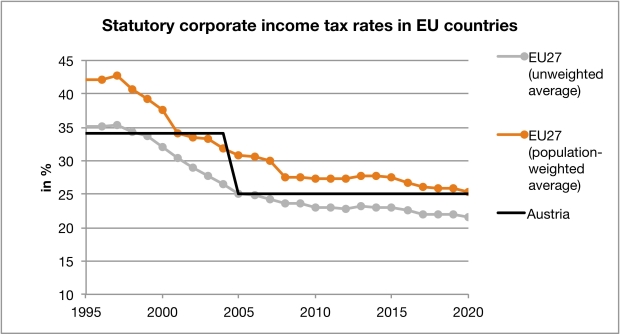

Corporate income tax rates have indeed fallen markedly in recent decades within the EU and internationally. As I show in a recent study, tax competition is a key explanatory factor for the decline in corporate tax rates: independent governments of different countries have interacted with each other in an uncooperative way when setting corporate taxes. When "competitor" governments abroad cut corporate tax rates, the government at home often responds by cutting taxes as well.

Source: European Commission (top statutory corporate income tax rate including surcharges); own calculations. EU27 excluding the United Kingdom.

It is clear that international tax competition can most effectively be tackled if there is tax coordination between governments. Unilateral action by individual countries does not solve the basic problem that there are incentives to reduce taxes uncooperatively in order to attract corporations. This is precisely why the introduction of a global minimum tax would be a big step.

But even a minimum tax would only restrict tax competition, not abolish it. The extent to which the business models of tax havens are actually curtailed will depend to a large extent on the details and exemptions – but also on negotiations on harmonising tax bases in the future, i.e. to standardise not only the minimum tax rate but also what is actually being taxed. Even bigger steps will be needed in the future to stop the profit-shifting strategies of increasingly powerful multinational corporations.