EU-Russia sanctions exchange has had important economic and political consequences

20 February 2019

The Russian economy has suffered but also adapted, while pivoting to the East. Ukraine is still in trouble and the EU lacks a strategy.

By Peter Havlik

In a few weeks we will mark the fifth anniversary of the Russian annexation of Crimea, and the onset of open conflict between Russia and the West. This conflict has gravely affected not only Russia and Ukraine, but it may potentially endanger a fragile economic growth in Europe as well. Western sanctions on Russia, which were initially introduced in March 2014 even before the Russian annexation of Crimea, have been since that time several times expanded and regularly prolonged.

Russia and Ukraine have naturally been the hardest hit. Among the key economic consequences of the conflict and, implicitly of sanctions, are:

- a deep recession in Ukraine where the economy shrank by more than 15% during 2014-2015 and the subsequent recovery - with expected GDP growth below 3% per year according to latest wiiw forecast - has been unimpressive;

- the economic losses incurred by Russia were estimated at some 1% of annual GDP during 2014-2015 (cumulated about EUR 100 billion), or at some 0.5%-1.5% of foregone GDP growth after the latest round of US financial sanctions introduced in August 2018 elevated investment risks;

- both the Russian recession of 2015 and the subsequent economic stagnation of 2016, as well as a weak recovery afterwards, have been attributed at least partly to Western sanctions (the collapse of oil prices 2015 and a depreciation of the Rouble played a role as well);

Impact on the EU varies by country

While on aggregate the impact on the EU has been much less, some individual countries have been negatively affected by the sanctions. The economic effects on individual EU countries vary according to their exposure to the Russian market, with the Baltics and several East European EU member states affected more than others.

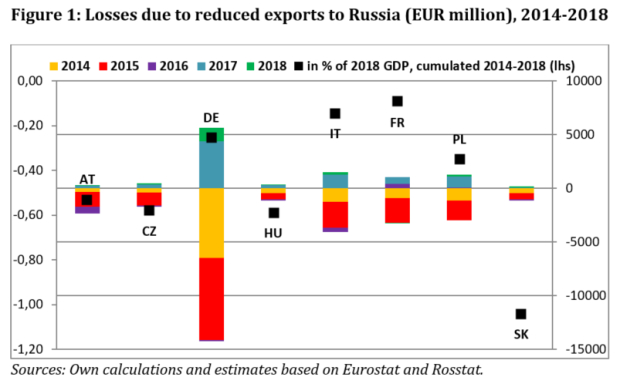

Recent wiiw estimates based on Eurostat and Rosstat foreign trade data reckon with a -0.2% loss of German GDP owing to the reduction of exports to Russia, cumulated over the period 2014-2018 (2018 was estimated from the Russian mirror statistics). A similar estimate for Austria yields a cumulated GDP loss of -0.5% of GDP over the same period. More affected were the Czech Republic and Hungary (each -0.6% of GDP), and especially Slovakia which has relatively high exposure towards the Russian market (loss of more than -1% of GDP – see Figure 1). In absolute terms, however, the biggest loss was incurred by Germany (export loss of more than EUR 14 billion during 2014-2016), with a subsequent export recovery in 2017 and 2018. Italy, France and Poland incurred large absolute export losses in Russia as well (Figure 1). As far as the EU as a whole is concerned, the cumulated export loss to Russia during 2014-2018 is estimated at EUR 30 billion (about -0.2% of EU’s GDP in 2018), again incurred largely during 2014-2016 as EU exports to Russia recovered in 2017 (see below).

The five European sectors most exposed to the Russian market at the time the sanctions were introduced were textiles, pharmaceuticals, electrical machinery, machinery and transport equipment – all sectors where goods exports to Russia accounted for more than 3% of the total in 2013. Machinery, transport equipment and pharmaceuticals still play an important role in Austrian and German exports to Russia.

By contrast, foodstuffs (imports of meat, milk, fish, fruits and vegetables from the West which were banned by the Russian embargo since August 2014) did not play a major role in EU exports (except for the Baltic states, Finland, Germany, the Netherlands and Poland). Austrian exports of these products to Russia amounted to just EUR 100 million in 2013 (ibid). Part of these exports was diverted to other markets and/or found their way to Russia e.g. via Belarus or Serbia.

In Russia, there was just an uptick in food inflation in 2014-2015 as a result, but a simultaneous import substitution contributed to a revival of domestic agriculture that has been one of the rare successes of the domestic economy – at least until the last year. In services, especially tourism was adversely affected as the number of Russian tourists dropped substantially after 2014, though rather than sanctions this can again be largely attributed to the devaluation of the Rouble in 2014-2015 (which made foreign trips for Russians much more expensive).

2017 witnessed a strong revival of Russian imports (+22% against 2016). This included higher imports from the EU, as the Russian economy returned to growth and the rouble appreciated – without any substantial change in sanctions policies during that year. The Russian import recovery, albeit weaker, continued in 2018 and economic growth reached a conspiciously high level (+2.3%) unmatched (and unsustainable) in the previous five years.

Russia-EU trade relationship has been permanently affected

In this way a part of export losses incurred during 2014-2016 could be compensated (Figure 1). Nonetheless, EU exports to Russia still remain about 20% (EUR 30 billion) below the pre-sanctions level of 2013. Simultaneously, Russian imports from China (but also from Japan, Turkey and Switzerland) expanded much faster. Consequently, Russia has been changing the pivot from the EU towards the East, particularly to China. Though China still cannot replace the EU as a source of imports due to structural reasons, these ‘structural gaps’ have been significantly reduced during the last couple of years. Russia has been reorienting its imports from the EU and China has become the biggest Russian trading partner, accounting last year for 21% of Russian imports and 13% of exports (2013: 17% and 7%, respectively), overcoming Germany (by imports already since 2008) and The Netherlands (by exports since 2017).

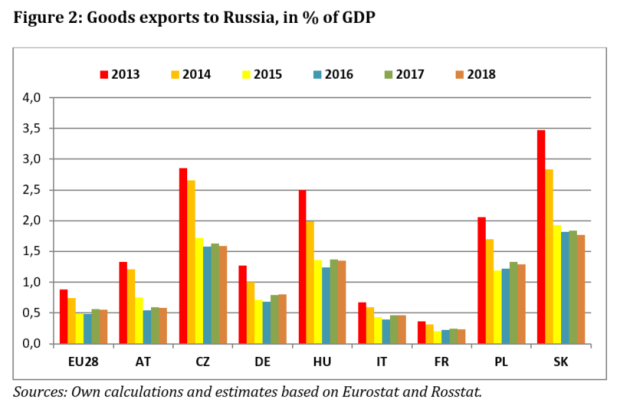

At the same time, the EU as a whole and even its new member states have become less dependent on the Russian market. On aggregate, the share of EU exports going to Russia halved between 2013 and 2018 (Figure 2). However, the EU’s import dependency – especially on Russian oil and gas that account for more than 60% of EU imports from Russia – is poised to increase, especially since the EU’s energy consumption is continuing to rise, and the Nord Stream 2 gas pipeline will be completed

Conclusion: sanctions damaged Russia economically, but had perverse impact on integration and modernisation strategies

One could conclude – perhaps with a bit of sarcasm – that Western sanctions ‘crippled Russia’s long-term economic prospects’ as they deter modernisation and restructuring investment, but they did not achieve the intended aims, namely the change in Russian policies – particularly with respect to Crimea and Eastern Ukraine (although some experts argue that sanctions have been effective since they might have prevented Russia from further incursions in Ukraine). While there is currently a stalemate in Ukraine prior to presidential elections scheduled for 29th March 2019, the Minsk agreements remain unfulfilled, with OSCE diplomatic initiatives stalled and, paradoxically, the issue of Russian sanctions remaining a toxic domestic policy topic in the US.

In addition, the sanctions definitely contributed to Russia’s pivot towards the authoritarian regime in China. With a current account surplus of more than EUR 100 billion in 2018 (7% of GDP), foreign exchange reserves of EUR 450 billion, simultaneous foreign debt deleveraging and fiscal surplus, Russia is getting ready for a prolonged conflict with the West – disregarding the collateral damage that sanctions have on the domestic economy.

photo: istockphoto/mikolajn