Just released: wiiw Handbook of Statistics 2019

03 December 2019

The new edition of the wiiw Handbook of Statistics 2019 offers a wide range of updated statistics for data-driven analysis of 23 CESEE economies.

The 25th edition of the wiiw Handbook of Statistics contains key macroeconomic and structural indicators for 23 economies in Central, East and Southeast Europe (CESEE), serving as an easy-to-use reference tool and facilitating comparisons across topics, countries and time. It is an important source of information for researchers, analysts with multinational corporations and banks, managers and policy-makers with a strategic interest in CESEE.

Key features include:

- Comprehensive macroeconomic data for 23 countries in CESEE, with Moldova included for the first time;

- Broad range of indicators, covering economic growth, population and labour markets, wages and prices, public finance, and external economic relations;

- Key indicators, tables and maps comparing countries in the region with key global benchmarks, including the EU, USA and Japan;

- A full overview of the processes of transition and convergence in the region over 1990-2018 in the Excel version of the book;

- Tracking structural changes in CESEE economies with data on value added, employment and wages by economic activities, export and import by product and partner country, FDI inward stocks by investing countries and economic activities;

- More extensive and detailed data on peripheral CESEE economies than comparable databases.

Sample tables and maps for each chapter can be viewed for free here: PDF or Excel.

Selected trends in CESEE economies captured by data presented in wiiw Handbook of Statistics 2019

For the second consecutive year, all CESEE countries posted positive real GDP growth rates in 2018. Three countries - Hungary, Poland and Montenegro - grew by more than 5%. These three, along with Turkey, Romania, the Czech Republic, and Estonia, all posted average growth of over 3.5% in the five years to 2018. Slightly more than half of CESEE countries posted stronger growth in 2018 relative to 2017. Of the rest, the most significant slowdowns relative to the previous year were recorded in Turkey and Romania.

Detailed statistics on GDP real growth rates see:

Chapter I Cross-country overview, Table I/2 / Gross domestic product, real growth

CESEE economies have generally been resilient to external headwinds and maintained a significant positive growth differential to Western Europe in 2018. Except Turkey, all economies moved closer to the average EU28 per capita income level (at PPP) in 2018. The Czech Republic still has the highest income level in the region, and is richer than Greece, Portugal, Cyprus and Spain. Its remaining income gap to the average EU28 level is less than 10%.

Chapter I, Table I/6 / Gross domestic product per capita at PPPs relative to EU-28

In 2018 real wages grew faster in the majority of the CESEE countries than in the euro area on average. Economic convergence is therefore reflected in catching-up in living standards. On a sub-regional level, Ukraine and the CIS countries experienced stronger annual real wage increase in 2018 compared with the previous year, and well above their five-year averages. By contrast, EU-CEE real wage growth last year was largely in line with the trend of the past five years. In these countries, significant real wage increases have been mainly underpinned by better bargaining positions of workers. This is owing to tight labour markets, in part due to population decline.

Comparison with other countries: Chapter I, Table I/17 / Average gross monthly wages, real

More structural data on wages: Chapter III. Structural indicators - 5. Average gross monthly wages by activities

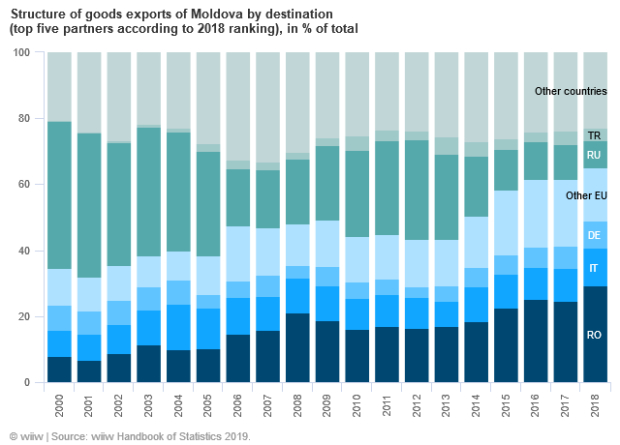

Regional income disparities between CESEE countries remain large, and the catching-up process for most non-EU economies in region remains at a relatively early stage. These economies have mostly not yet benefited from closer trade integration with or FDI inflows from the EU, nor from EU budget transfers. Along with Ukraine, Moldova is the poorest country in the region in terms of GDP per capita at PPP. Moldova’s real GDP growth of 4% or higher over the last three years is encouraging, but positive economic prospects are at risk due to domestic political uncertainty and unaccomplished reforms. The Deep and Comprehensive Free Trade Agreement (DCFTA) with the EU, that entered into force in July 2016, has contributed to changes in Moldova’s export structure: 69% of exports went to the EU in 2018, an increase of 7 percentage points from 2015. Exports to Russia, previously Moldova’s second most important partner, fell to 8% of the total in 2018, 4 percentage points lower than in 2015. Even when treating countries individually, Russia slipped to the fourth place in the 2018 ranking of most important export destinations for Moldova, after Romania, Italy and Germany. The changes in trade direction were accompanied by an increase in Moldova’s total exports from EUR 1.8bn in 2015 to EUR 2.3bn in 2018.

Main indicators for Moldova: Chapter II, Table II/13 / Moldova: Main economic indicators

More detailed data on foreign trade by partner:

Chapter III. Structural indicators - 6. Foreign trade by partners

More detailed data on foreign trade by product groups:

Chapter III. Structural indicators - 7. Foreign trade by commodities

Most CESEE economies have not lost their attractiveness for foreign investors, despite a global trend of declining FDI. FDI inward stock growth in euro terms was particularly strong in Moldova, Albania, Serbia and North Macedonia in 2018 compared to the previous year. At the same time, the decline in the stock of inward foreign direct investment in euro terms was most pronounced in Russia and Turkey.

Traditionally, the CESEE region has attracted most investment from EU countries. For each of EU-CEE countries, more than three quarters of their inward FDI stocks come from the EU28, according to the last available data (2018 or 2017). However, for Hungary and Slovenia the importance of investment from the EU28 has been declining slightly over the last five years. For the Western Balkans countries, except Kosovo and to a lesser extent Bosnia and Herzegovina, the role of EU28 countries as foreign investors, based on inward stock data, is declining as well.

Chapter III. Structural indicators - 8. FDI inward stock

Countries covered:

Albania, Belarus, Bosnia and Herzegovina, Bulgaria, Croatia, Czech Republic, Estonia, Hungary, Kazakhstan, Kosovo, Latvia, Lithuania, Moldova, Montenegro, North Macedonia, Poland, Romania, Russia, Serbia, Slovakia, Slovenia, Turkey, Ukraine.

Country groups list: CESEE countries

The wiiw Handbook of Statistics is available in hardcopy with the most recent years and in Excel format covering the whole period.