Why Europe needs more public investment

18 October 2016

wiiw Economist Philipp Heimberger assesses Europe’s fiscal policies and calls for a coordinated push for public investments, in which the surplus countries should lead the way

Macroeconomic troubles in the euro area (quietly) continue, as the unemployment rate is still above 10%. In July 2016, 16.3 million people across the European Monetary Union were unemployed. The problem of mass unemployment is most acute in the periphery of the euro area. In Spain, unemployment still stands at around 20%, in Greece at 23.4%; and in France and Italy – the two largest euro area economies after Germany –, the unemployment rate exceeds 10%. ‘Core countries’ such as Austria, the Netherlands and Finland, however, have recently also recorded unemployment rates at historically high levels.

Fiscal policy, unemployment and growth

Against the backdrop of low growth and high unemployment, the role and usefulness of fiscal policy for spurring growth in post-crisis Europe is the subject of fierce policy debates. The International Monetary Fund and renowned macroeconomists have recognized by now that fiscal consolidation efforts in recent years have not delivered the promised results.

Critical assessments about the macroeconomic effects of fiscal austerity are backed up by a growing academic literature, which points to substantial negative growth effects of fiscal consolidation measures during periods of economic underutilization and during periods characterized by severe constraints in the ability of monetary policy to offset the negative demand effects of fiscal austerity. In a much-cited paper, the (former) IMF chief economist Olivier Blanchard (together with Daniel Leigh) presented evidence according to which each percentage point of fiscal consolidation caused GDP to decline by more than 1 percentage point.

The policy debate on the dearth in investment

While investment in the private sector remains weak due to high economic uncertainty and low sales expectations by firms, both prominent economists and some politicians have recently recognized that governments have to play a key role in financing and directing investment. In mid-September, Jean-Claude Juncker proposed doubling the EU investment plan to €630 million in order to create more jobs and alleviate the problem of mass unemployment. However, it is often argued that even the proposed doubling of the investment funds would not be enough to provide a sufficient boost for the ailing European economy.

Decline in public investment due to austerity policies

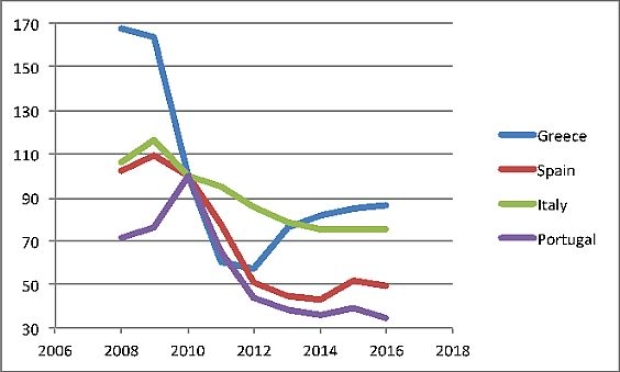

The turn to fiscal consolidation policies in Europe, implemented by policy makers in 2010/2011, has indeed left deep traces in the evolution of public investment: cuts in government spending have disproportionately affected investment-related spending for infrastructure. This is illustrated by the plot below, showing that the periphery countries of the euro area – which were under the most severe pressure to pursue fiscal consolidation – have also seen the most pronounced decline in real (price-adjusted) public investment. In Greece, the cuts have amounted to 13.5% between 2010 and 2016; in Italy, the decline has so far been 24.6%, in Spain 50.4%, and in Portugal 65.3%.

Graph 1: Real public investment (2010=100)

Periphery countries of the euro area

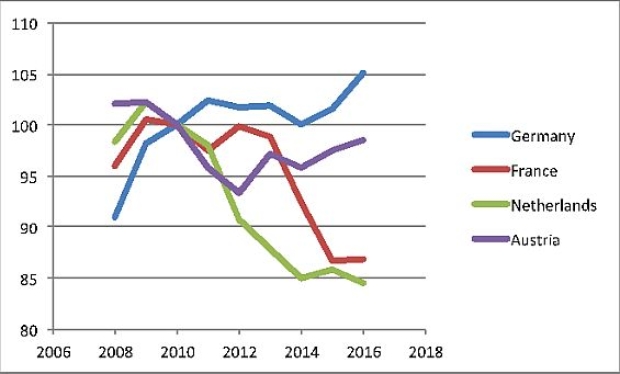

However, cuts in public investment are not restricted to the periphery of the euro area, as so-called ‘core countries’ have also been affected. In France, for example, real public investment has fallen by 13.1% between 2010 and 2016; and in the Netherlands, the decline of 15.5% has been even more marked. In 2016, public investment in Germany was only 5.1% above the level from 2010.

Graph 2: Real public investment (2010=100)

Core countries of the euro area

In Austria, price-adjusted public investment between 2010 and 2016 has fallen by 1.6%. The Austrian debt brake, which was put into place on the basis of the European Fiscal Compact, has resulted in a restrictive fiscal policy stance, impeding investment-related government spending.

Reduction in public investment has prolonged the crisis

Since 2010/2011, the marked reduction in public investment has deepened and prolonged the economic crisis in the euro area. The reason is that cuts in government spending push down aggregate demand (and, hence, production). On the one hand, this is due to negative direct effects, as total spending in the economy declines when government spending is cut. On the other hand, there are indirect negative effects of fiscal consolidation, as lower aggregate demand makes companies cut back on their investments as well. A plethora of recent academic studies have demonstrated that reductions in public investment by 1% of GDP cause a drop in GDP by more than 1%, implying that the fiscal multiplier is higher than unity.

The IMF calls for more public investment

The International Monetary Fund has prominently put forward the relevant arguments about why more public investment is needed in order to adequately address the macroeconomic challenges in Europe. On the one hand, infrastructure investment raises output and employment in the short run. On the other hand, public investment – especially in infrastructure (such as public transportation, broadband, power supply system etc.), education, R&D, and also retraining schemes etc. – increases the growth potential of an economy via the supply side. Furthermore, the IMF has argued that due to positive growth and employment effects, a push for public investment would also incentivize private companies to invest more (‘crowding-in of investment’), which would further support the reduction in unemployment. The European Commission’s Investment Plan for Europe (“Juncker-Plan”) also rests on the assumption that more public investment crowds-in private investment.

Defending the merits of public investment

Two objections are typically raised against a push for more public investment. First, it is argued that issuing debt for public investment projects will make existing government debt problems worse; therefore, more austerity is needed in the future, so the argument goes. However, the evidence suggests that austerity has not only failed to bring about growth and employment. Due to its strongly negative effects on economic activities, fiscal consolidation measures have also caused public-debt-to-GDP-ratios in many European countries to increase further. Furthermore, the deflationary forces resulting from weak demand have increased the real debt burden. Debtors are forced to cut their spending when their debt burden rises; creditors, however, do not increase their spending by the same amount. The result is that deflation exerts a depressing effect on spending by raising debt burdens – this is the classic insight formulated by Irving Fisher in his theory on debt-deflations.

In other words: Excessive fiscal adjustment efforts have largely proven self-defeating, as they aggravated macroeconomic troubles via the demand side. Furthermore, not only the IMF but also the renowned economists Brad DeLong and Larry Summers have shown that under the prevailing circumstances of economic underutilization, fiscal stimulus via public investment will generate additional tax revenues and increase the long-term growth potential so that premature fiscal consolidation measures might lead to higher long-term public debt ratios than under expansionary fiscal policy.

Regarding the financing of public investment, one also has to take into account that interest rates on long-term government bonds are currently at historically low levels: For Austria, interest rates on ten-year governments bonds amounted to merely 0.1% in August 2016. Austrian public finances have benefited from the lower interest rate burden, which should increase the room for fiscal policy manoeuvring. The potential returns from investing in infrastructure, education and innovation can be expected to be much higher than the bond yields of 0.1%. As pointed out by Paul DeGrauwe, debt issuance “that makes it possible to invest in assets with a much higher rate of return than the cost of borrowing (now close to 0%) will reduce net debt in the future.“

Public investment benefits future generations

The second objection that is usually raised is that financing public investment by issuing government debt is a burden on future generations. It is, however, problematic to suggest that deficit-financed public investment simply acts as a burden on future generations. Public investment in infrastructure and education creates assets, which increase a society’s prosperity in the long-run, so that future generations benefit as well. Furthermore, as shown by economist Mariana Mazzucato, public investment plays an important role in promoting innovation that leads to technological progress and growth. A combination of private and public investment initiatives therefore opens up the most promising perspective for a boost in productivity that lifts the competitiveness of an economy.

A coordinated push for public investment in Europe

It is certainly important to make sure that public investment is efficient, i.e. that money is not wasted on the least relevant projects; hence, money should be channelled towards infrastructure bottlenecks. There are large investment needs in many infrastructure areas across Europe – related to constructing and developing schools, hospitals, care facilities for the young and old as well as to establishing infrastructure that allows for higher energy efficiency and environmental sustainability. The investment needs are there and wait to be undertaken in an efficient manner.

The consultancy firm McKinsey has recently shown in a study that German infrastructure is suffering from an investment deficit that is striking in a global comparison, although the German government would have sufficient fiscal space to make a positive turn towards more public investment. More public investment in countries with current account surpluses would have positive spillover effects on other euro area countries, as argued in recent research published by the European Commission.

Surplus countries should lead the way

Countries with the most room for fiscal policy manoeuvring – especially Germany, but also Austria, the Netherlands and other ‘core countries’ – should therefore lead a coordinated quest for more public investment in Europe. The mentioned core countries are running large current account surpluses (especially Germany and the Netherlands, and – to a lesser extent – Austria), and those surpluses do not only reflect high export competitiveness, but also weak domestic demand that could be boosted by pushing for public investment. Furthermore, public-debt-to-GDP ratios in ‘core countries’ such as Germany and Austria are markedly lower than in Southern Europe, which provides room for fiscal manoeuvring.

Even if more public investment may lead to a small increase in public debt in the short-run, the positive impact on growth and employment will also increase (future) government revenues, which – under the current conditions – might even lead to lower debt-to-GDP-ratios in the medium- to long-run. Additionally, more public investment in the core might have positive spillovers by increasing demand for export products of periphery countries, but also by easing the deflationary pressure in the euro area, which would make it easier to reduce existing macroeconomic imbalances. Nevertheless, a push for investment should be accompanied by a new European industrial policy agenda, geared towards allowing the periphery countries to catch-up to the core countries of the euro area.

The prevailing macroeconomic circumstances in the euro area are very favourable for a coordinated investment push. Persistently low economic growth, high unemployment, the ongoing deleveraging in the private sector and lasting deflationary pressures indicate that European economies still suffer from significant economic slack. In this situation, public investment multipliers are high, and the role of the state is to fill up existing demand gaps by additional public spending in order to stabilize the economy and move towards full employment.