On the brink of economic collapse, Iran is forced to reach a deal in Vienna

27 April 2021

Its failing economy has brought the Islamic Republic back to the negotiating table. Only a return to the nuclear agreement of 2015 can ease the pressure of sanctions and avoid an uprising.

By Mahdi Ghodsi i)

image: iStock.com/racide

- Indirect negotiations between Iran and the US in Vienna via the joint commission of the JCPOA have shown progress. A return to full compliance with the JCPOA is feasible for both the US and Iran.

- The economic consequences of the US’s ‘maximum pressure’ have been dire and imports of humanitarian products to Iran have been significantly hampered.

- The reduction in export revenues has paralysed the Iranian government’s implementation of fiscal policy, and financing it through the Central Bank by issuing money has increased annual inflation by up to 50%.

- Given the worsening economic circumstances and intense shortages of primary goods, cyclical protests could explode into a larger nationwide uprising if sanctions are not removed.

- The EU should finally play its major role in facilitating economic exchange with Iran, since otherwise China and Russia will quickly rush into Iran’s market.

The UN Security Council’s five permanent members (P5+1; i.e., China, France, Russia, the United Kingdom, and the United States, plus Germany) gathered in Vienna to negotiate Iran’s return to full compliance with the Joint Comprehensive Plan of Action (JCPOA). After the US left the deal under former President Donald Trump, Iran also took steps away from its commitments under the JCPOA, countering the US step and trying to improve its position for future negotiations.

The new administration of President Joe Biden is now willing to return to the JCPOA if Iran also returns to full compliance with it. Currently, indirect negotiations between the two governments are being held to design a “roadmap” and plan the practical steps for both countries to return to the deal. The official progress report, and the proposed ‘roadmap’ to achieve this goal, is now being discussed and analysed by both governments.

Iran’s willingness to negotiate again does not come as a surprise. Trump’s campaign of “maximum pressure” has pushed Iran’s economy closer than ever to collapse. In 2020, Iran’s GDP had shrunk to 89% of its 2017 level and its currency depreciated against US dollar by 450% compared to 2018. And the prospects are dim.

Economic consequences of US “maximum pressure”

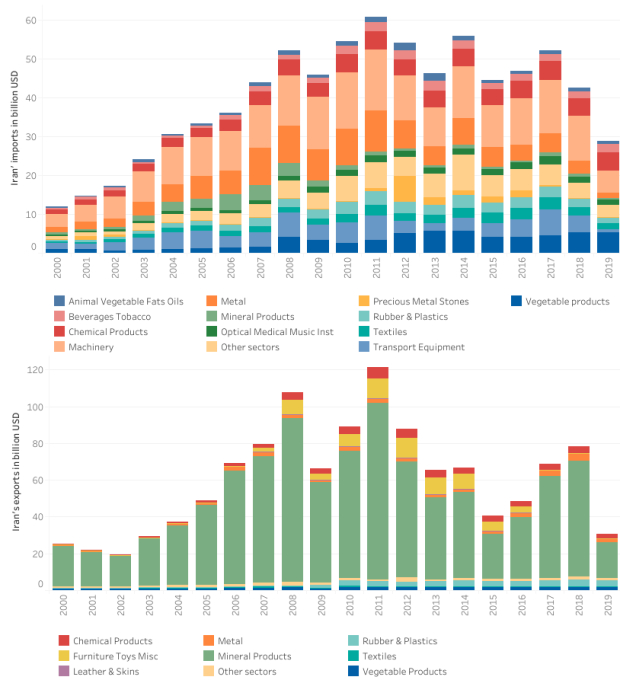

As Figure 1 shows, due to secondary US sanctions, in 2019 global imports from Iran fell significantly to just USD 30.8 billion. Despite the government’s desire to diversify and increase non-oil exports, 80% of Iran’s exports have always been mineral products including oil and its derivatives, which dropped by 63% in 2019 due to sanctions. As Iran’s currency reserves in many countries such as South Korea were blocked, global exports to Iran also fell below USD 29 billion in 2019. Iran’s international banking transfers were prohibited by the US and the trading costs of imported humanitarian goods have also increased. A barter trading system between exporters to Iran and importers from Iran was established, to import primary goods such as food, medicine (in the Harmonized System section classified as chemicals), pharmaceutical and medical devices, livestock, and machinery. A major reduction in Iran’s imports of machinery and capital goods has contributed to three consecutive years of recession.

Figure 1 – Global trade with Iran in most-traded sectors – 2000-2019

Click on Tableau to see the visualised data on the graph. Visualization and data analysis by Payam Elhami. Note that since the official data collected by Iran is not publicly available, the data on mirror flows from trading partners are used in these figures.

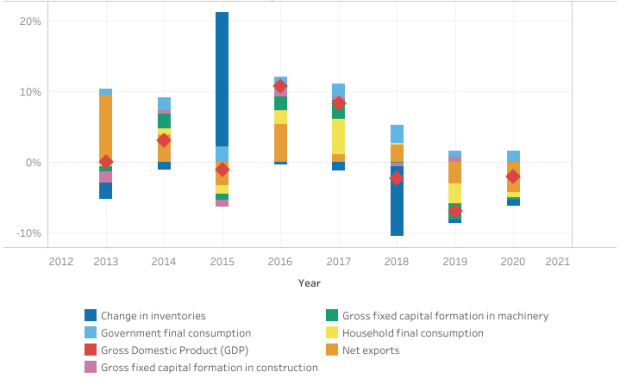

Figure 2 depicts Iran’s GDP growth and contribution of individual demand components. In 2019, 2.3% of the 7% recession was due to a reduction in gross fixed capital formation in machinery, 3% due to a reduction in net exports, and 2.8% due to a drop in household final demand. The latter has triggered social unrest.

Figure 2 – Iran's GDP growth and contribution of individual demand components, 2013-2020

Source: Statistical Center of Iran, author’s elaboration. Click on Tableau to see the visualised data on the graph. Visualization and data analysis by Payam Elhami.

Why is Iran’s economy closer than ever to collapse?

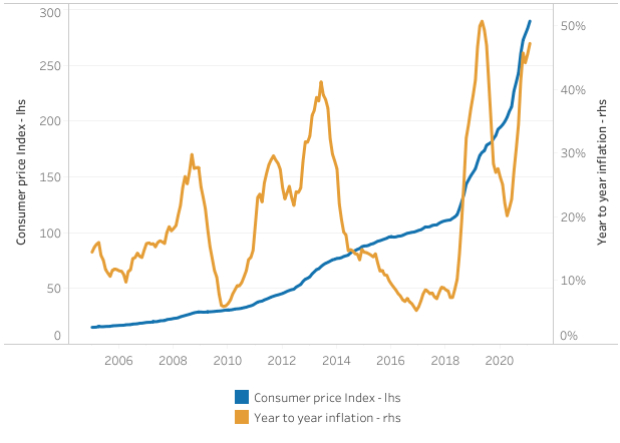

Iran’s economic structure is vulnerable to sanctions. The total planned budget of the government and public companies and entities comprised more than 60% of Iran’s GDP in 2020. The smaller private sector cannot afford lending to this large public sector. The revenue side of the government budget shrank due to reduced oil revenues. The government has been forced to finance its budget through borrowing from the Central Bank as requests for foreign loans were denied by the US. Hence, the money supply expanded at a faster rate than the growth of the size of the economy, which was actually in recession. This has caused the monthly year-to-year inflation rate to erupt to 50% in March 2019 and March 2021 (see Figure 3).

Figure 3 – Development of consumer price index in Iran - 2005-2021

Source: Statistical Center of Iran, author’s elaboration. Click on Tableau to see the visualised data on the graph. Visualization and data analysis by Payam Elhami.

The cash-handout policy introduced by President Mahmoud Ahmadinejad in December 2010 has saved many people from poverty. However, because of average inflation of about 22.3% since then, and even higher inflation since the campaign of “maximum pressure” by the US, that monthly cash handout is now worth only one to two kilos of chicken. The absolute poverty rate increased by about 11% from March 2018 to March 2020. However, the political elites in the Islamic Republic argue that Iran’s resilient economy has proved its “maximum resistance” as the “maximum pressure” has not led to a regime change.

Nevertheless, nationwide protests have become more cyclical in the Islamic Republic. In December 2017 and January 2018 a jump in food prices triggered nationwide protests. In November 2019 a cut in fuel subsidies led to nationwide protests and violent suppression that led to the deaths of more than 300 people. In February 2021, the alleged killing of fuel smugglers in the impoverished southeast province of Baluchistan led to another deadly round of unrest. These events indicate that the Islamic Republic is enforcing its “maximum resistance” policy with “maximum suppression”.

Why is Iran back at the negotiating table?

Fiscal constraints are stifling. The general government budget in the current calendar year is 43% larger than the previous year while the consumer price index has risen by about 50%. This indicates a contractionary fiscal policy in real terms, which would probably be increased as soon as sanctions are removed and higher oil exports bring fresh revenues. Therefore, this budget was legislated in the hope that Iran could finally sell its oil with the US re-joining the JCPOA. However, if sanctions are not removed, the government may borrow again from the Central Bank, further increasing the money supply and pushing up inflation. This may lead to hyperinflation that is out of control if decreasing confidence makes the Iranian market more turbulent. It is important to note that since Biden’s victory in the US presidential elections, confidence in Iran’s market has been improving. Given the worsening economic circumstances and intense shortages of primary goods, cyclical protests could explode into a larger nationwide uprising. The Iranian government is trying to avoid that at all costs.

What will be the outlook if both sides return to the nuclear deal?

However, western multinational enterprises (MNEs) may need time to evaluate the political risks around Iran to take concrete investment decisions. Numerous issues of concern between the US and Iran such as human rights violations, ballistic missiles and Iran’s aggressive regional policy will remain. And it is not in the interest of hardliners in Iran to resolve these issues soon, as they can use them to win the next presidential elections to be held in June.

Russia has recently discussed closer economic cooperation with Iran by integrating it into the Eurasian Economic Union. China has signed a 25-year “strategic partnership” with Iran to strengthen investment and trade ties with the Islamic Republic.

Iran has a lot to gain from the lifting of sanctions. The US government may endorse the USD 5 billion loan Iran requested from the International Monetary Fund to counter the COVID-19 pandemic. This would also allow the government to import COVID-19 vaccines and implement an expansionary fiscal policy to fight the economic crisis. It is expected that Iran’s economy will start to grow again if it exports about 2.5 million barrels of crude oil per day as in 2017. However, the only way to achieve sustainable development and long-term growth is to privatise and diversify industries which should invite foreign direct investment and advanced technologies to Iran.

The EU should therefore facilitate economic exchange with Iran. The first step would be to activate the so-called “Instrument in Support of Trade Exchanges” (INSTEX), a mechanism to circumvent American sanctions for European firms trading with Iran, until sanctions are fully removed. Iranians’ living standards and health are being severely damaged by the multiple crises of “maximum US pressure”, “maximum suppression” by the Iranian government and the COVID-19 pandemic. Rapid delivery of humanitarian goods, food, and medicine may revive a glimpse of hope to those Iranians who once voted for a moderate president in order to restore relations with the West.

i) Special thanks go to Payam Elhami for the data analysis and visualisation of the data on figures.