One Trillion Euros for a European Silk Road

20 November 2019

The Vienna Institute for International Economic Studies (wiiw) has just released a new Policy Note, in which it proposes a financing model for a European Silk Road.

Much of Europe’s transport infrastructure is in a bad state, even in some wealthy parts of Europe, such as Germany. Europe’s periphery is underdeveloped and has difficulties to catch up, in part because of substantial infrastructure deficiencies.

The suggested European Silk Road project could help to solve both the problem of sluggish growth in the west of the continent and the developmental problems in the east. Moreover, it could constitute a new narrative of cooperation for Europe.

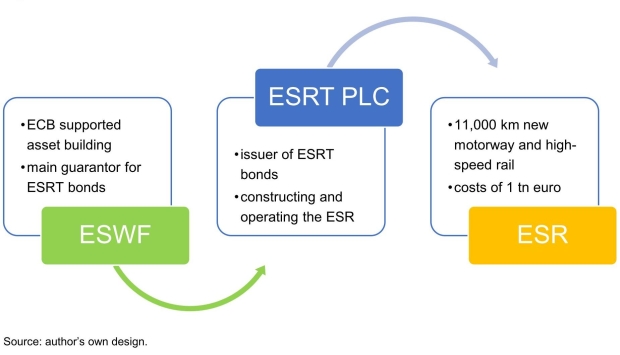

In our Policy Note, we make a proposal for the financing of infrastructure across the European continent with the help of a European Silk Road Trust (ESRT), backed by a European Sovereign Wealth Fund (ESWF). In the initial phase, the European Central Bank could reinvest a part of its assets in a way that would carry more risk, but also bring greater revenues, following the structure of the Norwegian oil fund. It is estimated that the ESWF would grow over the longer term to about 3% of the euro area’s GDP. This should be sufficient to guarantee the ESRT bonds – even if long-term interest rates move back into positive territory in the more distant future.

A financing model for a European Silk Road

Our proposal for a European Silk Road will be discussed on 21 November 2019, 11:30 am at a Panel discussion at the Permanent Representation of Austria to the EU (Avenue de Cortenbergh 30, 1040 Brussels) which is being organised in cooperation with the Oesterreichische Nationalbank (OeNB).