Tax advantage for heated tobacco products risks undermining fiscal and health gains in Ukraine´s tobacco tax reform

03 December 2024

An expected rise in tobacco excises will boost Ukraine’s fiscal revenues and public health, but these gains would be partially forgone by the privileged treatment of popular heated tobacco products

image credit: istock.com/Satyrenko

By Kristijan Fidanovski and Nóra Kungl

The Verkhovna Rada, Ukraine’s national parliament, is currently debating the adoption of a proposed law (11090-0) to increase its tobacco excise taxes. The proposal passed the first parliamentary reading on 27 November and may become law at the second reading, which is expected to take place sometime this month. Should Ukrainian parliamentarians vote in favour of this legislation, the cigarette excise tax will increase to EUR 90 per 1,000 cigarettes by 2028, theoretically bringing it in line with the current European Tobacco Tax Directive. The excise tax for heated tobacco products (HTPs), on the other hand, will increase to EUR 72 per 1,000 items by 2028.

Earlier this year, the Vienna Institute for Economic Studies (wiiw) published a study simulating the expected fiscal and health implications of Draft Law No. 11090-0 through the Tobacco Excise Tax Simulation Model (TETSiM). The study also modelled a hypothetical scenario of a larger and more rapid increase. The four wiiw economists who co-authored the study – Biljana Jovanovikj, Nora Kungl, Kristijan Fidanovski and Hana Ross – estimated that the proposed reform to the Ukrainian tax system would bring EUR 3.69bn (Ukrainian Hryvna 157.8bn) in additional tax revenue and avoid 65,000 smoking-related deaths by 2028.

The proposed reform would thus provide a significant boost to Ukraine’s stretched public finances in the face of Russia’s ongoing full-scale invasion while also resulting in significant health benefits in a country where an estimated 23.2% of adults are regular smokers. However, the bill is also marred by several important limitations. First, the alignment of the country’s tobacco excise with the EU norm is scheduled to occur gradually, which makes it unlikely that convergence will ever be achieved, as the minimum excise tax in the EU is likely to increase before 2028.

Second, as outlined above, the proposed reform introduces a 20% tax advantage for heated tobacco products. The differential treatment of manufactured cigarettes and heated tobacco products carries particularly strong implications in Ukraine, whose consumption of heated tobacco products is estimated to make up around 18% of the tobacco market – several times above the global average. The consumption of heated tobacco products is discouraged by the World Health Organization (WHO), which precautionarily treats these products as equally harmful as manufactured cigarettes in the absence of definitive evidence to the contrary. Moreover, heated tobacco products are disproportionately consumed by young smokers, which raises additional concerns about their role in creating long-term smoking habits and exacerbating their negative health impact.

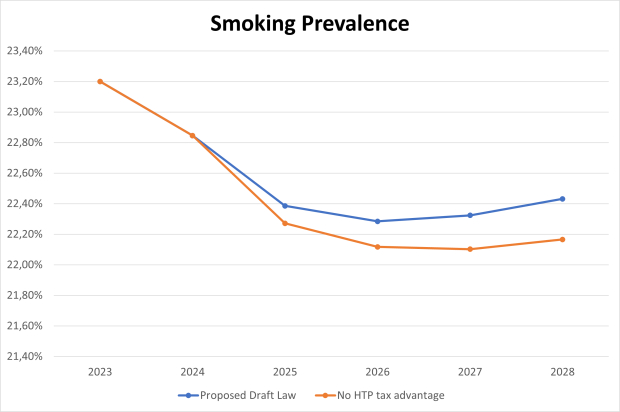

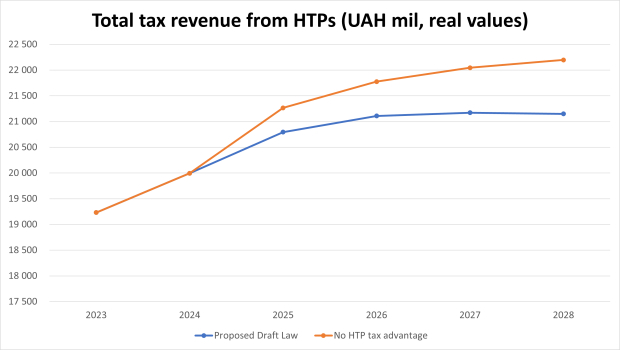

To inform the ongoing public debate in Ukraine, as a follow-up effort to our published study, we have estimated the forgone fiscal and health gains from the tax advantage provided by the proposed reform. Compared to legislation that would maintain equal taxation of manufactured cigarettes and heated tobacco products, Draft Law No. 11090-0 forgoes more than UAH 3bn and 22,485 premature deaths saved by 2028. Under the proposed reform, yearly fiscal revenues from heated tobacco products would increase by 5.8% between 2024 and 2028. Under a scenario of equal treatment, however, the revenue boost would almost double, rising to 11%. Our economist Kristijan Fidanovski and senior research associate Hana Ross also highlighted some of these discrepancies at a hybrid panel discussion in Kyiv on 26 November.

It is worth highlighting that our modelling assumes no substitution between manufactured cigarettes and heated tobacco products. Given the lack of evidence on the health effects of heated tobacco products, it also assumes equal health effects of smoking regardless of product type. Overall, however, the persistence of high consumption of heated tobacco products in Ukraine despite the adoption of non-price measures, such as the ban on flavoured tobacco products in 2023, suggests that tax reform might be the only effective tool for reducing the popularity of these products while at the same time aiding the country’s public finances in what is currently a highly delicate national security context.

The study referenced in this article has been produced as part of the Tobacco Taxation in Eastern Europe research network, coordinated by wiiw and supported by Bloomberg Philanthropies.