Can economic sanctions against Russia succeed?

02 May 2018

The latest economic sanctions introduced by the US will increase the severity of economic hardship in Russia, and could impact the popularity of the regime.

By Olga Pindyuk

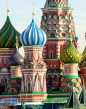

Photo: St. Basil's on Red Square near the Kremlin, by Victor Nuno, CC-BY-NC 2.0

In recent decades, the US, EU and UN have increasingly turned to sanctions in order to discourage violations of international law. A step short of military conflict, they are a way to signal official displeasure with certain behaviour, and can serve the purpose of reinforcing a commitment to a behavioural norm, such as respect for human rights or opposition to proliferation of weapons of mass destruction.

Sanctions have been studied in economic literature for decades, and there is no consensus yet on their efficiency in general. One of the important aspects in the analysis is measurement of sanctions’ results. Economic damage is not considered to be a primary goal of sanctions, and as Kaempfer and Lowenberg show, the appearance of sanctions ineffectuality might be illusory as even those sanctions that create minimal economic hardship can still generate political change through communicating specific signals and threats. At the same time the scale of economic effects can be a factor in sanctions’ success. Shidiqi and Pradiptyo find that an attempt to increase the severity of economic sanctions may reduce the probability of the target country in violating international agreement/law. Other factors determining sanctions’ efficiency are found to be the institutional structure of a target country, the strength and duration of sanctions, and whether they are introduced unilaterally or multilaterally.

First round of sanctions on Russia had limited economic impact

The first round of sanctions against Russia was introduced in 2014 after its annexation of Crimea and military incursions in Donbas – actions that are seen to be a part of strategic deterrence approach, built on the view of conflicts as defensive, preventive, and just. The sanctions are often considered to have had a limited effect, as the resulting economic hardships for Russia were rather small, especially compared to the impact of the concomitant slump in global oil prices. However, they can be still seen as a success, as they had not only inflicted damage on the Russian economy, but had a signalling value. Western nations took coordinated action (signalling unity) against strategic enterprises of the Russian state (signalling attribution of responsibility), in a manner designed to cause concrete economic damage (signalling credibility), while accepting the risk of economic pain (signalling resolve).

Russia’s more recent actions (namely, alleged interference into the 2016 US election, intervention in Syria, alleged involvement in the attempted murder of a former Russian spy) were a deliberate escalation, in line with the country’s strategic deterrence vision. The main challenge in this situation (from the Russian perspective) is that deterrence signalling activities may raise the risk of inadvertent escalation during a critical time, especially taking into account Russia’s inability to credibly signal limits or engage in restraint. Russia’s recent actions brought about a consensus in the West on the need for hard deterrence, while also keeping the channels of communication open. Western capitals felt that escalation by the Russian side had to be met with a toughening of sanctions by the US and EU, otherwise the actions of the West would signal lack of credibility and be considered as posturing by the Russian side (which would then consequently have no motivation to change its behaviour).

New sanctions will have a stronger impact on Russian economy

The latest economic sanctions introduced by the US appear to have higher chances of success, as they will increase the severity of economic hardship in Russia (not only in the short run, but also in medium- to long-run), and are more likely to impact the popularity of the regime. The economic effects of the sanctions are likely to be more profound as they are targeted not only against future issuances of securities, but also against existing ones, thus increasing greatly the perceived unpredictability of investing in the Russian assets. Russia is tightly integrated into global finance, and the extent to which Russian companies, banks and oligarchs are exposed to the US dollar means that no bank, whether US-based or not, will want to risk handling funds that could bring attention from American authorities. The sanctions also have spill-overs to other, not directly targeted Russian companies, such as Norilsk Nickel. At the same time, the sharp drop in Russian markets has had a limited contagion effect on global markets. This implies a relatively low cost of introducing the sanctions for the US, and increases the credibility of the threat of a continued introduction of sanctions in response to future Russian actions.

The latest round of sanctions is likely to have three tangible effects on the Russian economy. First, as Russia is a medium sized economy skewed towards the extraction sector, its restructuring would be crucial for going beyond sluggish 2% economic growth. Restructuring requires significant investment, thus a further decrease in FDI and foreign portfolio investment will make the country’s already challenging economic prospects even bleaker. This will make it increasingly more difficult for Russia to finance its conquests abroad.

Second, targeting oligarchs and officials that go beyond the “inner circle” of the Russian president and an apparently almost random selection of names introduces a high level of unpredictability into future measures, thus increasing the chances of tensions between different influential groups within Russia. Different branches of Russia’s siloviki (security community) were openly at odds last year, and there is deep mistrust between the heads of Russia’s state corporations and Russian President Vladimir Putin’s government technocrats.

New sanctions could affect domestic political stability

Third, using market forces for sanctions makes it harder for the Russian government to turn falling market prices into a story of victimisation by outside powers. Although the Putin regime is not likely to collapse in the near future, the government is likely to need to divert resources from external conflicts to improving local economic conditions, to react to signs of growing dissatisfaction among the population. In recent years the real income of Russian households has been declining, and even the living standards of people with relatively high incomes have decreased dramatically.

According to the state-run VTsIOM poll, Russians’ trust in Mr Putin dropped to below 50% by mid-April, and this should be considered as a warning sign by the president. The country’s youth is the most active in verbalising discontent and is increasingly organising on social media. It could develop into a more powerful force over the years prior to the next elections.