Economic forecast: Eastern Europe’s resilience likely to fade as war and inflation pressures mount

- Russia’s war in Ukraine is causing high inflation and adding to supply-chain bottlenecks

- Economic growth in the region will slow drastically in the second half of the year

- Risks that energy crisis could push region into recession are increasing

- Ukraine’s economy will contract sharply

- Russia: Economic shock in stages (GDP -7% in 2022; -3% in 2023)

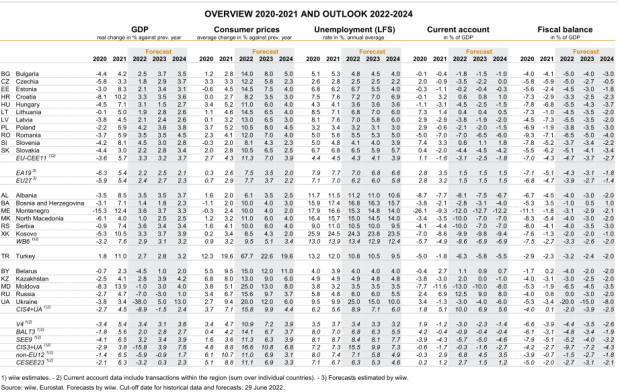

The war in Ukraine is clearly having negative effects on the economies of the 23 countries of Central, Eastern and Southeastern Europe (CESEE), but so far the scale of the impact varies widely across the region. This is demonstrated by the new summer forecast of the Vienna Institute for International Economic Studies (wiiw).

Although growth will be considerably lower on aggregate than expected pre-invasion, most of the region will avoid an economic recession this year. The 11 EU members of the region continue to be among the most resilient. Despite high inflation, the energy crisis, supply-chain problems and slowing dynamics in industry they should be able to grow on average by 3.3% this year. The main pillar of the economy is private consumption, while exports are weakening. The six Western Balkan states and Turkey will grow at a similar pace in 2022 – by 2.9% and 2.7% year on year, respectively – which is a weak performance for both compared with the previous year.

The picture is different for Ukraine, Russia, Belarus and Moldova. The crash will be particularly drastic in Ukraine, which is expected to lose more than one third of its economic output this year. Russia, where GDP is expected to shrink by 7%, is getting off more lightly for the time being than we assumed in our spring forecast (-9% in the baseline scenario), reflecting the strengthening of its currency. In Belarus (-4.5%) the effects of Western sanctions in response to the country’s support for Russia are manifesting themselves. Moldova is also suffering (-1%).

Ukraine: Blockade of Black Sea ports fuels food crisis

The war continues to have a devastating effect on the Ukrainian economy, with damage from the destruction of residential and non-residential buildings and infrastructure exceeding 60% of the country’s 2021 GDP. As Ukraine is adjusting to the new reality of the war, economic activity is starting to recover slowly in both the manufacturing and the services sector, with more companies resuming their activity. Still, capacity utilisation remains 40% lower than before the start of the war. The budget deficit is expected to reach 20% of GDP this year. The bulk of this will be financed through borrowing, which poses risks to the sustainability of the country’s public debt. ‘One of the biggest problems for Ukraine’s economy is the blockade of the Black Sea ports. It prevents exporting of much of the country’s grain, further pushing up global food prices,’ says Olga Pindyuk, Economist at wiiw and lead author of the summer forecast. The recently granted EU candidate status is a positive signal and should help Ukraine’s reform efforts in the medium term.

Russia: Economic shock in stages

Russia has so far coped better with the sanctions than was foreseeable in spring. The sharply lower imports and still high revenues from energy exports have pushed the rouble to a new five-year high against the euro and the US dollar. At -7%, Russia's recession this year will be somewhat shallower than forecast in spring (-9% in the baseline scenario). The strong rouble and the population's reluctance to spend are also dampening inflation, which we now see at around 16% in 2022. In the short term the country has additionally benefited from the EU oil embargo via further increases in the oil price. ‘However, Russia is facing an economic shock in stages. Although it was possible to slow down the slump, the full effect of the Western trade sanctions is only gradually becoming apparent,’ Vasily Astrov, Senior Economist and Russia country expert at wiiw, points out. The production losses in several industrial sectors due to a lack of Western components are already dramatic. ‘Where this is not yet the case, it is only a matter of time as stocks are depleted at rapid speed,’ Astrov says. The EU oil embargo could also have a negative impact in 2023.

High inflation and energy crisis dampen growth prospects

In May inflation grew in double digits in all the 23 countries of the CESEE region that we monitor, with the exception of Slovenia. The clear frontrunner is Turkey, which faces inflation of around 68% this year, driven by its ultra-negative real interest rates as well as the major commodity price inflation. However, also the EU members of the region are likely to see inflation average around 11% in 2022. Food prices are rising at double-digit rates despite price-regulation efforts in some countries. A major reason for this is the shortage of supplies on world markets due to the loss of Ukrainian and Russian agricultural exports. Lower supplies of fertiliser as a result of the war could limit crop production in many countries and further exacerbate the food crisis.

Worryingly, core inflation (excluding food and energy) is also picking up in the CESEE region. This suggests that inflation is now becoming increasingly broad-based. In macroeconomic terms, ever-higher inflation is reducing the region's growth prospects by eroding people's real incomes. If oil and gas have to be rationed in winter, Central, Eastern and Southeastern Europe could slide into recession.

About the wiiw Forecast Report for CESEE

The report analyses the economies of 23 countries in Central, Eastern and Southeastern Europe (CESEE) and provides a detailed forecast of the macroeconomic indicators of the following countries: Albania, Belarus, Bosnia and Herzegovina, Bulgaria, Croatia, Czechia, Estonia, Hungary, Kazakhstan, Kosovo, Latvia, Lithuania, Moldova, Montenegro, Northern Macedonia, Poland, Romania, Russia, Serbia, Slovakia, Slovenia, Turkey and Ukraine.

The new Summer Forecast Report 2022 is available upon request.

About the Vienna Institute for International Economic Studies (wiiw)

The Vienna Institute for International Economic Studies (wiiw) is an economic think tank that has been producing economic analyses and forecasts for currently 23 countries in Central, Eastern and Southeastern Europe for almost 50 years. In addition, wiiw conducts research in the areas of macroeconomics, trade, competitiveness, investment, the European integration process, regional development, labour markets, migration and income distribution.

Contact:

Andreas Knapp Mario Holzner Olga Pindyuk

Communications Manager Executive Director Economist, main author

Tel. +43 680 13 42 785 holzner@wiiw.ac.at pindyuk@wiiw.ac.at