Financial linkages of Eastern Europe with the EU and other global players

20 June 2023

The EU remains the main source of capital for Eastern Europe. However, China’s influence in the region has been growing, especially in the Western Balkans and Turkey

image credit: wiiw/Bertelsmann Stiftung

By Olga Pindyuk

The EU plays an important role as a source of foreign capital for many East European countries – defined here as the six Western Balkan countries (Albania, Bosnia and Herzegovina, Kosovo, Montenegro, North Macedonia and Serbia), Turkey and the six post- Soviet countries covered by the EU Eastern Partnership programme (Armenia, Azerbaijan, Belarus, Georgia, Moldova and Ukraine). Linkages are strongest with the Western Balkans and Turkey.

The EU is still the main source of FDI …

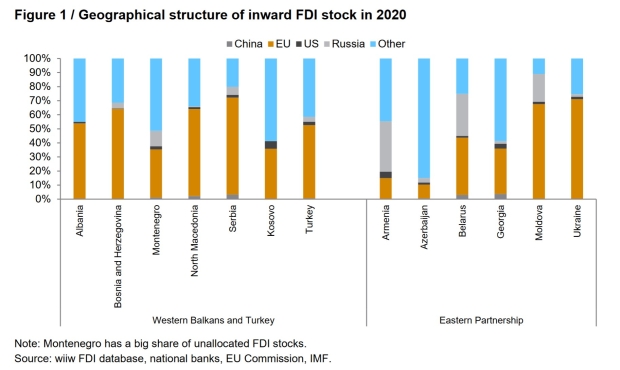

First, the EU has been the main source of foreign direct investment (FDI), significantly outpacing its main geoeconomic rivals in the region – the US, China and Russia. The bloc accounts for the lion’s share of inward FDI stocks in most countries of the Western Balkans and Turkey (see Figure 1), except for Montenegro and Kosovo, where it accounts for about a third. Ukraine and Moldova stand out in the Eastern Partnership as countries where the EU is far and away the most important foreign investor, accounting for 71% and 67%, respectively, of inward FDI stock in 2020. In Belarus and Georgia, the EU is a relatively important investor as well (41% and 32% of inward FDI stock, respectively), while investment in Armenia andAzerbaijan has been barely significant.[1]

Russia has a relatively large share of inward FDI stock only in Belarus, Moldova and Armenia. To date, China has not played any serious role as a source of FDI in the region, as its primary modus operandi in the region has been via the debt financing of investment projects within the framework of its Belt and Road Initiative (BRI).

Figure 1 / Geographical structure of inward FDI stock in 2020

… but China has been increasing its influence

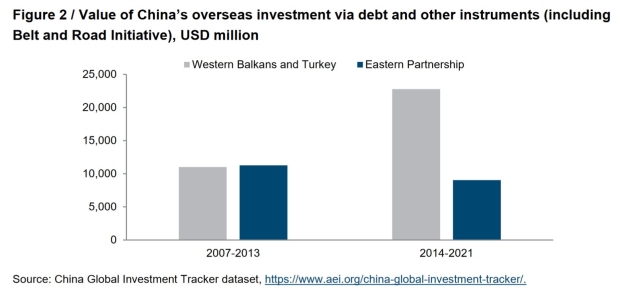

Figure 2 shows the value of China’s overseas investment via debt and other instruments. During 2007-2021, the value of Chinese debt-financed investment in the Western Balkans and Turkey exceeded USD 33bn, which is more than ten times greater than the value of its FDI stock there. The subregion’s significance as an investment destination for China increased during 2014-2021, when the debt-financed investment value there more than doubled, compared to 2007-2013. Most of the investment during 2014-2021 went to Serbia, which accounted for 62.8% of China’s investment in the subregion; meanwhile Turkey lost its relative importance as a destination for Chinese investment, with its share decreasing from 79.2% in 2007-2013 to 24.7% in 2014-2021.

The Eastern Partnership continues to hold little attraction for Chinese investors – as evidenced by a fall in the value of their investment there in 2014-2021, compared to the period 2007-2013. This may well have been at least partly influenced by the instability in the region caused by Russia’s annexation of Crimea and the outbreak of the military conflict in Donbas in 2014.

Figure 2 / Value of China’s overseas investment via debt and other instruments (including Belt and Road Initiative), USD million

Foreign assets of the banking sectors dominated by EU banks

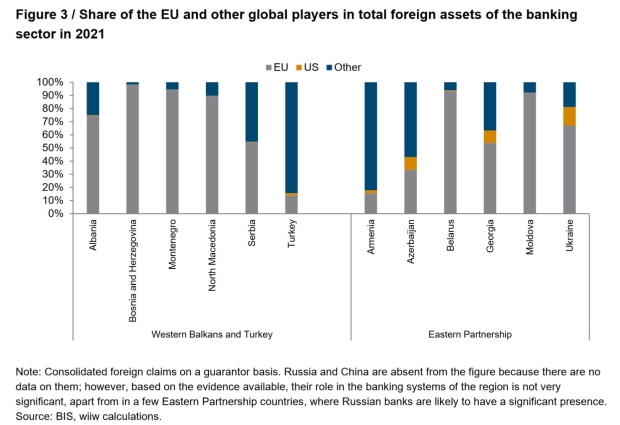

The EU and other global players have also established linkages with East European

countries via the banking sector. Figure 3 shows the shares of EU and rival banks in the total foreign assets of the banking sector in 2020. EU banks are the main foreign banks in many countries of the region: Albania, Bosnia and Herzegovina, Montenegro, North Macedonia and Serbia in the Western Balkans; Belarus, Georgia, Moldova and Ukraine in the Eastern Partnership. This points to the high interconnectivity between the banking sectors of the region and the EU.

Among other global players, only US banks present any competition to the EU in the banking sector (but mostly only in Ukraine). Turkey, Armenia and Azerbaijan have a high share of foreign assets from other countries: the UK, Persian Gulf and some Asian countries account for a significant share of assets there; Russia is likely to have a notable share in some of the Eastern Partnership countries.

Figure 3 / Share of the EU and other global players in total foreign assets of the banking sector in 2021

The Western Balkans and Turkey are the biggest recipients of EU budgetary support

The Western Balkans and Turkey are the biggest recipients of EU budgetary support

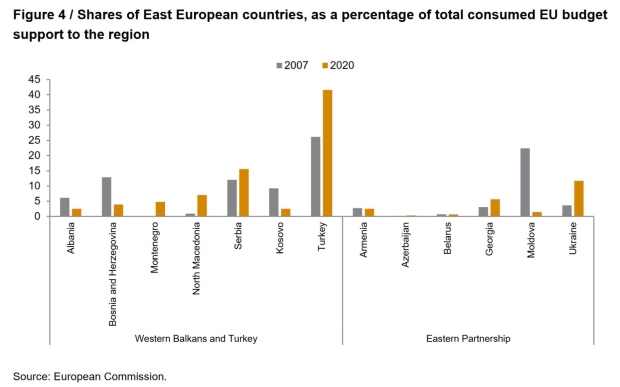

The EU is one of the world’s top providers of budgetary support, which involves direct financial transfers to public bodies and private companies of partner countries that are required to conduct sustainable development reforms.[2]Total consumed budgetary support to the Western Balkans and Turkey and the Eastern Partnership countries from the EU amounted to EUR 2.4bn in 2020.

The breakdown of commitments by country (see Figure 4 ) shows that Turkey remains the largest recipient of EU budgetary support in terms of volume (42% of total support allocated to the region in 2020), followed by Serbia (16%). The lowest levels of budgetary support were allocated to Azerbaijan and Belarus (0.3% and 0.6%, respectively). The Western Balkans and Turkey have clearly become more important than the Eastern Partnership region as a destination for EU budgetary support: their share of total EU budget support to the region rose by about 10 percentage points after 2007, to reach 78% in 2020.

Figure 4 / Shares of East European countries, as a percentage of total consumed EU budget support to the region

Impact of Russia’s war in Ukraine

Russia’s full-scale invasion of Ukraine has had a profound effect on the EU’s financialinterconnectivity with the region, particularly with its Eastern Neighbourhood. As well as granting EU candidate status to Ukraine (and Moldova), the EU has substantially increased its budgetary support for Ukraine. As of March 2023, the EU, its member states and European financial institutions have collectively mobilised EUR 35.9bn in budgetary assistance for Ukraine since the beginning of the war;[3] that is more than ten times greater than the total amount of budgetary support allocated to the country over the previous ten years. Belarus, by contrast, has become more isolated from the EU due to the economic sanctions imposed on it in the wake of the Ryanair incident, and later for its support of Russia’s military aggression.

Besides, the war has interrupted the post-COVID-19 recovery of FDI inflows to many countries of the region. That said, some countries do appear to have been able to benefit from the acceleration in the EU’s green transition and the relocation of European companies away from the war zone.[4] China’s ambitions in the region have strengthened, as evidenced by the high value of its greenfield investment projects. Russia, on the contrary, has been withdrawing its financial presence from the region, as it needs to deal with its own economic problems, caused by the unprecedented level of economic sanctions imposed by the West.

This article is an abridged and updated version of a chapter from the joint wiiw-Bertelsmann study, Keeping Friends Closer: Why the EU should address new geoeconomic realities and get its neighbours back in the fold, Joint Study No. 2023-02, February 2023.

References

[1] Several other countries are important investors in the region: Canada, the United Kingdom, Switzerland and certain Persian Gulf economies.

[2] Due to data limitations and compatibility challenges, here we only refer to budgetary support provided by the EU as a whole. However, budgetary support often comes directly from individual EU member states. As a result, the figures referred to in this section represent only part of the full EU budgetary support received by East European countries.

[3] Source: A. Antezza et al., Ukraine Support Tracker, Kiel Institute for the World Economy, https://www.ifw-kiel.de/topics/war-against-ukraine/ukraine-support-tracker/.

[4] See O. Pindyuk (2022), Strong post-COVID FDI rebound likely to be short lived, wiiw Monthly Report No. 5.