Greece’s adjustment problem

25 June 2015

Keynes knew it was hard for a country to adjust to changing financial circumstances and to correct for its external imbalances. A commentary by Vladimir Gligorov

“… (W)e are trying to fix the volume of foreign remittance and compel the balance of trade to adjust itself thereto.” Keynes, The German Transfer Problem.

Keynes argued that it was hard to turn a country around, to adjust the economy to changing financial circumstances, in particular to increase its exports in order to correct for external imbalances. 1) Greece provides a good example of this adjustment problem. It is a relatively closed, small economy with persistent external imbalances, which have become unsustainable.

A relatively closed, small economy with persistent external imbalances

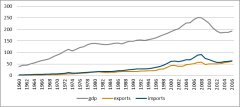

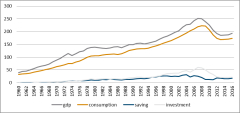

Going back to 1960, the period that there is readily available data for, it is clear that exports have not been the driving force of the Greek economy (Figure 1). Overall exports of goods and services have reached only 20 percent of GDP before the crisis of 2008-2009 and have gone up to 30 percent by 2014, but the latter is due to the decline of GDP, as the value of exports has hardly increased. For a small economy, Greece’s is quite closed.

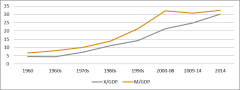

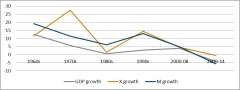

Imports (Figure 1) have been larger than exports throughout, but by at most a factor of 10 percentage points, and that much mostly after 2000 (Figure 2). Imports have gone up to about 30 percent of GDP in 2014, which again for a small economy is not a very large number. Both exports and imports have tended to grow faster than GDP (Figure 3).

Clearly, the gap widened in the 1990s and before 2009. Since then, exports in euro have stagnated and imports have plummeted so that close to balanced trade has emerged (deficit came down to about 2 percent of GDP in 2014).

So, foreign trade data points to a rather closed economy, given its size, certainly before the current crisis.

Real exchange rate, inflation, and interest rates

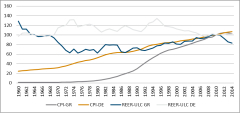

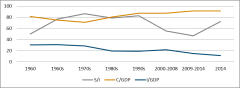

What supported this economic development? Before the 1970s, real exchange rate tended to depreciate with relatively stable inflation. Since then, and until mid-1980s, real exchange rate tended to depreciate, though often not sustainably, with some acceleration of inflation, while since then inflation and real exchange rate appreciation went hand in hand (Figure 4).

In the early decades, the real interest rates tended to be negative, which changed from the beginning of the 1990s when real exchange rates shot up strongly (Figure 4).

The main change after the adoption of euro was a sharp decline of real interest rates (figure 5). Inflation and real exchange rate appreciation continued, however, and there was significant acceleration of growth (Figures 4-5).

This relationship of low real interest rate and relatively fast growth is the key effect of joining the European monetary union on Greek economy before the crisis of 2008-2009.

Consumption, saving, and investment

Given relatively low levels of exports, the growth of the economy has depended on the strength of domestic demand, throughout the last five or so decades.

Figures 6-7 show the importance of consumption and also the steady decline of investments as a share of GDP. Again, in the 1900s and also after the introduction of the euro, consumption increased significantly, while investment stayed flat at around 20 percent of GDP for close to three decades since the early 1980s (Figure 7).

Again, from mid 1990s savings started to decline and investments were increasingly financed from abroad, i.e. trade and current account deficits tended to widen Figures 6-7).

Thus, persistent gap between saving and investment and the need to close it is the other way to state the adjustment problem.

The three debts

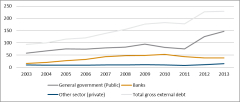

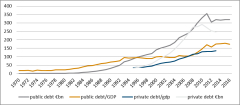

Figure 7 shows the gap between saving and investment that has been around from the beginning and which means that there has been an enduring reliance on foreign finance, which of course translates into increases in foreign debt, especially after the adoption of euro (Figure 8).

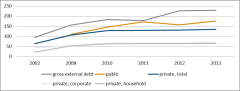

Overall debt development shows significant increase in household indebtedness (Figure 9), and thus overall private debt, from about the year 2000 all the way to 2008 (that is, after the adoption of euro; Figures 9-10), while foreign debt is interestingly enough mostly owned by the government and the banking sector (Figure 8).

Gross foreign debt is currently about 230 percent of GDP and the aim of adjustment is to achieve GDP growth without further increase of foreign debt, or rather of the foreign debt to GDP ratio, and indeed the intended target is the prolonged decline of that ratio. That requires growth with current account surpluses (or small deficits), which means that growth needs to be increasingly driven by exports while investments need to be financed from domestic savings.

That is mostly the task for the government and the banks, as the households and the corporations do not hold too much foreign debt, and their demand for foreign financing is not increasing. Figure 8 shows a sharp increase in public debt after 2011, mostly due to GDP collapse, and assuming that some of the debt of the banks is also public debt in one way or another, that means that practically all public debt is foreign owned or that practically all foreign debt is publicly owned.

Private debt, which is sizable and mostly reflects growing increase of household debt before 2009, is apparently domestically owned (Figure 10).

So, the adjustment problem in the Greek case requires primary fiscal surpluses, supported by higher saving and with exports growth, as it is the government that needs to reduce its foreign debt.

Demand, but not supply adjusts

So, in summary, even with exchange rate adjustments, before the adoption of euro, export performance, though improving, has been unremarkable. After the adoption of euro, households and the government took advantage of lower real interest rates to borrow (Figures 10-11), while the corporate sector did not. So, consumption went up, but not investment. After the crisis erupted, real exchange rate adjusted sharply, but mainly imports declined due to lower consumption and investment, while exports mostly held their ground.

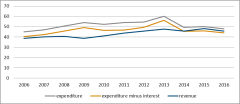

Also, even though private debt declined and public revenues, as a share of GDP, increased while expenditures, again as a share of GDP, declined (Figure 11) from 2013, the burden of private debt, as a share of GDP, did not decline and that of public debt, both in euro and as a share of GDP, shot up rather dramatically as GDP collapsed.

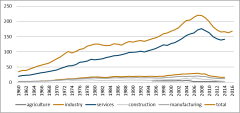

So, demand has adjusted, but not the supply. On the demand side, consumption has declined and brought the imports down, but also investment. On the supply side, decline is visible in all main branches (Figure 12), but there is scant evidence of the change in the structure.

Greece's is basically a services economy (about 80 percent of gross value added in 2008 and around 85 percent in 2014), and of which tradable services, e.g. tourism is not a large part. The tradable sector – industry, agriculture, and tradable services – is quite small, and its share in the economy is not increasing.

That is the third necessary aspect of the adjustment problem: increase of the tradable sector as a share of total economy.

The mandate

Adjustment is about political economy as much as about prices and balances. This is reflected quite clearly in the policy alternatives that the public and the government are facing in Greece. The mandate that the new government received basically asks for the return to the pre-2009 era. This is achievable with Greece remaining in the European Monetary Union (EMU) and with the debt write-off.

Alternative adjustment would mean a break with a structure of production that has quite long history. And that could prove hard to do, as Keynes argued. Greece does not have so much a budgetary problem, but a transfer problem – to use Keynes’ distinction. Even with real exchange rate depreciation and with low interest rates, it has hard time increasing saving, investing in the tradable sector, and growing exports.

Now, clearly, the mandate that the new government received in the early elections can prove inconsistent. Staying in the EMU requires that the Greek economy adjusts. While the first requires that foreign debt burden is made sustainable, the latter requires policies that are not easy to design and structural changes that those would aim at are not desired by the public anyway.

So, current negotiation with the creditor countries within the euro area and with the European Central Bank (ECB) and the IMF are mostly about the debt sustainability part. The structural adjustment part is mostly for the Greek public and its political and social institutions to deal with. That latter part is the adjustment problem, and it is not clear whether it has a solution in the Greek case.

Footnotes:

1) Detailed discussion of Keynes-Ohlin controversy in V. Gligorov, “The Transfer Problem”, working paper, forthcoming.