Turkey: Is the worst yet to come?

01 December 2021

The use of negative real interest rates to support credit growth has again led to a lira rout and skyrocketing inflation. The crisis is unlikely to be over

By Çiçek Serkan

image credit: unsplash.com/Omid Armin

- The progress on structural reforms and institutional upgrading carried out in the early 2000s began to be reversed after 2013, as the government turned more authoritarian and loyalty came to be valued more highly than expertise in appointments to key positions.

- There was an attempt to artificially stimulate growth via too-low nominal interest rates that failed twice (in 2018 and 2020), but is now being tried again.

- This policy lacks theoretical support and is causing serious damage to the economy, especially via the cost channel, due to the depreciation of the Turkish lira.

- Although the currency depreciation is touted as a ‘conscious strategy’ by the central bank, it is clear that it is more of a side-effect, while the core aim is to keep credit growth high via low interest rates.

- The ‘new’ competitive exchange rate strategy is likely to damage the Turkish economy even further in the near future; therefore, the economic and social situation is likely to get worse before it gets better.

New economic order after 2001 crisis

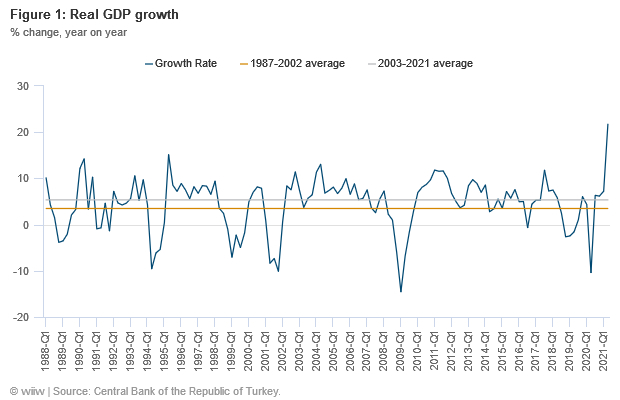

After a series of economic crises in the late 1980s, the 1990s and the early 2000s (in 1989, 1994, 1999 and 2001) – mostly a consequence of domestic issues – the Turkish economy implemented a series of policy changes in the 2000s which led to domestic economic stability. Following these policy changes – and leaving to one side the effects of the global financial crisis, which was caused by external shocks – growth rates remained steadily positive for 14 years (Q1 2002 - Q2 2016), as can be seen from Figure 1.

Several factors played an important role in this success. The first two were the structural and institutional reforms of the early 2000s. Autonomy was granted to institutions under a series of laws, and care was taken to ensure that those institutions could reach their decisions independently. The third factor was the major inflow of capital into Turkey, especially in the early 2000s. The availability of international capital allowed government officials to carry through big infrastructure investments. The large-scale capital inflows also contributed to cheaper credit, underpinning an acceleration in consumer spending.

Change in the political climate

Despite the positive developments in the economy, the political climate began to change from 2013. From then on, there was a systematic erosion of institutional structures. As the government won more elections and strengthened its hold on power, it became easier for the administration to intervene in the independence of the institutions. In the same period, the outflow of capital at the global level, due to the 2013 ‘taper tantrum’, meant that the effects of political instability on the economy spread much faster.

The coup attempt of 2016 was the single most important event in the altered political climate of Turkey. In its wake, the government gained the ability to directly influence all aspects of public life. The institution where government pressure can be seen most clearly is the central bank. Having earlier spoken out in favour of interest rate cuts, President Erdoğan then began to enforce the idea by dismissing central bank governors. As a consequence, interest rate decisions in Turkey began to be taken without regard for the objective of maintaining price stability. The upshot was that the Turkish lira depreciated sharply. Following the policy rate cuts (which were carried out in defiance of any credible economic theory), the sharp lira depreciation and mounting inflation meant that the policy rate had to be hiked back up. This happened following exchange rate shocks in August 2018 and November 2020. However, since the inflation expectations had already deteriorated due to the loss of confidence in central bank policies, these interest rate hikes could not forestall the jump in inflation. Moreover, the abrupt interest rate rises resulted in a sharp decrease in the growth rates of the economy in 2018 and 2020, while the outbreak of COVID-19 led the 2020 exchange rate shock to be felt even more profoundly (Figure 1).

Expecting the right result from the same wrong decision

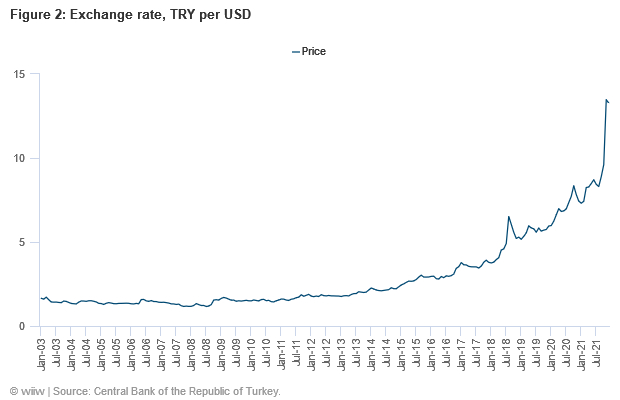

The Turkish economy has faced the same scenario over the past few months. Despite inflation being well above target, the policy rate has been cut at each of the last three Monetary Policy Committee meetings, taking the real policy rate ever deeper into negative territory. As a result, the Turkish lira (TRY) has gone into freefall. The US dollar, which was worth TRY 8.30 at the beginning of September, rose above TRY 10 and reached almost TRY 13.00 following the last policy rate decision (Figure 2).

The reduction in the policy rate to 15.00% means that the exchange rate is likely to remain highly volatile and the currency could depreciate further. Although the administration of the Central Bank of the Republic of Turkey (CBRT) described the exchange rate increase as a deliberate ploy, in line with the aim of narrowing the current account deficit, the bank has not been able to convince the public of this. Too-low real interest rates and the ensuing lira depreciation have created significant difficulties for Turkish companies and households.

Effects of unsuccessful policies pursued

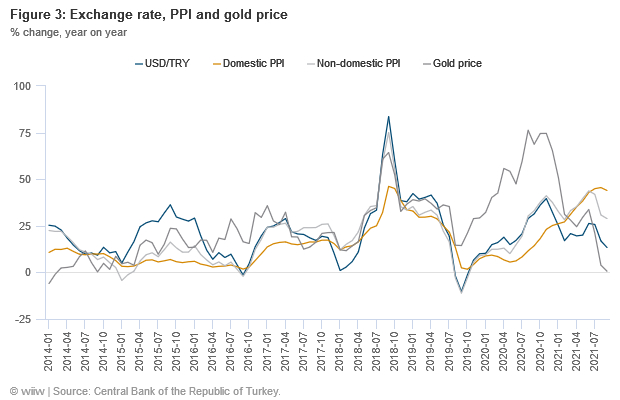

The most immediate effect of the fall in the exchange rate has been that the lira-denominated prices of assets such as gold, cars and oil (whose prices are determined on foreign markets) have soared. The heavy dependence of Turkish production on imported inputs has meant that the increases in the exchange rate have been rapidly reflected in almost all non-domestic and domestic producer prices, through the cost channel. Figure 3 shows the percentage change in the exchange rate and the percentage change in domestic (PPI-D) and non-domestic (PPI-ND) producer prices and gold prices denominated in TRY. The strength of the co-movement between the change in the exchange rate and these variables is clear.

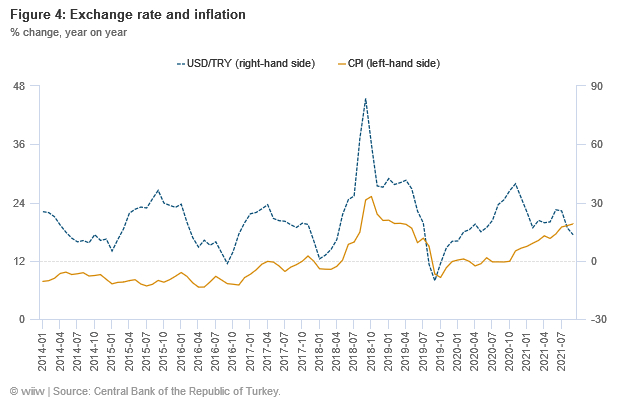

The next step is for the decline in the exchange rate to affect consumer prices. Figure 4 shows the relationship between the Consumer Price Index (CPI) inflation and the exchange rate changes. The co-movement is quite evident. And academic research indicates that the situation is getting worse: one study has shown that the pass-through coefficient from the exchange rate to the inflation rate in the current month increased from 0.13 in the 2000s to 0.28 after 2014. And figures reported in the press recently indicate that the pass-through is approaching 0.40.[i] This suggests that there is an evolution towards an inflation–exchange-rate spiral in the economy.

Is the ‘competitive exchange rate’ policy a conscious choice?

The CBRT administration and some economists who support the government have started to promote the concept of a ‘competitive exchange rate’, touting the depreciation in the exchange rate as a ‘conscious strategy’. According to this claim, the depreciation in the exchange rate will contribute to an improvement in Turkey’s export performance and will lead to a narrowing of the current account deficit. After about a year, the Turkish economy will emerge from the trouble it is currently in.

Those who defend this theory use the following arguments:

- the Turkish economy is currently at the deepest point of the crisis;

- the economy has tended toward positive momentum with the competitive exchange rate policy;

- there should be absolutely no concern about the increase in the exchange rate;

- this is actually the result of a conscious economic choice;

- the most pressing economic problem in the Turkish economy is the current account deficit;

- the growth that will emerge with the narrowing of the current account deficit will compensate for the decrease in standard of living due to inflation.

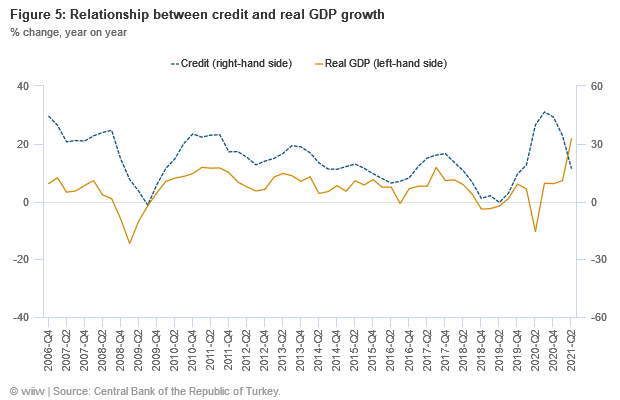

Although the above statements seem to be consistent with economic theory, it is clear that they do not correspond to the current situation in Turkey. First of all, there is no such thing as a competitive exchange rate policy in Turkey. It is clear that the choice of currently pursued economic policies in the Turkish economy is shaped by the use of low or negative real interest rates to keep credit growth high. The government is trying to keep credit growth high, in order to secure a return to the economic growth rates seen in the golden years of 2002-2015, because past experience has shown that there is a strong relationship between the growth rate of credit and the growth rate of the economy (Figure 5). The expectation is that the increase in credit will lead to a boom in investment and the housing market. President Erdoğan and those surrounding him most likely believe that a revival in the housing market will provide a stimulus for the economy as a whole. They may believe that the slowdown witnessed in the economic growth rates (which were high for many years) can be reversed through credit expansion, which will also help alleviate the debt problems of investors.

Expectations and facts

So, could this plan succeed? As mentioned before, the strategy being implemented is not a new one. The same strategy has been tried twice in the recent past, and on both occasions the CBRT had to abandon it, raising interest rates abruptly and sharply. The depreciation and volatility of the lira that followed as a consequence of this policy created many problems in the country. First, it caused high inflation, leading to a serious decline in the standard of living of the population. Although each year the minimum wage was increased by above inflation, real median wages declined on account of the acceleration in the inflation rate. Secondly, it led to a change in income distribution in society, to the detriment of those on low incomes. Thirdly, it created difficulties for producers in securing the necessary raw materials, intermediate goods and capital goods, most of which are imported, leading to a slowdown in investment. Fourthly, and most importantly, it caused economic agents to lose confidence in the independence and capacity of the economy, further undermining the effectiveness of the policies pursued.

In the light of these developments, there will be a further deterioration in the Turkish economy in the coming period. In other words, the situation is likely to get worse before it gets better. On current evidence, it seems unlikely that the government will enact policies that could re-establish trust in institutions.

[i] https://iktisatvetoplum.com/enflasyonda-cift-haneli-yillar-doviz-kuru-geciskenligi-gu%CC%88cleniyor-mu-hakan-kara-cagri-sarikaya/ The authors claim that the exchange rate pass-through increases and strengthens as inflation reaches double digits.