Paper on international investment linkages published in Journal of Comparative Economics

30 January 2026

New research by Konstantin Wacker sheds light on how foreign direct investment by multinational firms translates into domestic investment. The financial system seems to be the critical link

image credit: wiiw/Konstantin Wacker

Our Research Associate Konstantin Wacker together with co-author Tim de Leeuw from the University of Groningen recently published a paper on how the foreign direct investment (FDI) of multinational corporations translates into domestic investment. The study was published in the Journal of Comparative Economics, a leading international journal for transition economies and comparative economics.

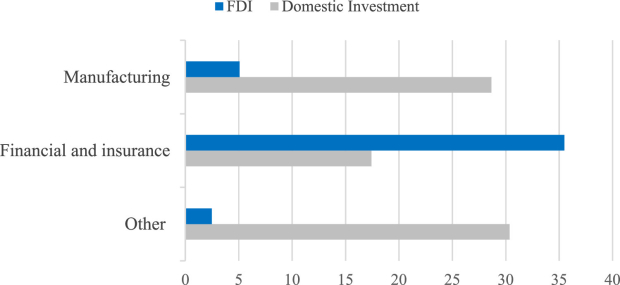

The study investigates data from 12 Central and Eastern European countries and shows that not all FDI translates into actual investment in these countries. The role of the financial sector is critical in this context: ‘A lot of FDI goes into the financial sector; think of all the foreign banks that are present in Central and Eastern European countries, including Austrian ones,’ explains Wacker (see Figure). ‘But the financial sector itself does not invest much in physical capital. Our study, however, shows that industries with close links to the financial sector increase capital investment when financial-sector FDI pours into the country.’

Figure: FDI flows in the financial sector & other industries (% of value added)

Source: de Leeuw and Wacker (2026). Averages over multiple years up to 2019.

The authors made extensive use of wiiw’s industry-level data in their research. Lead author Tim de Leeuw from the University of Groningen explains how these data facilitated their research: ‘Comprehensive, industry-level data that are comparable across countries are scarce for non-OECD economies. The expertise of wiiw in constructing this harmonised dataset was therefore indispensable to our research.’