Russia is shifting its foreign trade massively towards China

02 October 2025

Russia’s foreign trade is undergoing a profound shift, with China replacing the EU as Russia’s main trading partner

image credit: istockphoto.com/Oleg Elkov

The war in Ukraine and Western sanctions have triggered an abrupt and far-reaching reorientation of Russia’s foreign trade, with China having replaced the European Union as Russia’s principal trading partner. This is the finding of a new analysis by the Vienna Institute for International Economic Studies (wiiw), published in the latest Monthly Report.

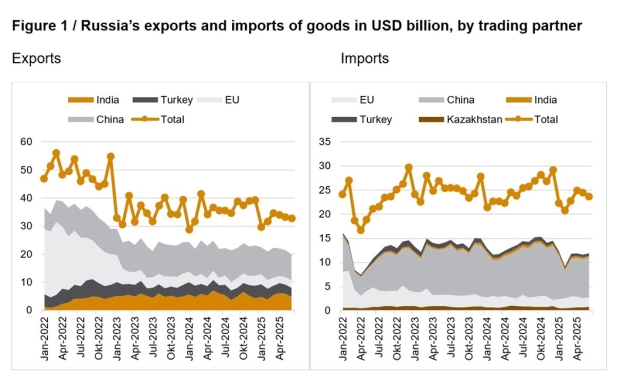

Russia's exports and imports of goods in US$ billion, by trading partner

Sources: Total: Russian Central Bank; individual countries (mirror statistics): N.E. Boivin, Z. Darvas, M.-S. Lappe, L. Léry Moffat, C. Martins & C. McCaffrey (2022). ‘Russian foreign trade tracker’, Bruegel Datasets, first published 10 October 2022, updated on 27 August 2025, available at https://www.bruegel.org/dataset/russian-foreign-trade-tracker

Before the war began, almost half of Russia’s goods exports went to the EU. But by mid-2025, that share had collapsed to only 8%. A similarly sharp decline can be observed on the import side – from around a third to just 12%.

The trade data make it clear: sanctions have turned Russia’s foreign trade upside down. China has benefited the most, both economically and geopolitically.

China as the big winner

Those countries that have not joined in the Western sanctions have benefited most from this shift – above all China, but also India and Turkey. China’s role stands out in particular: it now accounts for around 30% of Russia’s exports and 35% of its imports (compared with 16% and 30%, respectively, before the war began in 2022).

China and India have become the most important purchasers of Russian oil – often at an extremely favourable price. At the same time, China is now Russia’s most important source of high-tech products and technology. This includes the re-export of both sanctioned and non-sanctioned Western goods, including parts used in Russian military production.

Estimates suggest that over the past three years, between 80% and 90% of the computer chips and electronic components required by Russia’s defence industry have been acquired via China and Hong Kong.

Russia’s dependence on China is risky for the Kremlin

Russia’s pivot to China is not the result of a strategic decision, but rather the unavoidable consequence of the country’s geopolitical isolation. Western sanctions ultimately left the Russian leadership with no choice but to turn to China. However, this (recent) development is not without risks for Russia.

First, China cannot take the place of the West in all areas. Shortcomings are particularly apparent in intermediate goods and investment goods, which are far more difficult to redirect than consumer goods. Examples include advanced industrial machinery, high-performance semiconductors, spare parts for aircraft engines, and specialised equipment for oil and gas extraction.

Second, Chinese direct investment in Russia remains extremely low, leaving many sectors dependent on outdated technology and damping down Russia’s growth prospects. China mainly exports consumer goods such as cars and household electronics to Russia, invests little in new production facilities, and cannot fully replace Western products in high-tech industries.

Furthermore, the economic relationship is highly asymmetrical: while China has become Russia’s most important trading partner by far, Russia accounted for only around 4% of China’s foreign trade in 2024. Last year, Russia ranked only eighth among China’s trading partners – behind the EU, the US, South Korea, Hong Kong, Japan, Taiwan and Vietnam.

This imbalance gives China considerable economic leverage over Russia – a potential source of pressure that Beijing could find useful one day.

The full Monthly Report is available for our members.