Sectoral data underlines differentiated COVID-19 economic impact on CESEE

22 December 2021

New data shows sharp declines for tourism and transportation activity in 2020, while ICT and healthcare held up better

image credit: istock/matejmo

-

CESEE economies on average contracted by less in 2020 than in 2009.

-

This was due to the relatively better performance of Turkey, the CIS and Ukraine; EU-CEE and the Western Balkans posted steeper declines in 2020 compared with 2009.

-

Newly released data quantify the major differences in sectoral impact of the 2020 downturn.

-

Accommodation, arts and the transportation sectors performed worst, owing to pandemic-related restrictions and increased caution among populations in CESEE.

-

Montenegro, Croatia and Turkey suffered most from the tourism decline, while the impact of supply chain disruptions on manufacturing was the main driver of contractions in the Visegrád countries, Bulgaria and Romania.

-

A bad year for agriculture in Moldova, Romania and Ukraine, and unfavorable conditions in oil markets in Kazakhstan and Russia, amplified the crisis in those countries.

-

Not all sectors did badly, however. The pandemic moved large parts of the economy online, supporting real growth in the ICT sector in almost all CESEE countries. Meanwhile, the health sector was a relative outperformer in the majority of CESEE economies.

The economies of the CESEE region posted 2.2% real GDP decline in 2020 (weighted average), a much better performance than the 5.6% contraction in the wake of the global financial crisis in 2009 (Figure 1). One country in the region, Turkey, posted positive growth in 2020 relative to 2019, helped by the low base from that year as well as significant credit stimulus. The contraction in the CIS and Ukraine was smaller than in 2009, as most of these countries prioritised the economy over health, with relatively low level of restrictions on economic activity. However, economies in EU-CEE and the Western Balkans experienced a steeper decline in 2020 (3.8% and 3.2%, respectively) relative to after global financial crisis in 2009 (3.1% and 1.3%, respectively).

The economies most negatively affected by the pandemic-driven economic downturn of 2020 are different from those that were most affected by the global financial crisis. Figure 2 shows annual changes in real GDP over the last two decades for each country in CESEE. Whereas a double-digit decline was observed in Estonia, Latvia, Lithuania and Ukraine in 2009, this was only the case for Montenegro (15.3%) in 2020. The next deepest contractions in 2020 were in Croatia (8.1%) and Moldova (7.0%).

In CESEE on average, services most affected by pandemic-related restrictions recorded the worst performance in 2020 (Figure 3). Accommodation and food services lost 35.4% of value added in real terms in 2020, measured as a simple average of 21 CESEE countries (excluding Albania and North Macedonia, for which 2020 data are not yet fully available). Other sectors with substantial declines in value added in 2020 were activities of households as employers of domestic personnel like cleaners, babysitters etc (-16.8%), arts (-13.7%) and transportation services (-12.4%). Not all service sectors suffered, however; demand for online services skyrocketing during lockdowns as large parts of the economy moved online, driving a 4% real increase in ICT value added. Meanwhile increased demand for medical services fuelled 2.2% real growth in the health sector. These sharp swings in value added in different sectors in 2020 naturally reflect not only the direct impact of pandemic restrictions, but also the ability to adapt to the crisis, and the relative success (varying between countries) of fiscal support measures to support vulnerable sectors.

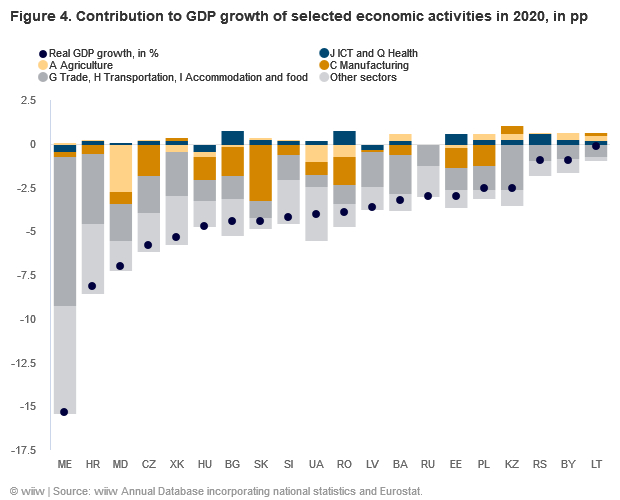

The major negative impact of the pandemic on particular sectors such as tourism, transportation and manufacturing was an important driver of cross-country differences in economic performance in 2020 (Figure 4). Accommodation and food services made particularly big negative contributions to growth in Montenegro (-5.8pp), Croatia (-2.7pp) and Turkey (-1.2pp). In Serbia, both accomodation and food services and transportation and storage services subtracted -0.4pp from headline growth. The latter sector also subtracted significantly from growth in Kazakhstan (-1.2pp), Latvia (-1pp), Kosovo (-1pp) and Belarus (-0.5pp). Manufacturing, hit by supply chain disruptions and delayed demand, was the main cause of last year’s economic decline in the Visegrád countries, subtracting heavily from growth in Slovakia (-3.2pp), Czechia (-1.8pp), Hungary (-1.3pp) and Poland (-1.2pp), while also badly affecting Bulgaria (-1.7pp), Romania (-1.6pp) and Estonia (-1.1pp). A bad year for agriculture amplified the crisis in several countries; in Moldova and Ukraine the negative contribution to growth from the agricultural sector was the largest among major areas of the economy (-2.7pp and-1.1pp, respectively). Low oil prices exacerbated the downturn in Kazakhstan and Russia, with the mining sector taking away -0.6pp and -1.1pp, respectively, from real GDP growth in 2020.

Across most of CESEE, the ICT sector was a success story in 2020, with the pandemic delivering a boost to the region’s ongoing digital transformation (Figure 4). Almost all CESEE countries for which data are available posted real value-added growth in the ICT sector last year. Even for the four countries with negative real growth rates in ICT last year - Latvia (-6.9%), Montenegro (-6.1%), Moldova (-1.6%) and Kosovo (-1.2%) - the contraction in this sector was less pronounced than for the economy as a whole (except in Latvia). However, growth in the ICT sector in 2020 was lower than its average for 2017-2019 except Romania, North Macedonia, Serbia, Turkey and Kazakhstan. The pandemic boosted digital development in Turkey and Kazakhstan, where the share of the ICT sector in GDP was traditionally very low (2.7% and 2.4%, respectively, in 2020). Both countries and Romania, a country where the ICT sector has been growing strongly in recent years, posted double digit growth in this sector in 2020 (Figure 5). Estonia, CESEE’s digital frontrunner, also posted further strong ICT growth in 2020 (9.5%). Like in Estonia, real growth in Belarus and Bulgaria followed a double-digit expansion in 2019 with a further strong performance in 2020 (growth of 6.9% and 4.1%, respectively). Across CESEE, Belarus and Bulgaria had the highest share of ICT in value added in 2020 (7.3% and 7.2% respectively).

Unsurprisingly in the context of a global pandemic, the health sector across most of CESEE performed relatively strongly in 2020. The pandemic revealed an underfinanced health sector in many CESEE countries. Fiscal support measures to address this contributed to the positive performance of the sector in the majority of CESEE countries in 2020. In nine countries, real value added in the health sector grew more strongly than the average rates of 2017-19 (Figure 6). Bulgaria is the most striking example with double-digit growth of 15.1% in 2020. Of the countries for which data are available, only five CESEE countries posted a real value added decline in the health and social activities sector in 2020: Hungary (-15.5%), Montenegro (-4.1%), Belarus (-3.2%), Lithuania (-1.1%) and Serbia (-0.2%). However, in Montenegro and Serbia, the contraction in this sector was less than the decline posted for the economy as a whole.

Background structural data for 2020 and backwards revisions are available in our wiiw Annual Database. This is ourlast update of the wiiw Annual Database this year, replacing our Handbook of Statistics in 2021. Additionally, our useful visual analytics tool CESEE Visual Data Explorer (CESEE VDE), which is exclusively available to members, offers new sections on value added and investment data by activity.

Countries covered:

Albania, Belarus, Bosnia and Herzegovina, Bulgaria, Croatia, Czechia, Estonia, Hungary, Kazakhstan, Kosovo, Latvia, Lithuania, Moldova, Montenegro, North Macedonia, Poland, Romania, Russia, Serbia, Slovakia, Slovenia, Turkey, Ukraine.

Country groups list: CESEE countries