Slovakia at a crossroads

by Doris Hanzl-Weiss and Veronika Janyrova

Slovak Flag: Nicolas Raymond, CC-BY-3.0 unported

- Upcoming parliamentary elections on February 29 could fundamentally alter Slovakia’s political direction

- Opposition parties are on the rise, including strong support for the far-right

- The Slovak economy is performing reasonably well with favourable conditions on the labour market

- However, the economy faces several long-term challenges and needs reforms

On 29 February the politically divided country goes to the ballot-box. This time, the elections might not only bring about a new government, but might also fundamentally alter Slovakia’s political direction.

Slovakia finds itself at a crossroads. After the elections, it could either follow the authoritarian path of some of its neighbours, or end up with a strong moderate coalition. However, a highly fragmented political landscape and a huge variety of possible coalitions make it almost impossible to predict the outcome. Small parties could end up holding the balance of power.

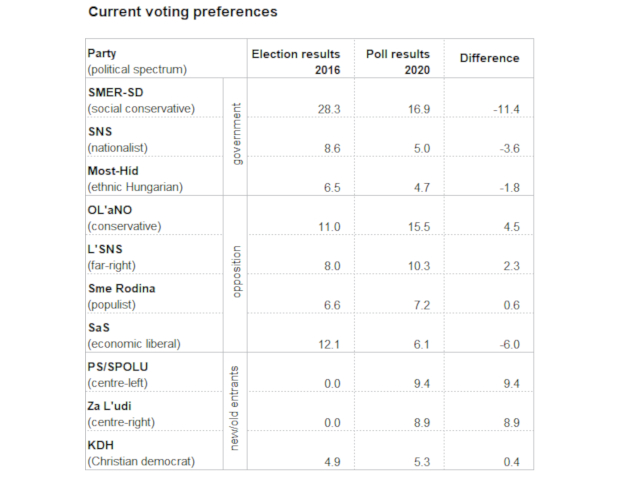

According to the most recent opinion polls published by the agency AKO s r.o., the ruling coalition parties, SMER-SD (Direction – Social Democracy), SNS (Slovak National Party) and the Hungarian party Most-Híd (Bridge), are losing public support. The latter two parties have seen their support fall to a level where they might not achieve the 5% threshold for parliamentary representation. The opposition OL’aNO (Ordinary People and Independent Personalities) and the recently formed PS/SPOLU (Progressive Slovakia/Together) and Za L’udi (For the People) are on the rise. The most worrying trend, however, is the strong support for the far-right L’SNS (People’s Party – Our Slovakia), which is, according to the polls, currently the third most popular party.

Economic challenges

While the cards are being reshuffled in Slovak politics, the Slovak economy is performing reasonably well. Between 2010 and 2018, the average growth rate was 3%. First estimates for 2019 show a GDP slowdown to 2.4%. This is better than data for the first three quarters had suggested. Positive contributions came from household consumption, government consumption and investments, while net exports had a negative impact. Slovak GDP is expected to grow by 2% in 2020 and by around 2.5% in the coming years.

The labour market has recovered after the global economic crisis and is in good shape. The unemployment rate has declined sharply and seems to have reached the lowest feasible level in 2019 (5.8%, based on LFS data). However, large regional disparities persist between the prosperous west of Slovakia (where there is nearly full employment) and the eastern and southern areas.

The automotive industry, which forms the backbone of Slovakia’s economy (the most specialised in the region) – accounting for 38% of manufacturing production and 32% of total goods exports – has been losing momentum. Industrial production has fallen since June 2019, owing to global headwinds. Besides VW Bratislava, PSA Peugeot-Citroën and Kia Motors Slovakia, Jaguar Land Rover began production in late 2018. Growing internal and external risks challenge the Slovak automotive industry, however: a shortage of qualified labour, rising unit labour costs and low R&D, together with strong dependence on external developments, where uncertainties are on the rise.

Although the outcome of the parliamentary elections may add to uncertainty, it should not have too significant an impact on the economy in the short run. In the long term, however, the country must tackle a list of long-standing issues and reforms: demographic change, the healthcare system, the education system, the judiciary, the fight against corruption, the integration of the minorities, and – not least – emerging environmental topics.