The Coronavirus could dangerously accelerate centrifugal forces in the EU

06 April 2020

Joint EU measures would not only alleviate short-term difficulties, but also help the recovery and improve the longer-term growth prospects of individual member states.

By Michael Landesmann

image: iStock.com/ipopba

The strain on medical facilities in EU countries (and, of course, globally) has become enormous in the current coronavirus crisis. National governments are, furthermore, putting massive programs together to support households, firms and basic infrastructure.

These programs go roughly in the right direction and governments in the advanced economies are not afraid to jettison long-held positions of economic orthodoxy. They are prepared to accept massive increases in fiscal deficits by supporting the wage bills of workers, waive immediate tax payments of firms, under-write the risks of borrowing by households and companies, and hand out cash payments to individuals and one-person companies whose means of livelihood have vanished. This comes on top of mobilising resources for the health systems such as attempting to get supplies for protection equipment, ventilators and extending hospital capacities.

Very similar programs are currently being put in place in most wealthy EU economies. The big question is whether the scale (but, of course also the efficiency and speed of implementation) of these programs will be sufficient to avoid an economic catastrophe that some commentators now judge will potentially rival the 1930s Great Depression. Further, what are the constraints on EU governments to set up programs of sufficient scale, what should be done at the EU level to overcome such constraints and what should be the sequencing and duration of such programs over time?

Phases of the crisis

To answer these questions, it is useful first to identify the phases through which the crisis is going to proceed:

The first phase is the immediate impact of the unfolding epidemic and governments’ reactions to it, in particular the various measures to achieve ‘social distancing’ through (at times staggered) processes of ‘lock-down’ of economic activities. We are still living through this first phase and see the differentiated strain on national health systems, the lack of essential supplies of medical equipment and the – almost unprecedented – speed by and scale at which production activity and employment falls, international production linkages get severed and mobility of people, especially across borders, gets severely restricted.

The second phase takes place alongside phase 1 but with a lag. It refers to a reallocation of resources, mostly within countries, to mobilise more effectively the production and allocation of resources towards the most pressing needs: this includes, foremost, the purchasing and production of essential medical equipment (masks, protection for medical staff, ventilators, etc.), reorganising the capacities in the health system (provision of more beds and intensive care units for Covid-19 patients and withdrawing from less urgent activities such as standard surgeries) and mobilising new capacities (new hospitals; drawing in more supporting staff and retired doctors and nurses; bringing in military for support, etc.). The reallocation of resources and building up new supply lines goes beyond the health sector. It encompasses the production and distribution of food, the maintenance of essential infrastructure (energy supply, various utilities such as garbage collection, etc.) and employing the capacities of ‘law and order’ enforcement.

This second phase is thus one of ‘structural adjustment’ (economists might call it a ‘traverse’) where production systems adjust to new demands. In this phase there are essential learning processes on the part of the administration, engineers and companies to supply necessities at the required scale to relieve the scarcity of essentials in the health system, in the logistics of organising new production lines and of course, in inventive efforts regarding testing procedures, medical treatments of this new illness, and – over a longer period of time – the necessary vaccines. The better this second phase of ‘adjustment’ proceeds the more one can come to grips with the immediate shortage phenomena that arise during phase one and that cost lives.

The third phase is one which starts when the initial emergency phase in containing and dealing with the epidemic is overcome and the challenge arises of getting the economy going again. This amounts to a ‘second traverse’, embarking on a path which restores the operation of a diversified economy, return to high levels of employment and also renew the production linkages (at regional, national and international levels) that provide the backbone of such an economy. In order to avoid a recurrence of waves of new infections, the restarting of economic activity will proceed in a staggered, gradual manner. This phase of recovery faces a number of constraints: the debt constraint of households and firms that have built up debts during the lock-down; these might have been backed up by the state but they are debt nonetheless. This will lead to a hesitancy to spend and, if firms expect such sluggishness in demand, they will be hesitant to invest. Furthermore, just like in the aftermath of the financial crisis, banks’ balance sheets will have deteriorated given the weakened position of their client base and this will make them hesitant to provide new credits. The result of all of this is an expected fragility in the level of aggregate demand by the private sector even when the epidemic itself has been contained. In the European context of highly interconnected economies, the recovery in each individual country depends on the timing and constraints faced by all the other economies.

How should policymakers react?

Let me now come to the policy issues associated with the three phases: governments all over Europe (with few exceptions) have reacted in similar ways to the challenges of the first two phases, albeit some earlier and some later, some more efficiently and some less efficiently. However, the scale of the response was widely different: The (mostly planned) fiscal responses in developed countries reflect the relative fiscal constraints different countries are under (for details see IMF, Policy Responses to Covid-19): these amount – at the time of writing – in the US to a bit more than 10% of GDP, in Japan over 6%, in the UK, South Korea and Canada 4-5%, in Germany about 4%, in Spain and France around 2%, Italy below 2%1. The last three are also the countries that have been hit earliest (in Europe) and most severely by the corona virus epidemic. We can thus see that the scale of fiscal policy responses are highly uneven even amongst the advanced economies, not to speak of the situation in developing countries, some of which – such as India and countries in Africa – are expected to be heavily hit by the epidemic.

Here, though, my intention is to focus primarily on the debate on policy responses in the European economy, and particularly those that rely on cooperation at the EU (and specifically the Eurozone) level:

In some sense, the current crisis should make it easier to come to a joint position, as the arguments that were made in the 2008/9 crisis that some countries were more profligate in their borrowing and spending than others, do not apply in this case. EU countries were – in the case of the corona virus epidemic - hit by a ‘symmetric (exogenous) shock’ (i.e. all are affected by a crisis that none of them had any role in causing). This was different in the 2008/9 financial crisis when one could argue that countries’ relative vulnerability to the global financial market disarray was due to previous policy positions taken with respect to the build-up of public and private sector debt and to the nature of national bank supervision and regulation. As nobody could foresee the current epidemic one cannot ‘blame’ countries for getting themselves into the position they find themselves in. Every country was affected – although with a different timing and severity - and this should in principle make it easier to generate a common commitment to agree on cooperative measures in the current circumstances.

However, differentiation still exists and this makes commitment to joint action difficult. There are three main reasons for this.

First, as already mentioned, the timing and the evolving pattern (and then the scale) of the pandemic itself is different across countries.

Second, there is the difference with regard to the strength and preparation of the health service infrastructure. The EU is particularly unprepared for cooperation in this area as health policy belongs to the national policy domain and little has been devolved to the EU level; exceptions are testing procedures for new drugs and technical specifications of medical equipment. Nevertheless, even if health is primarily a national competence, significant EU cooperation in this area even in the short-run is both sensible and feasible. Thus, an extension of collaborative efforts could be mobilised also in the short-run as regards pooling resources for the joint development of testing procedures, joint production and also acquisition of medical equipment, protection and testing gear. This is clearly an area where economies of coordination, the establishment of essential production lines involving European producers, and the use of joint purchasing power on international markets could be of great benefit to all participating countries. It is likely that in this area there could also be a high degree of consensus and popular support.

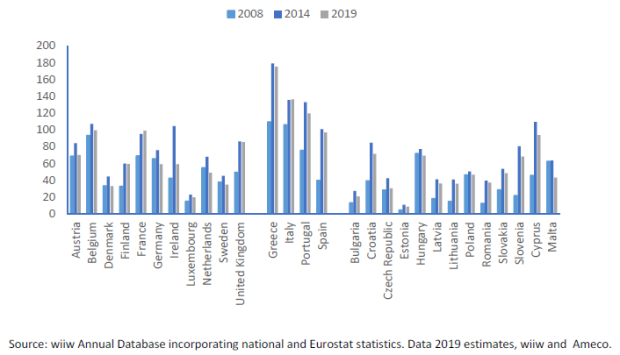

Third, and particularly important for the current economic debate, is the differentiation in the fiscal situation which is to a significant degree a legacy of the past and has been heavily affected by how countries previously emerged from the financial and economic crisis. Fiscal space is decisive in the current circumstances to mobilise the vast resources that are necessary to support the medical infrastructure, but, most importantly, to prevent the economy from falling into a ‘black hole’ and – of course – to emerge from it. It is vital, as we move into the third phase, that the ‘hysteretic’ loss of capacities, i.e. the permanent closure of enterprises and plants and losses of employment opportunities that can affect particularly the young (youth unemployment remained very high after the financial crisis in a number of EU economies) should be kept as low as possible. In a situation in which companies will be hesitant to invest, households still constrained by their incurred income losses and banks hesitant to lend, the role of governments to provide a long-term perspective of recovery of demand and the possibility to emerge from a debt constraint will be vital.

Figure: Public Debt (% of GDP)

The fundamental differentiation of positions taken by policy-makers at EU level, much less so amongst economists, is – as in the aftermath of the financial crisis of 2008/9 – the extent to which joint responsibility should be taken by EU (or Eurozone) member countries for the additional debt taken on as a result of the virus epidemic. All the different measures discussed at the moment (see the recent Bruegel paper for an overview) involve some degree of joint responsibility:

- The already enacted steps by the European Central Bank (ECB) through the Pandemic Emergency Purchase Program (PEPP), that provides for additional purchases of securities by the Eurosystem of up to 750 bio euros and the decision to allow some flexibility in such purchases from countries’ capital shares; the latter was important as some countries were already at or close to the previously set limits. These measures are designed to keep interest rate spreads from diverging too much and thus reduce the financing costs of borrowing and signal sustainability of the debt situation of Eurozone member countries;

- The use of the ESM’s (European Stability Mechanism) existing credit lines (the ECCL – Enhanced Conditions Credit Line) and the creation of new credit lines (a Covid Credit Line) specifically for providing supports linked to the impact of the current epidemic (see proposals made by Benassy-Quere et.al).

- The issuance of Corona crisis Eurobonds - in short, ‘Coronabonds’ - by an agency still to be decided (could be the ESM under newly decided rules, or other EU institutions such as the EIB, the Commission itself or a newly set up institution). Here again, a wide range of proposals are debated ranging from more limited use of such bonds, such as bonds financing health service needs and equipment, or financing temporary employment support schemes, up to the point where a substantial share of the additional debt accumulation caused by the corona virus epidemic by the different Eurozone countries would be covered by such bonds; some proposals mention a possible volume of 1,000 bio euros (see Bofinger et al in FAZ).

The above suggestions differ by a number of criteria:

- Whether the responsibility is taken by an independent institution such as the ECB or by politically accountable actors i.e. EU/EZ governments;

- The scale of support given to countries that are differently affected by the virus epidemic and who operate under different fiscal constraints; the issue here is what difference the support makes in terms of debt repayment;

- The implicit or explicit duration of the support which affects the long-term debt situation of countries. This is particularly important once EMU returns to enforcing its normal budgetary rules (which have been temporarily suspended) which will then determine whether the more heavily indebted countries will have to return to long periods of austerity to repay these debts as was the case in the aftermath of the financial crisis;

- Whether new instruments (either using existing or new institutions) are being created in the course of this crisis that will provide a basis also for widening the fiscal support and coordination mechanisms in the Eurozone which has long been seen as too rudimentary to ensure the long-term stability of the EMU itself.

Apart from these direct fiscal supports, other actions taken at the EU/EZ level will determine the pattern of recovery and longer-term growth paths of the different economies after the immediate impact of the epidemic is over. Of particular importance will be:

- Joint actions with regard to the banking systems which will have been heavily affected by the credit lines kept open (with national state support) to firms and households during the epidemic and whose balance sheets will have markedly deteriorated. Differences in the ability of different countries to provide support to the different national banking systems will affect their ability to provide credit to firms and households in the ensuing recovery. A major activation of provisions made under the (incomplete) banking union will have to take place; the Covid-19 crisis could in this area also provide a push towards implementing the intended measures of the ‘banking union’ particularly by advancing joint efforts in the areas of bank restructuring and bank recapitalisation;

- Restructuring the expenditure plans of the EU budget for the next seven year financial period starting at the beginning of 2021 (the MFF) to take account of the new situation regarding the changed needs of EU member countries emerging from the Covid-19 induced economic and social crisis. An interesting new development is the SURE program proposed by the EU Commission to add a borrowing scheme at the EU level to support particular sectors that have been heavily affected by the economic impact of the epidemic.

Conclusions

The coronavirus epidemic generates challenges of a massive scale:

- The lock-down procedures now adopted in all European countries are due to cause a precipitous fall in economic activity, employment and income flows;

- Governments in advanced economies have so far adopted measures similar in nature to concentrate resources to keep medical facilities from collapsing and maintain basic infrastructure, but also to keep life-lines open for households and businesses;

- The scale of government intervention is constrained by the starting points in the fiscal positions of countries even though they all face a similar ‘symmetric exogenous shock’;

- These constraints hinder asymmetrically the different economies to counter, first, the immediate impact of the crisis, and then to embark on a recovery that will have to cope with increased debt levels of households and firms, weak balance sheets of banks and high rates of unemployment;

- A high degree of cooperation amongst EU/EZ member countries is needed to reduce these asymmetric constraints which will hinder recovery of the EZ as a whole, and could easily lead to another ‘double dip’ recession as was experienced in the aftermath of the 2008/09 financial crisis.

- The political implications of a mishandling of this crisis with a lack of willingness to react jointly and effectively with policy instruments to avoid deepening the cleavages across member states would add to delegitimising the European integration project as a whole and might lead to its demise altogether.

- Hence this policy note advocates taking the opportunity of the current crisis to use a variety of measures that would dampen its asymmetric impact not only in the short run but also covering the recovery period and the longer-term growth prospects of individual EU member countries.

- Some of these measures can be implemented immediately (such as the ECB response), some require adjustments of current rules (such as the conditionality requirements associated with ESM loans), some will take longer to set up (new loan programs such as SURE, or the issuance of specific bonds targeting special cooperative measures e.g. in the areas of encouraging re-employment and fighting youth unemployment), some imply taking the further steps that had been planned already (such as further deepening of the banking union or proposals that have been forward for some time by a range of advocates such as an EU level unemployment re-insurance scheme and some require strong political leadership and commitment to deal with the longer-term deficiencies in the current policy set-up of the EU and the Eurozone in particular (restructuring of the MFF, reviewing and reforming the GSP to achieve a more balanced and effective use of monetary and fiscal policy).

- The important thing is that the bundle of measures and institutional and policy innovations implemented currently and in the coming months and years provide the scale of cooperative effort needed to avoid the persistence of forces of divergence in the EU and the Eurozone which, in turn, are in parts grounded at the national level, but also importantly based on a lack of cooperative efforts and an insufficiently developed policy-framework at the EU level.

Notes:

1 Two components are included in these calculations: Fiscal measures, that include household tax cuts/handouts, corporate tax cuts, wage subsidies, direct spending in healthcare and public services. And ‘safety net’ measures that include tax referrals and temporary loan bridging programs (see Gavin Davies, FT 30/3/20). Hence potential costs of credit guarantees are not included.