The structure and demography of Austrian companies engaged in foreign trade

13 September 2023

Companies that export tend to be more productive and to pay higher wages than companies that are only active domestically. This also applies to small and medium-sized enterprises

image credit: pexels.com/Frans van Heerden

This study provides a comprehensive overview of the structure of firms in Austria that undertake export or import activities, or that are members of some multinational, as compared to businesses that are exclusively domestically oriented. It is based on business-level data, linked to personal data, and is accessible for the first time for Austria via the Austrian Micro Data Center (AMDC). It confirms previous findings that associate export activities with better performance by exporting companies. The study shows that the story is rather similar for importing firms and companies that are part of a multinational, as well as for ‘marginal’ exporters, to some extent.

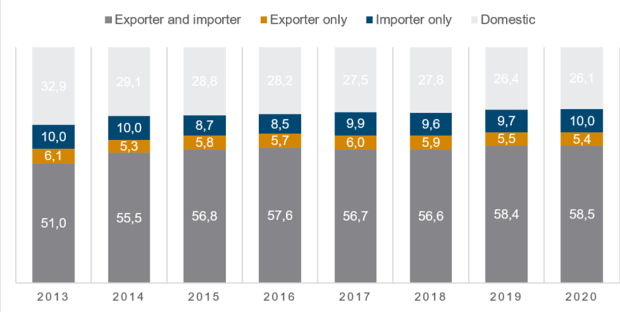

Figure 1 - Share of companies by export and import status

Furthermore, these correlations were analysed for companies of different sizes, with the main focus on small and medium-sized enterprises (SMEs). The linking of company data with detailed employment and income data allows for the first time employment structures in the different categories of companies to be analysed and conclusions reached as to how international activities affect wages and salaries according to employment groups, differentiated by education, age and gender, and various company characteristics. The most important results can be summarised as follows:

- Among firms active in manufacturing (NACE C) – based on the primary survey – just under 60% are active as both exporters and importers; about 5% are exclusively engaged in exports and just under 10% solely involved in imports; the remaining 25% do not engage in any foreign trading.

- The share of companies engaged in foreign trade is about 45% among small firms with fewer than 10 employees; slightly more than 60% among those with 10-49 employees; and over 90% among larger businesses with more than 49 employees.

- The share of ‘marginal’ exporters (i.e. firms exporting to only one partner country) is 15% of exporting companies; a stricter definition of marginal exporters as firms supplying only one product to a partner country results in this figure dropping to about 7%. The values for ‘marginal’ importers are somewhat lower: 7% and 3.5%, respectively. The share of marginal exporters or importers is much higher among smaller firms.

- Export and import activities are highly concentrated: about two thirds of exports are undertaken by 5% of (exporting) firms; 75% by about 10% of firms; and almost 90% by a quarter of firms. Import activities are similarly highly concentrated, with about 25% of companies responsible for 90% of imports. If one differentiates according to different size classes, this concentration is somewhat less in each case, but still significant.

- Most companies export to only a very few countries: about 1,200 firms export to only one country; 450 export to two countries; about 250 export to three countries; and so on. Only very few businesses export to as many as 150 countries. A similar picture emerges for imports. Larger firms have the most export or import partners on average.

- About 32% of businesses in the sample are part of a multinational company (of which slightly under 50% are based abroad); 46% are part of a domestic group of companies; and 22% do not belong to any group of companies. There are big differences depending on the size of the companies.

- Businesses that are internationally active are larger (‘size premium’) and more productive (‘performance premium’). This correlation was found in earlier studies – above all with regard to export activities; but it is also evident for import activities. The size or performance premium is even greater for those that are exclusively importers than for those that are exclusively exporters. There is also a positive correlation for firms that are part of a multinational company.

- This size or performance premium already exists among marginal exporters, but to a lesser extent (about 25% less) than among non-marginal exporters.

- With regard to the employment structures examined, it may be seen that exporting firms have a smaller proportion of employees with apprenticeship qualifications and a larger proportion with a higher vocational (BHS) or university degree. This general pattern is evident across all size classes, although the differences are not always statistically significant. Exporting firms also generally have a somewhat smaller share of female employees – something that is especially true of larger firms.

- If we look at the size and productivity of exporting firms, and at the socio-economic characteristics of their employees (education, age, gender), we find that export activity has a very small positive effect on the wages and salaries of employees. By size class, it is only significant for medium-sized firms (10-49 and 50-249 employees); it is negative for larger firms with 250 or more employees. The same applies if a company is part of a multinational group.

- Compared to non-exporting firms, companies that export pay slightly higher wages and salaries to persons with higher educational qualifications. Among women, this effect is only evident in large firms with 250 or more employees.

Contact:

Scientific Director

Vienna Institute for International Economic Studies (wiiw)

Tel. +43 1 533 66 10-47