wiiw prepares first regional Investment Report for CEFTA

08 February 2018

Given the right policy mix, CEFTA economies could significantly increase the amount of FDI they receive, with positive implications for income growth.

By Gabor Hunya

- The Central European Free Trade Agreement (CEFTA) Investment Report 2017, the first of its kind, and prepared by wiiw, has been published. It highlights the key features of foreign direct investment (FDI) in CEFTA economies comprising the Western Balkans and Moldova.

- FDI into CEFTA economies remains at a low level, although as a share of GDP is similar to that received by EU-CEE (reflecting the small size of CEFTA economies).

- The report concludes that CEFTA economies could significantly increase the amount of FDI they receive, with positive spill-overs for growth and income convergence with wealthier countries. However, achieving this will require further reforms of the investment climate, better governance, and improved infrastructure.

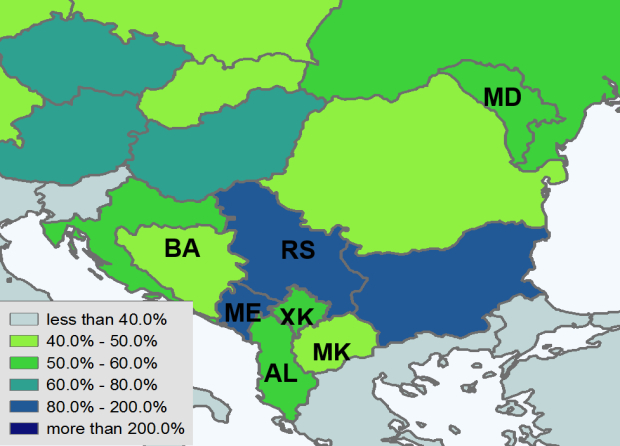

The post-financial crisis recovery in CEFTA economies took place with only a modest rise in FDI, and a very limited shift to export-oriented FDI. With annual FDI inflows of about EUR 4 billion and a 2016 FDI stock of EUR 54 billion, CEFTA economies have accounted for only 0.3% of the global annual FDI inflow in recent years, and 0.2% of global inward FDI stocks as of 2016. They have a similar record to EU-CEE in attracting FDI relative to their size (measured in FDI/GDP - see figure below), but mainly on account of relatively low GDP levels.

The size of FDI inflows differs greatly between CEFTA economies; in absolute terms Serbia receives by far the most, reflecting its large size, followed by Albania and Montenegro. As a share of gross investment, Montenegro is comfortably the top CEFTA performer, while Macedonia fares best in terms of FDI in manufacturing. Differences between economies reflect the economic backdrop, advance in privatisation, and specific features of particular sectors in each economy.

Greenfield FDI has been the more favoured entry mode of FDI than mergers & acquisitions (M&A) although the largest projects originate in privatisation deals. The remaining assets waiting for privatisation may present interesting opportunities for foreign investors which assess risks correctly. A revival of the currently sluggish greenfield investment activity in the tradeable sectors is the key to further increase in FDI and economic growth.

This report concludes that CEFTA economies have significant potential to further increase the amount of FDI they receive. Investors with experience of EU-CEE will not find conditions in CEFTA economies too different, particularly in the institutional sense, with most CEFTA economies working towards EU membership. One potential attraction for investors is that labour costs in CEFTA are lower than EU-CEE.

However, attracting more FDI to CEFTA economies also faces challenges, and will require further reforms to ensure attractive conditions for investment. The external environment is not as supportive as it was before the 2008-09 global financial crisis. Certain aspects of the investment climate in some CEFTA economies dissuade many investors. Transaction costs are higher than in EU-CEE, reflecting weak governance standards and infrastructure deficiencies. In particular, there is a need to improving regional transport infrastructure for which steps have been made under the umbrella of the Berlin Process.

A careful data-based examination of the main features of FDI in CEFTA economies is provided in this report informing potential investors and policy makers. FDI is set into the broad context of economic growth, foreign trade and transport infrastructure development (Part I). Drawing on central bank data as well as on international resources including company news, Part II presents the salient features of FDI inflows and inward stocks, analyses the entry mode of foreign investors and discusses to what extent CEFTA economies utilise their potential for FDI. The manufacturing sector is in the focus of Part III as it has a central role in driving technological progress, boosting productivity, and creating market for advanced services, while its development depends on FDI which can connect CEFTA economies with international value chains.

FDI stock in CEFTA economies, in percent of GDP, in 2016