wiiw’s health tax initiative moves its tobacco research forward with a conference and internal workshop

06 July 2024

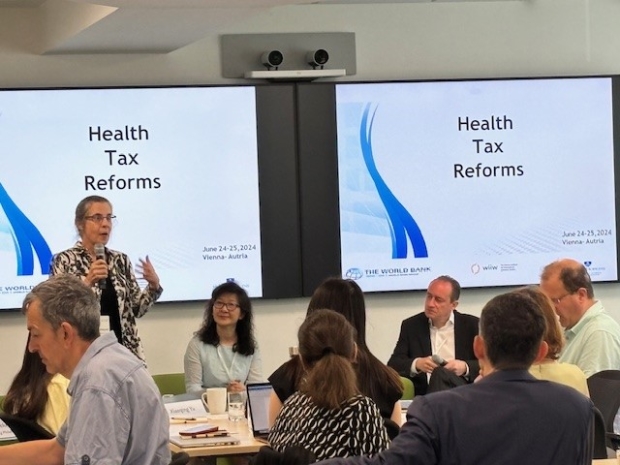

Experts and CEE policy makers in public health and taxation gathered in Vienna to present the latest trends and results in health tax policy in the region

image credit: wiiw/The World Bank

In late June, wiiw and its seven research partners within the Taxes for Health Initiative (THEi), launched in February 2024, gathered in Vienna for a two-day health taxation conference in collaboration with the World Bank (Health Tax Reforms — Challenges and Lessons Learned). The conference was followed by a three-day internal workshop setting THEi’s research agenda for the rest of the year.

The health taxation conference featured opening addresses by wiiw’s Executive Director Mario Holzner, World Bank Country Director for the Western Balkans Xiaoqing Yu, and Bloomberg Philanthropies Public Health Advisor Jo Birckmayer, highlighting the centrality of tackling future regional prosperity amid persistent high levels of tobacco and alcohol consumption, ageing populations, and increasing public spending needs. Attended by finance ministers, public health officials and prominent health tax researchers, the conference provided a fruitful exchange of ideas and best practices on some of the key challenges in health taxation in the region, such as raising public awareness, advocating for swifter and more comprehensive reform with policy makers, and combating illicit trade of tobacco products.

The internal workshop took place at wiiw’s premises and brought together wiiw’s in-house research team in charge of managing THEi, experts from the seven CEE partner institutions, and representatives of THEi’s funder (Bloomberg Philanthropies), as well as Professor Hana Ross, an external consultant. The seven CEE partner institutions are: the Institute of Economic Sciences in Serbia, the Institute for Structural Research in Poland, the Institute for Economic Research in Bulgaria, the Aspen Institute in Romania, the Centre for Economic Strategy in Ukraine, the Econometric Research Association in Turkey, and the Georgian Institute of Public Affairs in Georgia. The partner institutions presented some preliminary outputs from their multi-layered research agenda, which varies between countries. It includes landscape studies outlining the current state of affairs in tobacco consumption and policy, econometric research on the price and income elasticities of tobacco demand, and simulations of the fiscal and health impact of future increases in tobacco taxes.

By the end of the year, THEi will seek to communicate its research findings to policy makers in national healthcare and finance ministries in the seven CEE countries of interest. THEi’s overarching goal is to highlight the fiscal and health payoffs of increased health-related taxes and recommend adequate policy designs to maximise their benefits.