Bulgaria: Lowest cigarette prices and highest smoking rates in the EU

17 June 2025

Increasing tobacco excise duties could generate EUR 0.7bn to 1bn in additional tax revenue over three years and prevent more than 37,000 premature deaths

image credit: unsplash.com/David Trinks

By Dimitar Sabev and Biljana Jovanovikj

Bulgaria currently has the lowest cigarette excise rates in the European Union. The minimum excise rate is approximately EUR 107.40 per 1,000 cigarettes, slightly above the EUR 90 minimum stipulated in EU Directive 2011/64/EC, but significantly below the levels proposed in the draft revision of the Tobacco Tax Directive (TTD). Meanwhile, Bulgaria has among the highest tobacco prevalence rates, not only in the EU, but also worldwide: around 38.8% of adults are using tobacco products in 2025 (WHO estimate); this is accompanied by a tobacco-related mortality rate that tops the EU rankings. The Global Burden of Disease estimates that in 2021, 107.71 deaths per 100,000 people in Bulgaria could be attributed to tobacco use – a mortality rate that is 2-3 times higher than in the old EU member states.[1]

In 2024, Dr Sabev and his team from the Institute for Economic Research at the Bulgarian Academy of Sciences, in collaboration with the Vienna Institute for International Economic Studies (wiiw) and the Bulgarian Smoke-Free Life Coalition, conducted a study into the potential fiscal and health benefits of increasing tobacco taxes in Bulgaria.[2] The research compared the outcomes of three simulated scenarios against a baseline scenario reflecting the planned increase in excise duties in accordance with the 2022 Excise Duties and Tax Warehouses Act (hereafter referred to as the old plan).

The general results indicate that Bulgaria has significant potential to raise government revenue from cigarette taxation. The findings reveal that raising tobacco taxes could generate an additional EUR 0.7bn to 1bn (BGN 1.4bn to 1.9bn) in tax revenue over three years and prevent more than 37,000 premature deaths from tobacco use, depending on how ambitious the planned increase is. There is considerable opportunity in Bulgaria to increase tobacco taxes and contribute significantly to the government budget, while at the same time preventing tens of thousands of premature deaths associated with tobacco use.

The study’s findings and recommendations were presented in December 2024 at a policy event attended by senior government officials, health professionals and researchers. The event was preceded by a press conference at the Bulgarian News Agency with Dr Geshanova and Dr Antonov, both members of the Smoke-Free Life Coalition, highlighting the health and fiscal benefits of higher tobacco taxes. This message was further reinforced through public media interviews and direct discussions with officials from the Ministry of Finance, contributing to broader policy engagement.

Impact on tobacco taxation policy in Bulgaria

These events attracted considerable attention both from the public and from government officials. The study and its findings were widely covered by the media, underscoring the urgency of increasing tobacco taxes in Bulgaria.

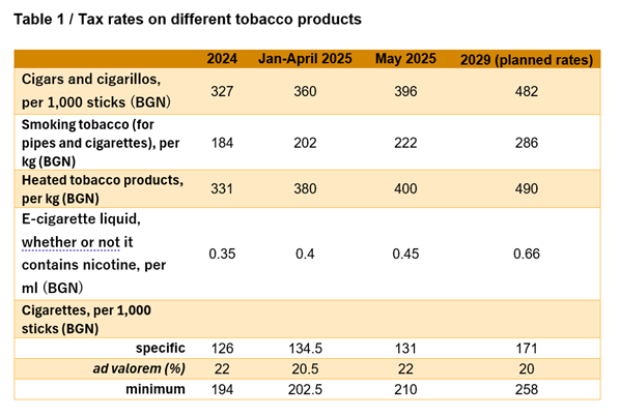

In March 2025, amendments to the Excise Duties and Tax Warehouses Act increased excise rates on all tobacco products (State Gazette, Issue 26/27.03.2025; with rates effective as of 1 May 2025). Compared to 2024, the new schedule represents an 8.25% increase in minimum cigarette excise tax. By 2029, the minimum excise duty on cigarettes should rise to BGN 258 (EUR 131.90) per 1,000 cigarettes. The specific component of the cigarette excise for 2025 remains largely unchanged, yet the ad valorem excise duty is set higher than initially proposed.

Table 1 / Tax rates on different tobacco products

Source: Excise Duties and Tax Warehouses Acts.

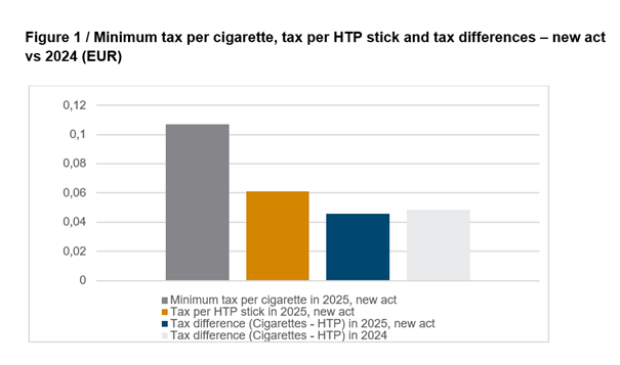

The amendments also established higher taxes on heated tobacco products (HTPs). The excise tax rate for HTPs has increased from BGN 331 per kg in 2024 to BGN 400 in 2025, an increase of roughly 21%. By 2029, a kilo of HTPs will have excise tax of BGN 490 BGN (EUR 250) levied on it. Nevertheless, when the HTP excise tax is converted into a per-stick equivalent – based on the assumption that each stick contains 0.3 grams of tobacco – it becomes evident that the favourable tax treatment of HTPs relative to cigarettes remains (Figure 1).

Figure 1 / Minimum tax per cigarette, tax per HTP stick and tax differences – new act vs 2024 (EUR)

Source: Excise Duties and Tax Warehouses Acts and authors’ calculations.

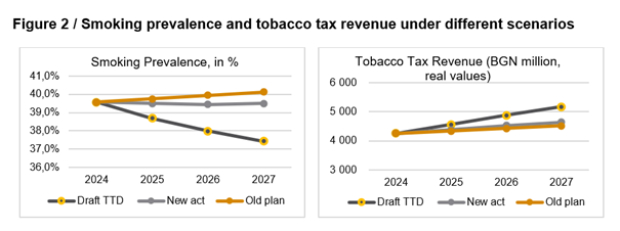

As a follow-up to the published study, the team assessed the likely fiscal and health impacts of the most recent tax changes. The outcomes were compared to those according to a scenario aligned with the draft TTD (which is one of the reform scenarios analysed in the published study) and the old tax plan (the baseline scenario from the published study). The results indicate that the newly adopted tax measures produce modest fiscal gains, while smoking prevalence remains largely unchanged over the forecast period. Between 2025 and 2027, the updated tax changes are projected to raise annual tobacco tax revenue by approximately 9% in real terms – only slightly higher than the 6% increase expected under the previous plan and significantly below the 21% gain anticipated with full implementation of the draft TTD. These findings underscore the limited effectiveness of the current tax adjustments, compared to the more comprehensive reform path proposed in the draft directive.

Figure 2 / Smoking prevalence and tobacco tax revenue under different scenarios

Source: Authors’ calculations.

The recent excise tax changes represent a positive step forward, indicating that the government acknowledges both the magnitude of the tobacco-related public-health challenge and the critical role of taxation in addressing it. The tobacco control measures proposed in the above-referenced study called for a significant increase in the minimum excise rate on tobacco products, a recommendation that is also reflected in the Ministry of Finance’s unexpected decision to raise the minimum excise rate.

However, the scope of the reform falls short of what was proposed in the study. The increase in the minimum excise rate that has been adopted is more modest than was suggested, and the structure of the tax burden has shifted disproportionately toward higher ad valorem rates. This will principally benefit cheaper tobacco brands and will limit the controlling effects on tobacco prevalence. Furthermore, the revised tax schedule maintains the tax advantage currently granted to novel tobacco products – a growing concern observed in many countries. The continued preferential treatment of these products over conventional cigarettes may undermine the overall effectiveness of the reform.

The study referenced in this article was produced as part of the Tobacco Taxation in Eastern Europe research network, coordinated by wiiw and supported by Bloomberg Philanthropies.

Notes:

[1] https://vizhub.healthdata.org/gbd-compare/#

[2] https://coalicia.bezdim.org/wp-content/uploads/2025/02/TETSiM-Bulgaria-Dec-2024.pdf