Corona reveals potential vulnerabilities in global supply chains

28 July 2021

One third of Austria's and the EU's non-European imports are vulnerable to shocks. Especially for high-tech and medical goods Europe is dependent on ‘Factory Asia’, in particular China.

By Oliver Reiter and Robert Stehrer

photo credit: unsplash.com/Nazarizal Mohammad

- A new wiiw study establishes to what extent the external trade of Austria and the EU is vulnerable to global economic shocks such as the Corona pandemic.

- One third of foreign imports are ‘risky’ products, i.e. products that pose a considerable availability risk in the event of trade turbulences.

- Especially the high-tech sector and medical supplies are dependent on shipments from China.

- Nonetheless, global value chains have proved resilient, and China has helped Europe through the pandemic via its vast production capacities.

- A general large-scale reshoring of ‘risky’ productions to Europe is economically not viable.

- Instead, the global trading system should be strengthened to be more resilient in the event of external shocks.

- Only strategic industries should be relocated back to Europe.

No semiconductors for the automotive industry or not enough Corona vaccines – these are just two examples that demonstrate the vulnerability of global supply chains in times of crisis. The current pandemic, in particular, has made strong dependencies on foreign manufacturing painfully obvious. For example, as many producers in the pharmaceutical industry had moved parts of their production to low-cost destinations such as China and India, the sudden stop of international shipments left many hospitals with shortages of needed equipment. Also, other events, such as a fire at a Japanese semiconductor factory or the blockage of the Suez Canal, have revealed the dependencies on global supply chains.

The ensuing debate has focused on which products – referred to as ‘risky’ products – are the most vulnerable to trade shocks, and to which extent do industries and countries depend on them? To answer these questions, the study ‘Learning from Tumultuous Times: An Analysis of Vulnerable Sectors in International Trade in the Context of the Corona Health Crisis’ constructs a composite ‘product riskiness index’, indicating which products and sectors are most susceptible to global economic shocks, and what lessons policy makers in Austria and the EU should draw from this.

To this end, almost 5,000 goods and intermediate products were subjected to a precise risk analysis based on the factors of market concentration, clustering tendencies, and the dominance of individual suppliers and their international substitutability.

High-tech production most vulnerable

The results show that 435 out of 4,706 products – 294 of which are intermediate products – are defined as ‘risky’. Especially high-tech products account for a large share of risky goods, indicating the high-tech sector’s heavy dependence on international supplies of critical products such as semiconductors, rail vehicles or precision machinery.

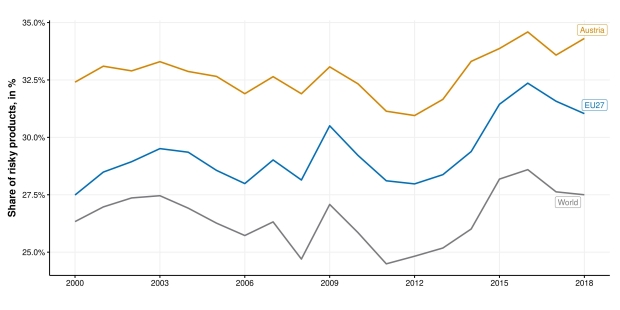

Measured in import values, one quarter of international trade falls into the category of risky products. For the EU and Austria the figures are even higher, reflecting their relatively large manufacturing industries and specialisation in higher-tech industries. No less than 30% of EU imports and almost 35% of Austrian imports from third countries are accounted for by products that pose a considerable availability risk in the event of trade turbulences (Figure 1).

Figure 1 - Development of the share of risky products in imports by region

Crucial China

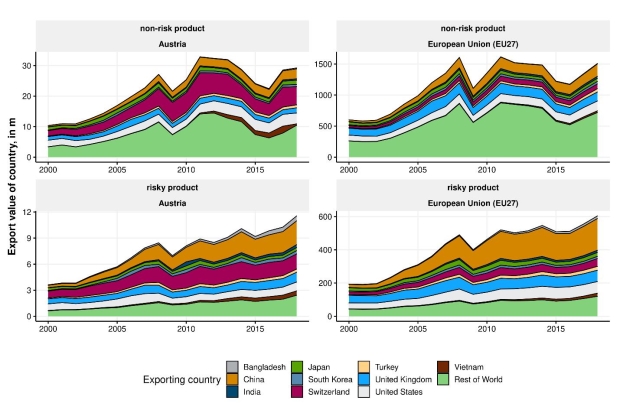

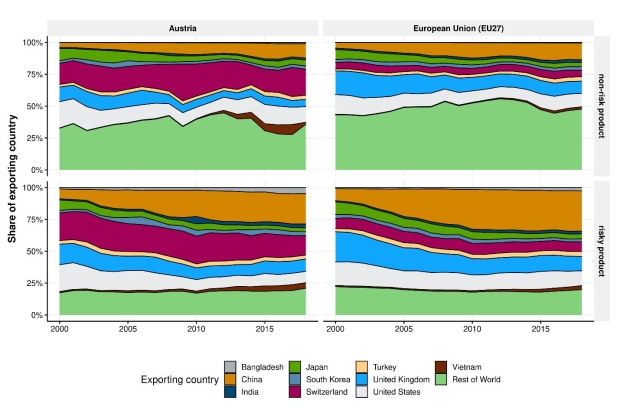

The People’s Republic of China plays a special role in trade for the EU. As the EU’s second largest-trading partner, the share of risky products in all EU imports from China is almost half (48.8%). This also applies to Austria, although imports from China are not as important as they are for the EU (Figure 2). The figures underscore China’s crucial role in supplying the EU and Austria with critical products.

Figure 2 - Imports of risky and non-risky products by partner

In the case of Corona-relevant products (as defined by the EU Commission) – such as face masks, respirators or components of vaccines – around one third of the EU’s imports are classified as risky. Imports of COVID-19-related products by the EU have increased, while imports of non-COVID-19-related products have fallen. Products that are considered to be risky, whether COVID-19-related or not, show higher (or less negative) growth rates. This indicates that despite certain disruptions in global value chains, they have in general been able to deliver the needed products during the pandemic and have thus by and large proved robust (i.e., able to maintain operations during the crisis) or at least resilient (i.e., managed to return quickly to normal operations after the initial shock).

Reshoring offers few economic benefits

Apart from the question of how to manage such an operation, the economic benefits of the highly debated process of reshoring the production of risky products would in any case be very limited. Applying a ‘partial global extraction method’ and assuming that the imports of risky products (i.e., both final and intermediary products) would be fully reshored to European countries, the EU’s GDP would increase by slightly more than 0.5%. In the more realistic scenario of a partial reshoring the effects would be even smaller. At the same time, supplier countries and industries would suffer accordingly.

Embolden global trade, stress testing, strategic stockpiling

The study suggests a differentiated political response to these challenges. In the fight against Corona, Austria and the EU have clearly benefited from global value chains. Supplies from China played a positive role in the fight against the pandemic, because Europe obviously could not build up the necessary production capacities fast enough. To diversify sources of supply, the study therefore recommends to aim at a more resilient multilateral trading system based on the principles of the World Trade Organisation (WTO). National governments will need to be supported with comprehensive information on potential market concentrations and possible bottlenecks along value chains. The study also advocates stress tests and the stockpiling of critical products.

Key industries in Europe

At the strategic level, the study highlights Europe's well-known structural dependencies on China and Southeast Asia for high-tech products and key medical goods. EU policy action is needed to reduce them. Only if the EU can bring strategic industries such as semiconductors back to Europe will the continent remain economically competitive in the long term.

However, this requires new economic policy framework conditions – from a change in EU state aid legislation for company relocations to a strategic industrial policy and a consistent digitalisation of the European economies. The study recommends these measures to be embedded in the corresponding EU initiatives, first and foremost the European Green Deal and the ambitious Corona recovery programme NextGenerationEU.

About the study

The study ‘Learning from Tumultuous Times: An Analysis of Vulnerable Sectors in International Trade in the Context of the Corona Health Crisis’ was commissioned and financed by the Austrian Federal Ministry for Digitalisation and Economic Affairs (BMDW).

Press Releases

- Lieferketten: Ein Drittel aller Importe in der EU anfällig für Schocks (German)

- Lieferketten: Ein Drittel aller Importe in der EU anfällig für Schocks (German)

- Covid-19 shows vulnerability of supply chains (English)

- Covid-19 shows vulnerability of supply chains (German)