Eastern Europe Coronavirus Tracker: Economic impact rising

16 April 2020

Most countries report far fewer cases than in Western Europe, but the macro fallout will still be huge.

- wiiw’s latest Coronavirus tracker for the countries of Central, East and Southeast Europe (CESEE) show that the number of cases is mostly much lower than in Western Europe. The main exception is Turkey, while the trends in Russia and Belarus are also potentially concerning.

- Despite a more limited number of cases, the economic fallout in CESEE is severe, as demonstrated already by high frequency sentiment indicators and movements in FX markets.

- Our tracker indicates few new policy measures since last week, although we note moderate increases in the planned fiscal responses in parts of the Western Balkans and Russia (but both remain low as a share of GDP relative to much of the rest of the region).

- Our main assumptions about the economic fallout remain unchanged. Although the initial trade shock from the Coronavirus will hit Central Europe’s export-dependent economies very hard, we also think that these countries (mostly the 2004 EU joiners) will be able to cope better due to superior healthcare systems and greater fiscal capacity to support workers and firms through the downturn.

- Over the medium term, we expect countries with weaker healthcare systems, a lack of fiscal space, and particular reliance on sectors that will be especially badly hit (for example tourism) to suffer most.

wiiw has released its latest Coronavirus tracker for CESEE. This follows on from previous updates (here, here and here) where wiiw’s main views on the economic impact of the Coronavirus on the region are set out in detail. Below, we outline the key findings from this week’s update:

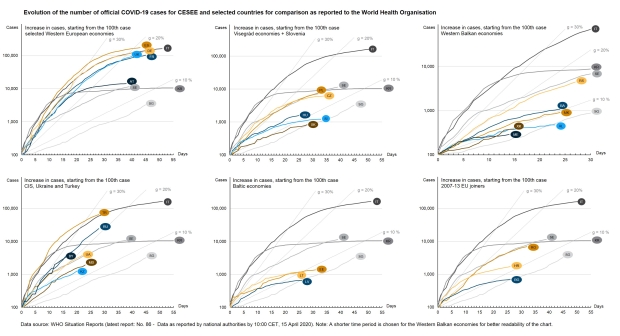

Spread of the virus: In most countries in CESEE, growth in the number of cases is significantly below those recorded in the big Western European countries (see charts below). The main exception to this is Turkey, although here also the curve seems to be flattening away from an Italy-type scenario and more in the direction of Sweden. The trend in Russia and Belarus is also potentially concerning.

Evolution of Covid-19 Cases (Click to enlarge)

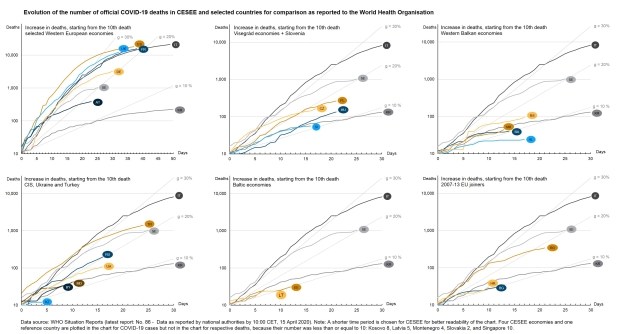

Evolution of Covid-19 Deaths (Click to enlarge)

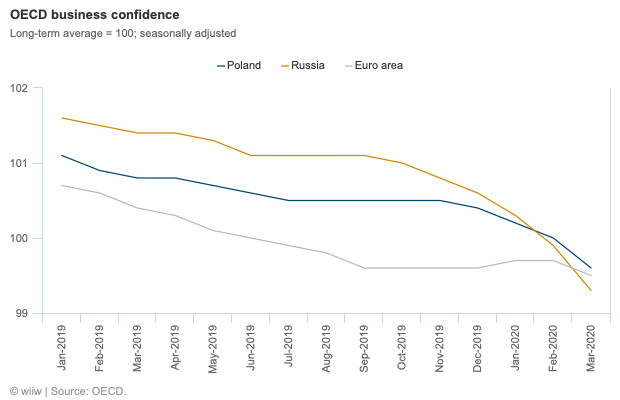

Economic fallout: Dire economic indicators continue to be released across the world, prompting comparisons not only with 2008-09 but also the depression of the 1930s. Data for CESEE also look increasingly worrying, with year-on-year declines in key areas of economic activity already comparable with the aftermath of the global financial crisis. Latest OECD business confidence data, for example, show that developments in key CESEE economies like Poland and Russia largely mirror those of the euro area. The impact on currencies remains quite differentiated in CESEE, reflecting in part the different responses of central banks (see summary table of measures for full details). However, almost all floating currencies have weakened substantially as the virus has spread, including the ‘safer’ currencies such as the Czech koruna. The Russian rouble is still the worst affected currency in CESEE (down 16% on the year as of April 14th), but has recovered significantly since the start of April reflecting the oil deal between Russia and Saudi Arabia.

Measures: We note far fewer significant changes this week (in terms of fiscal and monetary policy or social distancing measures) compared with previous updates (full data here. The basic tenets of crisis response are now set out across the region, and governments are waiting to see how the numbers of cases evolves and the scale of the impact before their next move. We record an expansion of fiscal plans in some countries, notably the Western Balkans (with significant help form international organisations) and a bit in Russia. However, both are still low as share of GDP compared with much of rest of region.