Eastern Europe Coronavirus tracker: Still a long way to go

07 April 2020

Although the virus does not seem to be spreading as rapidly as in Western Europe, the economic fallout in 2020 will be severe.

- Today wiiw has released its second weekly update on the spread of the Coronavirus and its economic fallout for Central, East and Southeast Europe (CESEE). We will update our forecasts by the end of the month.

- Cases of the virus have continued to rise in CESEE, albeit mostly at a slower rate than in Western Europe.

- The economic fallout is increasingly clear, with confidence among consumers and business tumbling, and most currencies under pressure.

- We continue to expect lockdowns to remain in place for some time. Measures will then be relaxed gradually, but only fully loosened when a mass vaccine is rolled out in the second half of 2021.

- For the region as a whole, a deep recession is baked in for 2020, and economic performance will be sluggish until restrictions are fully lifted.

- The fallout will be highly differentiated. We expect those countries with relatively strong healthcare systems and more fiscal space to do better. This means above all the Baltic States, the Czech Republic, Slovenia and Slovakia.

Today we release our second weekly update on the Coronavirus in Central, East and Southeast Europe (CESEE). Our broad views on the economic fallout for the region—in terms of timescale and magnitude—remain largely unchanged (see last week’s update for full coverage). In this update, we will cover three key areas: the spread of the virus, high frequency indicators of the economic fallout, and a restatement of the key factors to watch (and based on this which countries are relatively better or worse prepared to handle the economic fallout).

Tracking the virus in CESEE

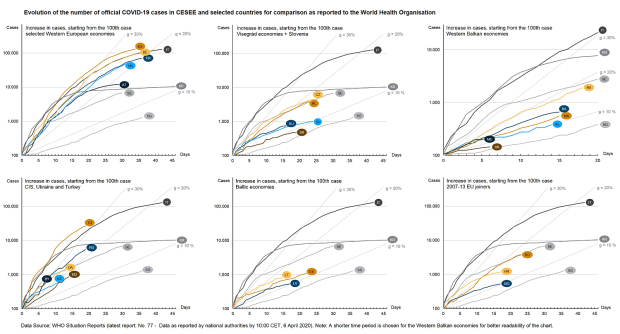

We have updated our tables from last week (see charts 1). Here, we take the following examples as benchmarks: Singapore, South Korea, Italy and Sweden. These countries are representative of different policy responses (in terms of scale and timing) to the Coronavirus.

We find that the Coronavirus has spread more slowly to Central, East and Southeast Europe (CESEE) than in Western Europe so far, with the exception of Turkey where the growth in the number of cases appears to be much higher. This is mostly good news, but could reflect differences in levels of testing, and so we will need to wait for more data before making concrete assessments.

Chart 1: Evolution of COVID-19 cases - click to enlarge:

Economic fallout and policy responses

Even at these levels of growth in cases, however, the impact on CESEE economies will be profound. We think that real GDP declines this year will be at least as bad as in 2009, and potentially worse for many.

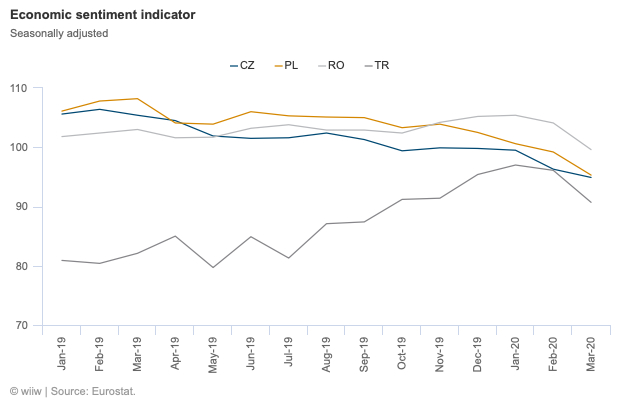

The negative impact on consumer and business confidence is ever more clear, although we think that the full extent of this will only become apparent in future data releases. Eurostat’s Economic sentiment indicator showed further sharp falls for some of the bigger CESEE economies in March (chart 2). Separate purchasing managers’ indices for CESEE countries released recently indicated that activity is already back at 2009 levels.

Chart 2: Economic sentiment

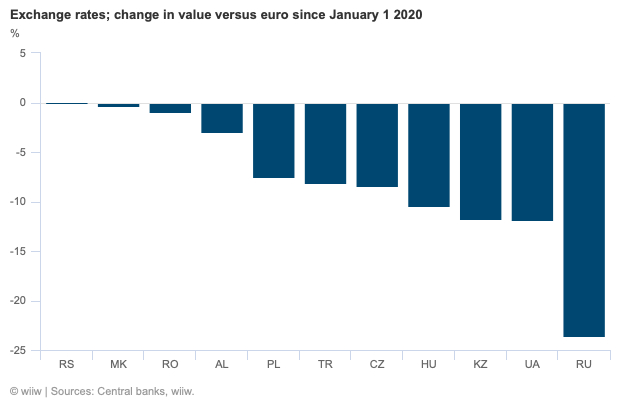

We also find that exchange rates are under pressure everywhere:

- The biggest depreciations have been in Russia, Ukraine and Kazakhstan;

- However, notable sell-offs can also be observed for the three non-euro Visegrad countries and Turkey;

- Many countries are intervening to support their currencies, but this is unlikely to be sustainable indefinitely.

Chart 3: Exchange rates

Our table summarising from last week summarising key fiscal, monetary and public order measures since last week can be download here. We are currently working on an update, which will be available soon. In the past week, many countries have tightened social distancing measures, and some have increased the planned size of their fiscal responses.

Key areas of resilience and vulnerability

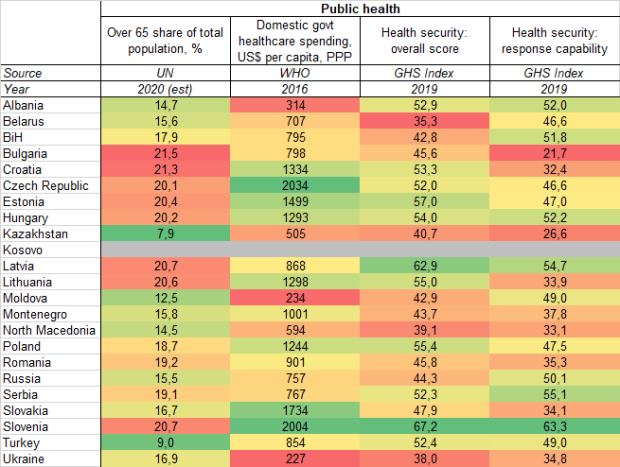

The extent of resilience will be key in determining the economic fallout of the Coronavirus. We define resilience in various ways, but think that the quality of the public healthcare system and the amount of fiscal space to help workers and firms weather the lockdowns will be the most important. Because CESEE is generally much weaker than Western Europe in both these areas, even with fewer cases the economic fallout could be at least as big as in wealthier countries.

1. Public health factors

We set out our main assessments of the capacity of public healthcare systems to cope here last week. The main points are as follows:

- Public healthcare spending adjusted for local costs is far below even poorer parts of Western Europe (see table below). Across most of the Western Balkans, CIS and Ukraine, public healthcare spending on this measure is less than one third of the Italian level. Even in Slovenia and the Czech Republic, it only reaches 80% of that in Italy.

- For health security and ability to respond to pandemics, the picture is more encouraging for parts of CESEE, especially the region’s wealthiest EU member states. Slovenia and Latvia score better than Austria according to the Global Health Security Index, but much of the rest of the region looks much worse, including the 2007-13 EU joiners.

2. Fiscal factors

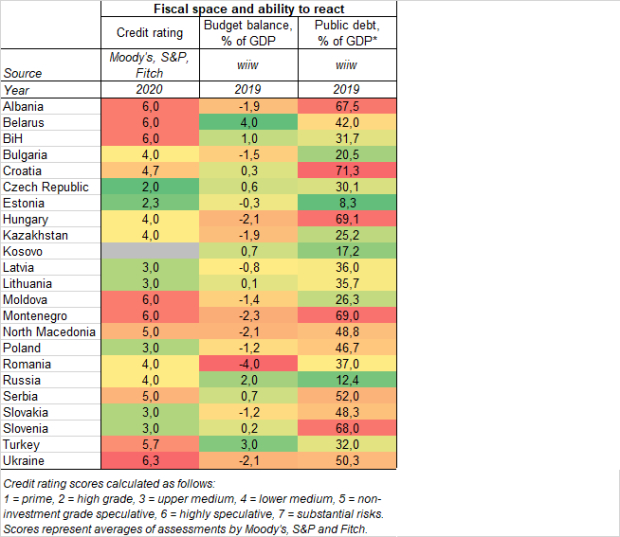

Few countries in CESEE will be able to enact serious fiscal loosening measures to offset the crisis, but the 2004 EU joiners will have much more room than the rest of the region. In short, we identify the following areas of fiscal resilience and vulnerability (for a full explanation, see here):

- Credit ratings differ substantially across the region, but capital flight is a serious risk for the majority of countries in CESEE. The ‘safest’ countries according to ratings agencies are the Czech Republic and Estonia, with the most vulnerable on this measure being Albania, Belarus, Bosnia, Moldova, Montenegro and (especially) Ukraine.

- Most countries in CESEE do not have especially high public debt/GDP ratios, and certainly not by the standards of Western Europe. However, almost all CESEE countries go into this crisis with substantially higher public debt/GDP ratios than in 2008, and this will probably affect their ability to borrow on international capital markets. The combination of relatively high debt and a heavy reliance on tourism (see the macro section below) is a source of concern for Albania, Montenegro and Croatia.

3. Macro factors

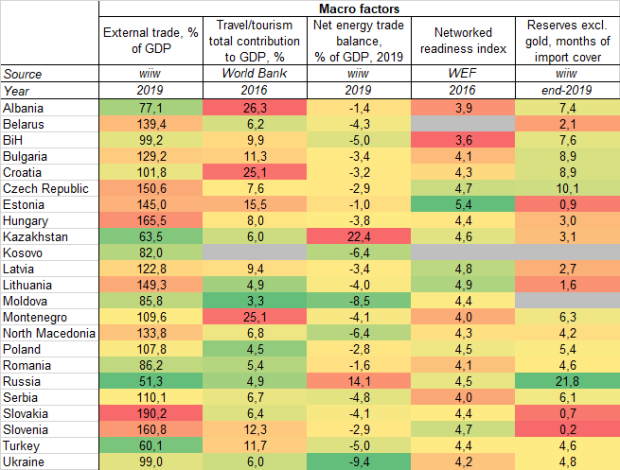

The true macroeconomic channels of contagion remain difficult to gauge. Here we focus initially on five areas that we think will be important. Our main conclusions are as follows (see here for more extensive coverage):

- The small, open economies of CESEE will have been hit hard by the first wave of the crisis (emanating from Asia and Italy), but some will weather this better than others. Many of the most ‘open’ are also those with the best healthcare systems and most fiscal room for manoeuvre (for example the Baltic states, Slovenia, the Czech Republic and Slovakia). As Asia recovers, these economies could receive an external demand boost. Their high level of integration with Germany could also help.

- Tourism will be one of the worst affected sectors, and here Albania, Croatia and Montenegro look particularly exposed. However, tourism has become increasingly important for many other economies in the region over the past decade. In a further five CESEE countries—Bosnia, Turkey, Bulgaria, Estonia and Slovenia—travel and tourism account for around one tenth of the economy.

- The collapse in the oil price will cause serious difficulties for Russia and Kazakhstan, increasing the strain on fiscal resources. Weak confidence will probably limit the positive impact of lower oil prices for the region’s energy importers.

- The Baltic states (especially Estonia) and Slovenia look best-placed to benefit from the positive push to digitalisation that the Coronavirus will generate. Russia and Kazakhstan also appear quite well placed by CESEE standards according to the World Economic Forum’s Networked Readiness Index.