FDI in Central, East and Southeast Europe: mostly robust despite global downturn; shift into services

06 June 2019

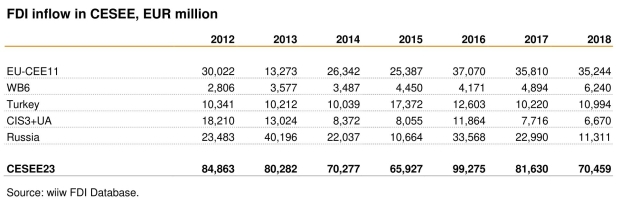

New wiiw Report finds the decline of FDI in 2018 being mainly on account of Russia, with inflows to the rest of the region being either flat or increasing. For 2019, a decline of FDI inflows is expected.

By Gábor Hunya

Foreign direct investment (FDI) inflows to Central, East and Southeast Europe (CESEE) declined in 2018. However, this was mainly on account of Russia, with inflows to the rest of the region either flat or increasing on the year. We expect lower inflows in 2019 throughout CESEE, on account of declining global investment appetite and weaker business sentiment. Austrian FDI in the region has declined, but continues to earn relatively high profits. These are the main conclusions of wiiw’s 2019 FDI Report.

Global FDI flows declined in 2018, reflecting faltering economic growth and policies in the US, China and to some extent in Russia to discourage outward FDI. In the US, a significant cut to the corporate tax rate, and temporary incentives to repatriate accumulated overseas earnings, prompted American parent firms to withdraw funds from foreign affiliates. In Europe, Ireland and Switzerland in particular experienced strong disinvestments (negative FDI inflows) as a result of these repatriations. Similar to the US, Austrian outward FDI also turned negative due to asset restructuring by multinational investors.

FDI inflows to the new EU Member States (EU-CEE11) were largely unchanged from the previous year, despite strong economic growth. By contrast, inflows into the Western Balkans rose by 28%, thanks in particular to rising investor interest in Serbia and North Macedonia. Turkey received a bit more FDI than in 2017, but the overall amount is still very low relative to the size of the economy.

Inflows declined in the CIS, especially in Russia, where they halved compared with 2017. Russia is becoming more and more inward looking, due to the exchange of sanctions with the West and (related) import-substitution policies. Efforts to stimulate the return of capital from abroad do not seem to be working: FDI outflows were three times greater than inflows in 2018.

Services account for the bulk of FDI in most countries in CESEE. In particular, producer-related business activities such as information and communication technology (ICT), business process outsourcing and shared service centres expanded across the region. These are not capital intensive, and thus are barely reflected in FDI data. However, the increasing share of services in announced greenfield FDI projects, and of commercial services in total exports, both point to a growing importance for foreign investors in these sectors.

Germany and the US are the most important ultimate sources of FDI in CESEE. Tax havens – in particular the Netherlands, Cyprus and Luxembourg – are among the largest immediate investors, but not among the important ultimate investing countries for CESEE. This confirms that these countries serve mainly as intermediaries and headquarters of holdings.

The share of CESEE in Austrian FDI is shrinking, in favour of Asia and the US. However, the profitability of Austrian FDI in CESEE is above average: the region accounts for 28% of the total stock of outward Austrian FDI, but 36% of the income earned.

Several trends shaping the future of FDI are given special attention in this study. First, we find that the link between FDI inflows and GDP growth has become less strong since the 2008 global financial crisis. Second, FDI inflows and participation in global value chains are strongly and positively correlated. Third, we highlight several CESEE countries attracting FDI at a level above that which would be consistent with their macroeconomic fundamentals, particularly Montenegro and Bulgaria. By contrast, Belarus and Moldova could attract more FDI if business conditions improve.

Finally, we note that business sentiment has a significant impact on greenfield investment decisions. Given that economic confidence across EU-CEE11 countries appears to be declining, we expect lower FDI inflows in 2019, which could lead to lower GDP growth. This is owing to faltering global and European economic activity. Tax reform in the US will likely continue to have a particularly important negative impact on global FDI flows.

Press Releases

Related Presentations

- Auslandsinvestitionen trotzen dem globalen Abschwung; Verschiebung zu Dienstleistungen (press conference presentation in German)

- Foreign Investments Mostly Robust Despite Global Downturn; Shift into Services (press conference presentation in English)