Fiscal austerity generally pushes income inequality upwards

10 April 2018

Fiscal consolidation episodes generally lead to an increase in income inequality. The size, composition and timing of the fiscal adjustment matter.

Summary

- Fiscal austerity increases income inequality (on average).

- Size, composition and timing of the fiscal adjustment matter in terms of how big the increase in inequality is.

- Governments concerned about high income inequality should avoid cuts in social programs that can be expected to have the most impact on low-income households.

Introduction

While economists have done a lot of research on the effects of fiscal consolidation measures on economic growth, research on the distributional effects of fiscal austerity has so far been comparatively underdeveloped. A new wiiw Working Paper provides evidence on how income inequality changes in the eight years following the start of a fiscal consolidation episode.

Covering 17 developed countries -- including Austria as well as a set of European and non-European OECD countries -- over the time period 1978-2013, we obtain the latest data on size and timing of fiscal consolidation measures together with harmonized data on income inequality (in terms of the Gini index for market and disposable income). By using recently developed econometric techniques, we obtain the following main results:

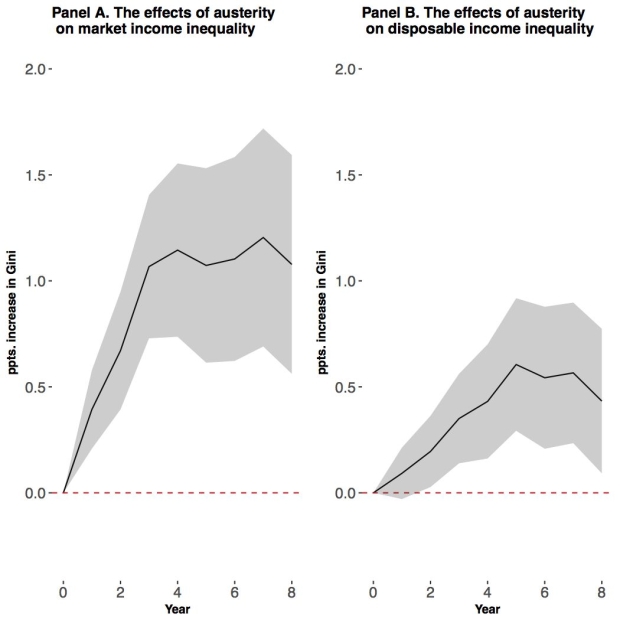

- Fiscal consolidation episodes have long-lasting effects on income inequality, measured in terms of the Gini coefficient of disposable household income. The Gini coefficient of disposable income (on average) increases by about 0.4 percentage points in the short-run (in year three) and by 0.6 percentage points in the medium-run (in year seven).

- The effect of consolidation episodes on market income is stronger than on disposable (after-taxes, after-transfers) income, as shown by the Figure below. This finding may be expected if the increase works through the channels of higher (long-term) unemployment -- fiscal austerity decreases demand, lowers growth and pushes up unemployment --, skewing the distribution of market incomes. However, the social safety net (consisting of unemployment benefits and other types of social spending) may still be able to compensate for parts of the consolidation shock to income inequality.

- We find that the effects on income inequality are more pronounced a) when the size of the fiscal consolidation package is large rather than small; b) when the duration of the adjustment is long instead of short; c) when the fiscal consolidation is based more on spending cuts than on tax increases; d) when the consolidation is started in the aftermath of a financial crisis rather than in a non-crisis episode; and e) when the adjustment falls into a period of low economic growth instead of high growth.

Policy relevance

Research findings point out that a growing divide in incomes may cause social cohesion to deteriorate and public health problems to become more significant. Recent research has also indicated that economies characterised by an unequal distribution of incomes may be subject to higher financial fragility and macroeconomic instability. Since the financial crisis of 2007/2008, fiscal consolidation measures have been a central feature of crisis management in several OECD countries, as countries have pushed for government spending cuts and tax increases in order to cut fiscal deficits and bring down public debt. As the increase in income inequality and high public debt in many developed countries may be seen as two of the most pressing policy problems of our time, the consequences of fiscal consolidation measures on the income distribution are of high relevance. In this context, concerns about the (potential) effects of fiscal austerity on income inequality have grown over recent years, as testified by the publication of papers by the IMF and the OECD.

The findings in the new wiiw Working Paper that fiscal consolidation policies are an important determinant of income inequality could be taken into account by governments for which introducing measures to counteract high income inequality is a priority. First, the composition of the measures matters: spending-based fiscal consolidations are generally more detrimental for income inequality than tax-based adjustments. Second, timing and size are crucial. Large, front-loaded fiscal adjustments should be avoided whenever possible, in particular in times of low economic growth, because they tend to worsen income disparities. Third, fiscal consolidations might increase income inequality via several channels. An important channel might be an increase in unemployment that widens the disparities in market incomes; furthermore, cuts in social transfers may affect households in lower parts of the income distribution the most, and a rollback of public programs benefitting the poor may also increase disposable income inequality. Hence, governments concerned about already high income inequality should especially avoid cuts in social programs that can be expected to have the most impact on low-income households.

Note: This article is based on the results of 'The dynamic effects of fiscal consolidation episodes on income inequality' by Philipp Heimberger, wiiw Working Paper No. 147

photo: iStockphoto/Grafner