How much of a risk is Trump 2.0 to the economies of Central, East and Southeast Europe?

21 January 2025

The region will feel the impact of Trump through trade, potentially reduced investment and the dollar. However, the main obstacle to stronger growth remains the crisis in Germany

image credit: istock.com/adamkaz

- Donald Trump’s return to the White House comes at a time when the EU and Central, East and Southeast Europe (CESEE) are very reliant on the US for security, export demand and energy.

- Trump’s policies could adversely affect the region via reduced exports due to higher tariffs, less FDI due to a weaker US security commitment to Europe, and higher inflation and interest rates due to a stronger dollar.

- However, CESEE has shown itself highly resilient in the recent past. Many of the region’s leaders will have a good relationship with Trump, and most CESEE economies did very well last time Trump was president.

- The main challenge to growth in CESEE at present is the continued downturn in German industry, which could be exacerbated by Trump’s policies.

- If this downturn in Germany continues, it will increasingly weigh on economic growth in the region.

Donald Trump’s victory in the US presidential election has created great unease across a lot of Europe. Yet in large parts of Central, East and Southeast Europe (CESEE) the reaction has been more mixed, if not indeed positive. Is the region right to be less worried – or even cautiously sanguine – about Trump 2.0?

The EU is currently very reliant on the US

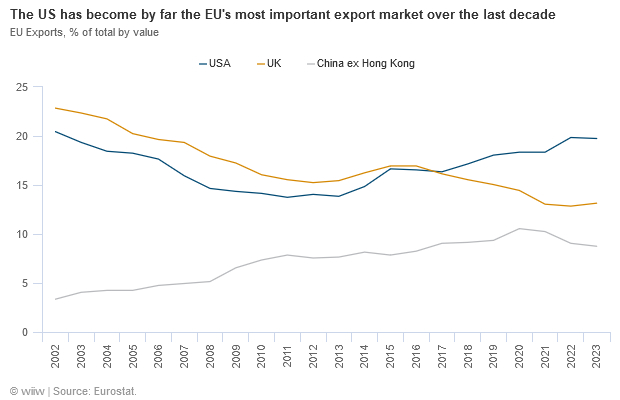

For Europe as a whole, Trump’s victory matters a great deal, for two main reasons. First, because it comes at a time of extreme European reliance on the US – not only for security, but also for export demand and energy. The oft-repeated phrase that the EU has ‘outsourced its security to the US, its export-led growth to China, and its energy needs to Russia’ needs to be updated. Over the last decade, the US has become far and away the most important source of external demand for EU exports (see chart below). Additionally, through liquefied natural gas (LNG), it has played a crucial role in supporting the EU’s transition away from Russian gas.

The second reason that Trump’s victory matters so much is that he will be much less constrained this time, and so is likely to ‘achieve’ much more than he did during his first term. Having won the popular vote, and with Republican control of both the House and the Senate, a supportive Supreme Court and a much better understanding of how Washington works, he is likely to feel (rightly) that he has significantly more power this time to push through his agenda.

CESEE will feel the impact of Trump 2.0 via trade, investment and the dollar

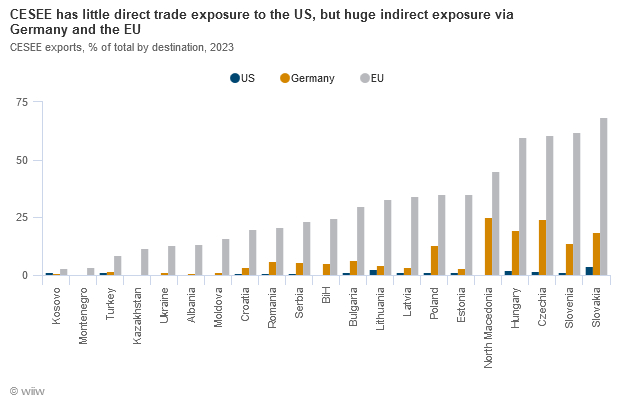

Economically, Trump’s agenda is likely to have at least three important implications for the region. First, he has promised to increase tariffs, and CESEE’s open, trade-dependent economies will feel the pain of this. Although the region exports relatively little to the US directly, it does have huge indirect exposure via Germany and the EU (see chart below). Even if Trump only increases tariffs on the EU to 10%, that would still be triple the current average level. The impact would pass through relatively quickly to CESEE. And even setting aside the prospect of increased tariffs on Europe, the increasingly all-out trade war between the US and China will also have implications for the region. Some firms dealing with both the US and China will have to make a hard decision about which country to deal with – as, for example, has been the case recently with ASML in the Netherlands. Meanwhile input costs will rise and become more volatile as the global trading system fragments.

Second, if Trump forces Ukraine into a ‘peace’ deal that is favourable to Russia and is not accompanied by watertight security guarantees, there will be repercussions for security in CESEE as a whole. That will be even more the case if the US commitment to NATO comes into question. In such a scenario, the region could lose out on foreign direct investment (FDI) inflows, which have been the backbone of the region’s success story over the past 30 years (recent signs in this regard are already quite worrying). NATO membership has played an important part in reassuring foreign investors who are considering pledging long-term capital to the region. There are valid reasons to worry about political stability in the Western Balkans under Trump 2.0. And for the region as a whole, the war in Ukraine and Trump’s (understandable) demand for European countries to do more to pay for their own defence will mean the end of the peace dividend that Europe has enjoyed since the conclusion of the Cold War.

The third clear way in which Trump 2.0 could impact the economies of CESEE is via a stronger dollar. That would increase import costs in the region, forcing central banks to scale back or abandon their plans for monetary easing, and would have an adverse knock-on effect on economic growth. However, a stronger dollar is by no means guaranteed over the medium term. Trump will be keen to avoid the negative impact that a strong dollar would have on US export competitiveness, and he is also likely to pressure the Fed to keep interest rates low, which would push the dollar in the opposite direction.

Reasons to be cheerful?

While the challenges are considerable, CESEE governments may well have reason to feel that the region could benefit from Trump 2.0 in some ways. At the very least, several factors suggest that some of the current pessimism could be overstated.

First, for the third time in 15 years, the region is demonstrating an impressive resilience in the face of negative external factors. Just as was the case after the 2008 global financial crisis and the 2020 COVID-19 pandemic, CESEE has shown itself better able than Western Europe both to withstand the fallout from the Russian invasion of Ukraine, the inflation shock and German industrial stagnation, and to bounce back quickly. We estimate that growth throughout the region in 2024 will have been roughly three times that seen in the euro area.

Second, a large part of CESEE is very likely to find it easier than most Western European countries to deal with Trump. Poland now spends almost 5% of GDP on defence – something that Trump will appreciate very much. Authoritarian leaders in the region, not least Hungary’s Viktor Orbán, are also likely to have a very good working relationship with the new US president.

Third, during Trump’s previous presidency, at least before COVID struck, CESEE enjoyed three excellent years. Between 2017 and 2019, the Romanian economy grew by a fifth, with countries like Poland and Hungary not far behind. Although Trump was not responsible for this, it suggests that whatever actions he did take did not fundamentally hold the region back. This could also be the case this time.

German industry, rather than Trump 2.0, is the main obstacle to higher CESEE growth

Taken together, Trump 2.0 in many ways adds to an already challenging picture for the region. But it seems unlikely that this will push the region into recession. We still expect CESEE as a whole to be able to grow by about 3% in real terms next year and the year after. This is not great, and in most cases is below pre-2020 levels. Yet in the context of the big external challenges, and by comparison with most of Western Europe, those are decent numbers.

Importantly, the key drivers of growth in the region at present are domestic, and that will help insulate the region from external developments. Private consumption, investment and government spending are all important growth drivers in CESEE at present. As inflation falls, so real wages will rise, and that will support consumer spending. Investment is being supported by inflows of EU funds and, in some cases, of FDI. Meanwhile, many governments are still running big fiscal deficits, adding demand to the economy. As interest rates continue to fall, growth will receive a further boost.

The main concrete negative for the region at present is the crisis in Germany. According to sentiment indicators, confidence in German industry is at one of its lowest levels since reunification. If Trump follows through on his tariff threats, the situation in German manufacturing will get worse before it gets better. The country’s industry is being hit by a perfect storm of high energy prices, weak demand in key markets, and a loss of market share to Chinese and US competition. The longer this lasts, the more likely it will be to filter through to the domestic economy in CESEE. For now, that – rather than Trump 2.0 – is the main risk to growth in the region.

This article is based on a series of presentations and discussions with wiiw members in Austria and across CESEE during November 2024. For more details about wiiw membership options, click here.