How to fill Europe’s investment gap

29 April 2019

The case for a coordinated pan-European infrastructure investment project inspired by the Chinese Belt and Road Initiative – the ‘European Silk Road’.

by Mario Holzner

Photo: chowbins/pixabay license

- Investment in the EU has been declining since the outbreak of the global financial crisis.

- While Europe was indulging in self-destructive austerity, China was building inter alia a huge high-speed rail network.

- Given the big weight of German public investment in the EU, it is pivotal that Germany reverses the course of its fiscal policy.

- We suggest a coordinated pan-European infrastructure investment project inspired by the Chinese Belt and Road Initiative – the ‘European Silk Road’.

In the long run, investment is one of the most important growth drivers – if not the most important one. Technological advancement and improved human capital endowment cannot translate properly into economic dynamism if no investment in productive capacities employing these new technologies and skills is conducted. Since the outbreak of the global financial crisis and the subsequent deleveraging process European economic agents’ willingness to investment has declined, as expectations about the future have deteriorated. Overall spending restraint and the related savings glut and export surplus are only symptoms of this lack of confidence, which is deeply rooted in the private sector. Moreover, this did not even change during the recovery of the European economy in 2015-2017.

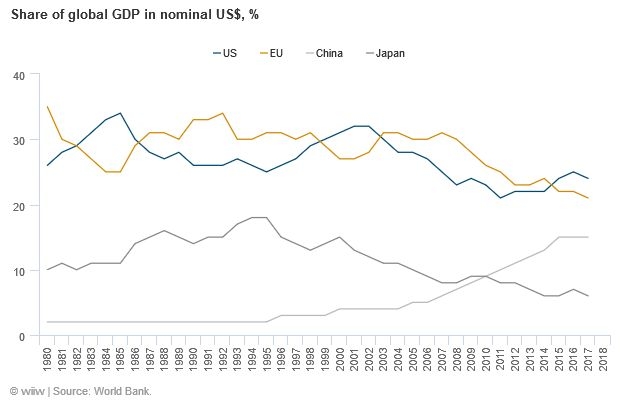

The most important reason for this ‘bad equilibrium’ is that the only force that could push the European economy into a ‘good equilibrium’ – the public sector – is limiting itself. The political leadership is propagating balanced budgets or even budget surpluses. This neglect of an active and expansionary economic policy comes at a very high cost. Apart from a whole generation of unemployed youth, Europe’s weight in the global economy has been shrinking significantly.

While Europe was indulging in self-destructive austerity, China was inter alia building a 27,000 km long high-speed rail network (about two thirds of the global high-speed rail network), with another 11,000 km under construction. This was part of a counter-cyclical public investment programme which helped China to keep up high GDP growth rates. Moreover, China is the only global player taking responsibility for the world economy (also out of self-interest as a major export nation) by financing investment projects around the world under its Belt and Road Initiative – inter alia also in Central, East and Southeast Europe (CESEE). In the Western Balkans Chinese construction loans are as important as the EU’s. European Commissioner for European Neighbourhood Policy and Enlargement Johannes Hahn has acknowledged that the EU has ‘underestimated’ China’s reach in the Balkans.

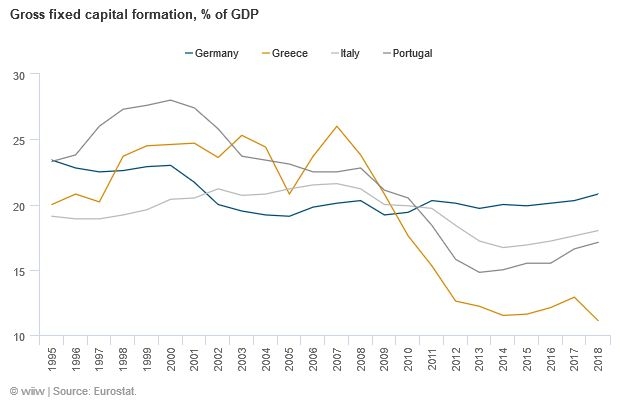

A collapse in EU investment spending

According to the European Statistical Office (Eurostat), gross fixed capital formation as a share of GDP in the EU has declined from 21.5% in the five years before the outbreak of the global financial crisis, to 20.6% in the following five-year-period, and further to 19.7% in the most recent period 2013-2017. Over the whole 15-year-period the bloc’s central economy – Germany – had an almost flat investment rate at an average of 19.8% of GDP. By comparison, during the same period, the US average investment rate was at 20.6% of GDP, according to Fed data. The EU Member States in Central and Eastern Europe (EU-CEE) had traditionally higher investment shares in GDP in the course of their economic catch-up process, but have more recently converged towards the low German levels (an average of 26.5% in 2003-2007, 23.8% in 2008-2012 and 21.4% in 2013-2017).

It is only due to the EU (and Chinese) co-financing of infrastructure projects in EU-CEE that the public investment share in the region is substantially higher than the EU average, let alone Germany. However, the average share of EU-CEE general government gross fixed capital formation in GDP decreased from 4.7% in the five-year-period after the crisis outbreak to 4.1% in the most recent 2013-2017 period. The shares for the EU average were 3.4% and 2.8%, respectively. And in Germany public investment in GDP declined from 2.3% to 2.1%, which is substantially below the EU average. However, higher EU-CEE public investment rates are only partially able to make up for the extremely low German ones. As a share of overall EU public investment, the EU-CEE represents about 11% and Germany 14%.

A policy change in Germany could push EU investments

Given the big weight of German public investment in the EU, it is pivotal that Germany reverses the course of its fiscal policy. So far, there have been little indications that this will happen. In 2018, Germany achieved a record budget surplus of incredible EUR 58 bn (i.e. 1.7% of GDP). In addition, the German Federal Statistical Office recently published new data showing that between 2003 and 2018 public net fixed capital formation was negative in every single year accumulating to a depreciation of public infrastructure in Germany of EUR 87 bn.

This happened at a time when Germany was mostly paying negative interest rates on public debt. German 2-,5- and 10-year Bund yields are still negative. Moreover, the interest rates are set to remain below zero. The European Central Bank (ECB) announced on 7 March 2019 that its policy interest rates will remain at the current record low levels at least through the end of 2019, that the ECB will reinvest the securities purchased under the asset purchase programme, and that a new round of cheap long-term loans to banks willing to expand lending (TLTRO-III) will be introduced. The question arises whether the ECB will be ever able to abandon monetary stimulus, at least in the foreseeable future.

One of the legal impediments to a more expansionary fiscal policy in Germany is the German Debt Break – the ‘Schuldenbremse’. Anglo-Saxon economists have been arguing for a long time against similar fiscal rules. However, it is fairly new that also German economists start to question the ‘Schuldenbremse’, including the director of the employer-oriented German Economic Institute. Also, given the increasing pressure from populist parties throughout Europe, the German government might change its mind and move to a more cooperative stance that has the potential to stabilise the Euro area with the help of increased investment and as a consequence higher economic growth. This is all the more important, given the current cyclical downturn.

A ‘European Silk Road’ could kick-off a big push

An additional option would be a pan-European infrastructure investment project inspired by the Chinese initiative to be developed and coordinated by EU institutions. In a recent study, wiiw suggested the construction of a ‘European Silk Road’. There, we argue for a ‘Big Push’ in infrastructure investments in greater Europe. We propose the building of a European Silk Road, which connects the industrial centres in the west with the populous, but less developed regions in the east of the continent and is thereby meant to generate more growth and employment in the short and long run.

After its completion, the European Silk Road would extend overland by around 11,000 km on a northern route from Lisbon to Uralsk on the Russian-Kazakh border and on a southern route from Milan to Volgograd and Baku. The central parts are the route from Lyon to Moscow in the north and from Milan to Constanţa in the south. The southern route would link Central Europe with the Black Sea area and the Caspian Sea littoral states.

A state-of-the-art motorway and high-speed railway line with a string of logistics centres, seaports, river ports and airports would set new European standards, among others in e-mobility. The full extension would cost around EUR 1,000 bn or approximately 8% of the gross domestic product of the countries situated along its two routes. The costs relative to the EU’s economic output amount to about 7%.

According to a conservative estimate, the European Silk Road could lead to a cumulated economic growth of 3.5% on average and an increase in employment of around 2 million along its routes in the course of an investment period of 10 years. Under favourable circumstances and at continued low interest rates, an employment creation of over 7 million can be expected in greater Europe.