Do trade imbalances affect economic growth?

23 January 2018

The internationalisation of production appears to have caused a decline in the global wage share, while large trade imbalances may have acted as a break on growth.

By Leon Podkaminer

Photo: Container, kmichiels, CC-BY-NC-ND 2.0

The last 50 years not only have produced a series of revolutionary technological changes which should have accelerated global growth. These decades have also witnessed a truly revolutionary systemic change (gradual at first, accelerating later on) at the global level. The change started with stepwise internal liberalisations and deregulations in major industrialised countries. The developed countries’ socio-economic models, which had sought to balance the interests of labour and business while relying on fiscal and incomes policies, were gradually replaced by neoliberal and monetarists ones.

The internal systemic changes have been synchronised with consecutive waves of liberalisation of international economic relations. Trade liberalisations (cuts in tariff levels, progressive removal of many non-tariff barriers to trade) were followed by the wholesale liberalisation of capital flows, to a large degree completing the process of globalisation. The phenomenal rise in international trade has been the most obvious effect of globalisation. But, globalisation – and the globalisation-driven expansion of international trade – seems to have been associated with a slowdown of economic growth at the global level (Podkaminer, 2014, 2016).

Output gains from trade liberalisation do not show up in the data

According to the classical, neoclassical and contemporary theories of international trade, ‘more trade’ (and especially more free trade) should bring output gains. Why are such positive effects not showing up in the available data? There may be two major reasons.(1)

First, the expanding internationalisation of production (which has been made possible by the liberalisation of trade and capital flows coupled with advances in transportation technologies) seems to be generating, or at least supporting, the tendency for the global wage shares to decline – and thus for the global profit shares to rise. This development may be closely related to the rise of inequality in individual countries – and most probably on the global level. While the impact of globalisation on global inequality remains a controversial issue, there is also a possibility of a reverse impact: from higher inequality to slower growth. The global shift in income distribution from wages to profits can account for the weakening of global growth because such a shift raises the overall saving propensity – without raising the propensity to invest.

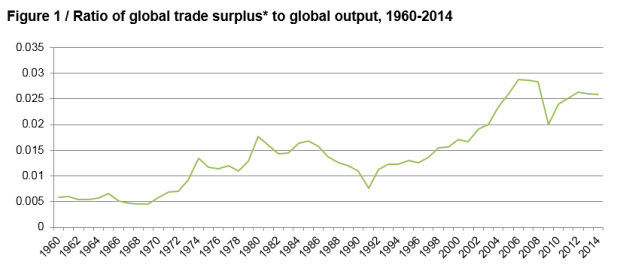

Secondly, it may be argued that expanding world trade could have been productive on the global scale if output growth in individual countries had been at least approximately balanced most of the time – and not only sporadically, in response to the severe debt/payments or exchange rate crises.(2) The negative output effects of rising global trade may have been due to the huge and persistent trade imbalances that have developed under progressing globalisation (Figure 1).

Per capita income growth has slowed since the end of the Bretton Woods system

Such imbalances may have acted as brakes on sustained output growth in both the persistent deficit and the persistent surplus countries. Under a different international economic order, somehow enforcing more balanced trade among nations – with major nations not allowed to compensate deficient domestic demand with huge trade surpluses that destabilise their partners – global trade may assume the positive role assigned to it by the conventional trade theories. The classical Bretton Woods system was an example of such international arrangements limiting persistent and large trade imbalances. It is worth remembering that from 1961 through 1973, global output kept rising, in per capita terms, on average by over 3.4% per year. In contrast, the average yearly per capita growth rate for the period 1974-2015 (that is, following the dissolution of the Bretton Woods system) was only 1.5%. Of course, there may have been other reasons for the onset of growth slowdown – the collapse of the Bretton Woods system remains the most obvious one.

It is true that some countries’ economic growth may heavily rely on the expansion of their exports. Moreover, productivity growth (and growth of potential output) in many cases may critically depend on rising imports of capital goods and intermediate inputs triggering technology transfers. It is equally true that rising net exports may contribute substantially to overall GDP growth in some nations (the performance of the ‘East Asian Tigers’, including China (as well as some CEEs), over the past decades is a particularly pertinent example).

However, rising net exports may also be achieved at the cost of domestic growth stagnation, which suppresses imports. This has been the case, for instance, in Germany where high trade surpluses (achieved through the sustained repression of wages and domestic demand) have been associated with secularly anaemic GDP growth. Moreover, it must be remembered that for each country relying for its GDP growth on the improvement of its net exports, there must be some other countries whose net exports necessarily contract as a result The existence of a club of countries following such ‘export-led’ growth paths implies the existence of a club of ‘import-fed’ countries whose GDP growth must sooner or later be held back by a debt or balance-of-payments crisis. Thus, the global economy – being an autarchic system where trade surpluses and deficits of individual countries necessarily sum up to zero – cannot follow the export-led growth path based on trade surpluses.

Time for a new international economic order

The final ‘policy conclusion’ could be that the basic paradigms of the international economic order need to be changed in order to enforce more balanced trade among nations. Under the reformed world economic order, broadly reminiscent of the Bretton Woods system the expansion of global trade could then be expected to support global growth rather than suppress it (as has been the case over the past few decades). Of course, the basic paradigms of domestic macroeconomic policy-making in major countries would have to be overhauled too if these countries were to follow the externally balanced growth paths (Laski and Podkaminer, 2012; Podkaminer, 2015). Whether the necessary internal reforms would have a chance to be implemented is another matter.

Footnotes:

(1) The supply-side, or structural, developments cannot be made responsible for the secular global growth slowdown. The natural resources have become more abundant secularly (as it is evidenced by their prices trending downwards in relative – and often absolute – terms). The weakening pace of labour productivity growth is also an unlikely cause of the slowdown of global growth. Rather, the weakening pace of productivity growth is a consequence of output growth slowdown rather than its cause (Podkaminer, 2017).

(2) In the neoclassical (and derivative) trade theories countries engage in barter trade – very much like the individual ‘agents’ populating the microeconomics textbooks. The barter trade is assumed to culminate in a Pareto-optimal, balanced, equilibrium. But in the real world nations do not engage in barter trade, but in trade involving money, or debt. Germany, or China, does not earn export revenues in order to spend them, immediately and completely, for paying for the imports urgently desired.