wiiw Opinion Corner: Is the falling wage share in most EU-CEE countries a symptom of the ‘race to the bottom’?

Throughout the developed world the adjusted GDP wage share has been falling secularly over the past decades. Output produced by a working person has been rising faster than the average working person’s compensation (i.e. wage and non-wage benefits). For example, the wage share for the euro area (EA-12) fell from 59.9% in 1992 to 55.9% in 2016. This tendency can be attributed to many developments such as, for instance, the technological change rendering labour relatively less productive as compared to the new capital goods installed. However, the growing significance of foreign direct investment and/or production being outsourced from technologically advanced high-wage countries to the much less advanced lower-wage countries indicates that human labour continues to be an important factor of production withstanding competitive pressures from the advancing technological progress. In effect it is legitimate to ascribe, at least partly, the tendency of the wage share to fall to the deepening internationalisation of production and trade – i.e. to globalisation.

Most EU-CEE countries entered the transition with fairly high wage shares. The Czech Republic and Slovakia were exceptions: by 1995 the wage share in the Czech Republic stood at 44.5% and in Slovakia at 42.6%. In Poland the wage share was 56.9%, in Hungary 53.6%, in Romania 64.2%, in Bulgaria 50.8%, in Estonia 56%, in Slovenia 67.5%, in Latvia 48.3% and in Lithuania 46% correspondingly. In Croatia the wage share was 59.9% in 1996. For comparison, the 1995 German share was 59.3% in 1995.Essentially the Czech Republic and Slovakia constituted ‘the bottom’ in terms of the wage shares (i.e. in terms of the wage costs per unit of output), at least in the European context. Both countries have retained that distinction since. By 2016 the Czech wage share stood at 47.8% and the Slovak at 45.6% (for comparison, the 2016 German wage share was 56.2%).

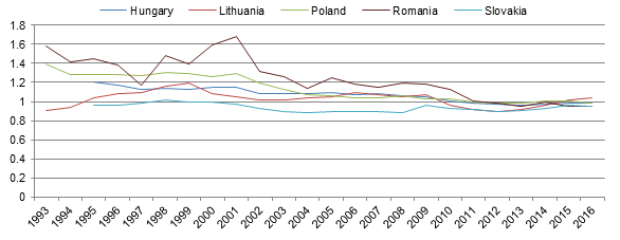

Interestingly, the wage shares of the industrial ‘core’ EU-CEE countries have been adjusting to the Czech level. The process of this adjustment has been quite monotonic in Poland and Hungary all along (and in Romania since 2001, Lithuania since 1999). Slovakia has always been close to the Czech Republic and is now converging to it in terms of wage shares. Since 2012 the differences between the Czech and other ‘core’ EU-CEE countries’ wages shares have been very low. Effectively the latter countries seem to have ‘raced to the bottom’ – even if the ‘bottom’ has moved upwards somewhat (see Figure below).

Slovenian and Croatian wage shares have also been declining in the long run. However, the process has been much slower than in the core EU-CEE. Compared to the Czech Republic both countries’ relative wage shares are still quite high (1.27 and 1.19 respectively). Both countries are successors to Yugoslavia where the employees had a say in the management of ‘their’ firms. The slow fall in the wage shares may be a part of the inherited institutional environment there. Otherwise, the structures of production (and employment) in these two countries may make them less dependent on cuts in labour costs as competitiveness-preserving measures.

In the three ‘peripheral’ EU-CEE countries (Estonia, Latvia and Bulgaria, not displayed in the above Figure) the wage shares have behaved unstably since the late 1990s. There is no visible tendency for these countries’ wage shares to converge to Czech levels. Instead one observes cycle-like movements of their relative wage shares with peaks in 2002-2003 and 2016 in Bulgaria and in 2008-2009 and 2015 2016 in Estonia and Latvia. The earlier peaks may have coincided with consumption and investment booms (supported by runaway current account deficits). The current ‘peaks’ may augur renewed cyclical trouble for these countries in the near future.

For each individual country (be it highly or moderately developed) the active participation in the globalising world economy necessitates taking part in the ‘race to the bottom’ in terms of wage shares (but also in terms of business taxation). Clearly, only the technology leaders may afford putting less effort in this race, without yet ignoring it altogether. But for the core EU-CEE countries active participation may have been of vital importance.

For the international economy as a whole the inter-country wage and tax competition is not really productive. Falling wage shares signify rising aggregate saving propensities (via differences in propensity to save out of wage and non-wage incomes). As such they are likely to depress the growth of private consumption – without necessarily speeding up fixed capital formation. In effect the ‘race to the bottom’ may have been responsible for secular growth stagnation – e.g. in the entire EU. Otherwise, the falling wage share seems to correlate with growing income inequalities. Arguably, both developments have been central to the growing ‘populist’, ‘nationalist’ and ‘protectionist’ tendencies in the EU and elsewhere. Checking these tendencies without tackling their root causes may be rather difficult.