Tariffs at the end of the tunnel

28 July 2025

Trump's tariffs hit EU exports with 15% duties. Trade drops, prices fall, and output shrinks slightly. The EU is likely to see balanced welfare effects, but tensions and uncertainty persist

image credit: unsplash.com/Yoav Aziz

Finally, some of Trump’s tariff deals are being implemented. Even the informed public has grown weary of the constant back-and-forth surrounding his tariff announcements. Initially, Trump targeted the United States’ closest trade partners, Canada and Mexico. Then, on “Liberation Day,” April 2, 2025, he took a scattergun approach and announced “reciprocal” tariffs against all countries worldwide. However, he soon walked back on most of these measures in response to threatening reactions from US bond markets.

In this respect, it is somewhat reassuring that – at least from today’s perspective – Trump has finally begun to settle bilateral agreements with tariff rates that are not entirely irrational, especially from the standpoint of the US economy. On May 8 2025, a trade deal with the United Kingdom was announced. One of the few countries with a trade deficit vis-à-vis the US, the UK will nevertheless face a 10% import tariff when exporting to the American market. On July 23, 2025, the White House announced a 15% tariff agreement for imports from Japan. Then, on July 27, at the fringes of President Trump’s golf outing in Scotland, a similar 15% tariff deal for imports from the European Union was agreed upon with European Commission President Ursula von der Leyen. While many details remain murky, it appears that the 15% rate applies to key goods such as cars, pharmaceuticals, and semiconductors. The deal also includes EU investments in the US, as well as increased EU purchases of energy and defence products from the US.

What could the effects of the latest tariff deals, as well as potential future bilateral agreements with other US trade partners, be? While the final outcome remains uncertain, a pattern is beginning to emerge: The closer the ally to Trump, the more likely a country is to face a 10% tariff rate. Semi-allies are subject to 15%. China, seen as the main adversary in the looming new Cold War, is currently facing a 30% tariff on exports to the US.

To assess the short-term consequences of these “agreements”, we apply the partial equilibrium global simulation model (GSIM) to the current situation for the US, Canada, Mexico, China, Japan, the UK, the EU and the aggregated rest of the world. In our model, goods trade flows are based on UN COMTRADE 2023 import and export data in USD. Domestic trade is approximated using 2023 GDP data from the WDI database. Initial tariff rates are taken from the 2022 ad valorem simple average rates in the WITS database. Following the outlined scenario, we assume US tariffs will increase to 30% on China, 15% on the EU and Japan, and 10% on the UK, Canada and Mexico, and 20% on the rest of the world. To ensure a conservative estimation of trade effects, we apply a composite demand elasticity of -0.5, an industry supply elasticity of 0.6, and an elasticity of substitution of 2.0 along half of their lower bound values in earlier research.

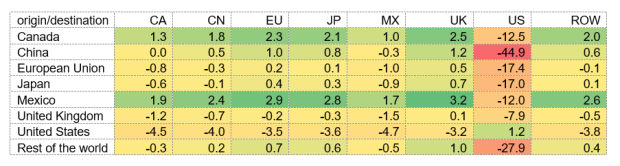

The projected trade impacts on most trading partners of the US are non-negligible. According to the model, Chinese exports to the US could decline by almost half, while EU exports to the US may drop by around a sixth. Japanese exports to the US are expected to decrease by a similar rate (Table 1). The model predicts a somewhat smaller decline in US imports from the UK, Canada and Mexico. Meanwhile, the US is expected to experience a slight decline in exports to all other regions, as domestic price levels are likely to increase due to the trade war. It is important to emphasise that these trade shifts reflect short-term effects, which are likely to be much stronger than longer-term adjustments. Factors such as exchange rate fluctuations and supply chain realignments (which are not considered in this analysis) could mitigate some of these impacts over time.

Table 1 / Simulated Trump tariff effects in terms of percent change of trade quantities

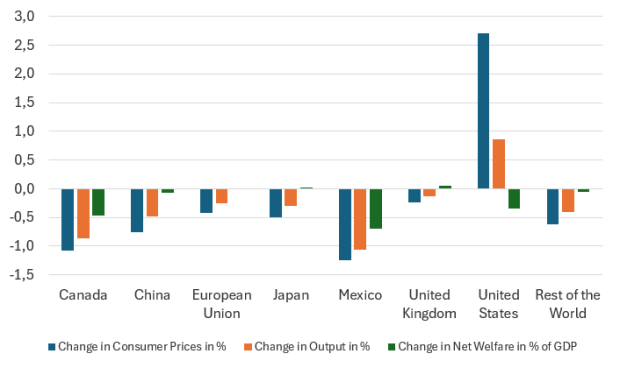

The US is expected to experience an additional inflation surge of almost three percentage points (Figure 2). At the same time, consumer prices in all other regions are projected to decline by between 0.5% and 1%, as some goods originally destined for export will be redirected to local markets. Conversely, while US output is expected to grow by about one percentage point, other regions are likely to face output declines of around 0.5%. Overall, most parties involved in the trade war are projected to experience net welfare losses, measured as the combined effect of producer surplus, consumer surplus and tariff revenue. However, for the EU (as well as Japan, the UK, and China too), the model predicts a balanced net welfare effect, as consumer gains and producer losses offset each other (EU consumer prices are expected to change by -0.4% and output by -0.3%). Interestingly, due to the high increase in prices, the US would be one of the most (negatively) affected economies (apart from Mexico and Canada), with a projected welfare loss of about 0.3% of GDP. While US manufacturing firms and workers may benefit, overall consumer losses are likely to outweigh these gains.

Figure 1: Simulated Trump tariff effects in terms of CPI, output and net welfare

The analysis suggests that while tariffs will harm most parties, the US manufacturing sector may see temporary gains. In the long run, Trump’s tariff obsession could reshape US production and trade patterns, causing significant disruptions in export-driven economies like China and the EU – although the full extent remains uncertain. Moreover, there is a high likelihood that no final agreement will be reached between the EU and Trump on the tariff issue, as President Trump retains the ability to raise tariffs in the future if he believes the EU is not meeting its commitments.