Braced for Fallout from Global Slowdown

Vasily Astrov, Alexandra Bykova, Rumen Dobrinsky, Vladimir Gligorov, Richard Grieveson, Doris Hanzl-Weiss, Gabor Hunya, Sebastian Leitner, Isilda Mara, Olga Pindyuk, Leon Podkaminer, Sandor Richter and Hermine Vidovic

wiiw Forecast Report No. Autumn 2019, November 2019

146 pages including 39 Tables and 50 Figures

EXECUTIVE SUMMARY

free download

OVERVIEW 2017-2018 AND OUTLOOK 2019-2021

Premium Members only

Summary of key recent macroeconomic data for CESEE, and overview of new wiiw forecasts for 2019-2021 (Excel file)

1.1 Global overview: time to panic?

by Richard Grieveson

The global economy is slowing, and this year and next will almost certainly be the worst since the global financial crisis. However, our baseline scenario is that the downturn is unlikely to develop into anything more serious. Economic growth in the euro area should recover a bit next year, with domestic demand providing some relief from the steep manufacturing downturn. Global monetary conditions will remain extraordinarily loose.

free download

2. CESEE economic outlook: Braced for fallout from global slowdown

by Vasily Astrov

Countries with particularly high degrees of exposure to Germany and/or where the automotive sector plays a large role in manufacturing – including the Visegrád countries, Romania, North Macedonia and Serbia – are particularly vulnerable to the external slowdown. However, although the peak years are over, we expect a soft landing rather than an outright collapse for CESEE. Domestic demand will remain resilient, helped by strong wage growth, robust public investment, loose fiscal policy and plentiful credit.

free download

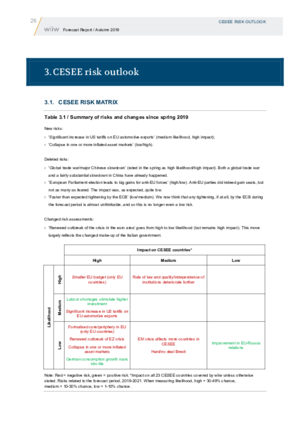

3.1 CESEE risk matrix

Downside risks to our projections are significant, and include a smaller post-Brexit EU budget, the fallout from global trade tensions, the impact of political developments in CESEE on institutions, and potential instability emanating from the financial sector.

free download

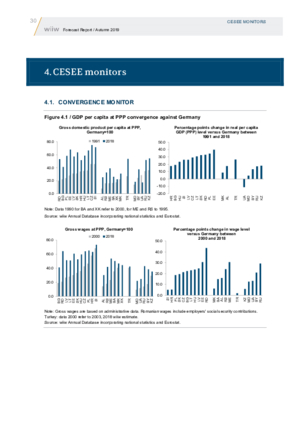

4.1 Convergence Monitor

In the 30 years since the fall of the Berlin Wall, the pace of transition and convergence in CESEE has hardly been homogenous. However, after a difficult start, many countries have become significantly wealthier. Five countries in CESEE have per capita GDP in PPP terms at 60% of the German level or above: Slovakia, Lithuania, Estonia, Slovenia and the Czech Republic. The two latter countries are above 70%, with the Czech Republic at almost three quarters.

free download

4.2 Business cycle monitor: Overheating still visible in regional labour markets

by Alexandra Bykova

For the region as a whole, conditions are stable, with no clear signs of under- or overheating relative to the historical period. Hungary, the Czech Republic and Romania had the highest scores for the headline business cycle index in Q2 2019. The sharpest increases in scores compared with the Spring were observed for Latvia, Croatia and Estonia.

free download

4.3 Credit monitor: Household demand remains strong

by Olga Pindyuk

The market has started to cool slightly compared with December 2018 in many countries. However, the likelihood of credit bubbles forming remains fairly high in large parts of the CIS and Ukraine. The share of non-performing loans has continued to trend downwards in most countries of EU-CEE and the Western Balkans. However, asset quality worsened in all CIS countries in our sample, most significantly in Kazakhstan.

free download

4.4 FDI monitor: Inflows to EU-CEE stagnate, catch-up in the Western Balkans, decline in Russia

by Gabor Hunya

FDI inflows into CESEE fell by around 17% in 2017, and by another 13% in 2018. The decline was mainly on account of Russia, where inflows halved in 2018. EU-CEE received about the same amount of FDI in 2018 as in the previous two years, while inflows to the Western Balkans rose by 28% last year. Serbia and North Macedonia have been the main hosts of new projects in industry and export-oriented services. FDI inflows into Turkey recovered in 2018, but the recent postponement of a new VW investment project on account of political instability signals investor perceptions of heightened risks related to political developments.

free download

You can also download separate country reports of this report

| No. | Title | Author | |

|---|---|---|---|

| 1 | ALBANIA: Growth will remain below potential | Isilda Mara | Free Download |

| 2 | BELARUS: Economic sluggishness likely to persist | Rumen Dobrinsky | Free Download |

| 3 | BOSNIA AND HERZEGOVINA: Suffering in the face of external headwinds | Vladimir Gligorov | Free Download |

| 4 | BULGARIA: Uneven growth signalling a slowdown | Rumen Dobrinsky | Free Download |

| 5 | CROATIA: Aiming at euro accession | Hermine Vidovic | Free Download |

| 6 | CZECH REPUBLIC: Weak growth at full employment | Leon Podkaminer | Free Download |

| 7 | ESTONIA: Revival of investment keeps growth buoyant | Sebastian Leitner | Free Download |

| 8 | HUNGARY: Clear signs of decelerating growth | Sandor Richter | Free Download |

| 9 | KAZAKHSTAN: Relying on state support to sustain economic growth | Alexandra Bykova | Free Download |

| 10 | KOSOVO: Opposition parties triumph | Isilda Mara | Free Download |

| 11 | LATVIA: In the midst of a soft landing | Sebastian Leitner | Free Download |

| 12 | LITHUANIA: Still growing swiftly, but slowdown ahead | Sebastian Leitner | Free Download |

| 13 | MOLDOVA: Solid growth amidst fragile political consolidation | Gabor Hunya | Free Download |

| 14 | MONTENEGRO: Fiscal consolidation puts a brake on growth | Vladimir Gligorov | Free Download |

| 15 | NORTH MACEDONIA: Recovery underway | Vladimir Gligorov | Free Download |

| 16 | POLAND: Soft landing ahead is a possibility | Leon Podkaminer | Free Download |

| 17 | ROMANIA: New government to initiate fiscal consolidation | Gabor Hunya | Free Download |

| 18 | RUSSIA: Self-inflicted stagnation | Vasily Astrov | Free Download |

| 19 | SERBIA: Back to reality | Richard Grieveson | Free Download |

| 20 | SLOVAKIA: Cooling due to external slowdown | Doris Hanzl-Weiss | Free Download |

| 21 | SLOVENIA: Domestic resilience amid external weakness | Hermine Vidovic | Free Download |

| 22 | TURKEY: Recovery arrives but risks rising again | Richard Grieveson | Free Download |

| 23 | UKRAINE: New reforms provide reason for optimism | Olga Pindyuk | Free Download |

Reference to wiiw databases: wiiw Annual Database, wiiw Monthly Database

Keywords: CESEE, economic forecast, Europe, Central and Eastern Europe, Southeast Europe, Western Balkans, new EU Member States, CIS, Russia, Ukraine, Romania, Czech Republic, Hungary, Turkey, Serbia, convergence, business cycle, overheating, external risks, trade war, EU funds, private consumption, credit, investment, exports, FDI, labour markets, unemployment, employment, wage growth, migration, inflation, central banks

JEL classification: E20, E31, E32, F15, F21, F22, F32, F51, G21, H60, J20, J30, J61, O47, O52, O57, P24, P27, P33, P52

Countries covered: Albania, Belarus, Bosnia and Herzegovina, Bulgaria, Central and East Europe, CIS, Croatia, Czechia, Estonia, European Union, Hungary, Kazakhstan, Kosovo, Latvia, Lithuania, Moldova, Montenegro, New EU Member States, North Macedonia, Poland, Romania, Russia, Serbia, Slovakia, Slovenia, Southeast Europe, Turkey, Ukraine

Research Areas: Macroeconomic Analysis and Policy, International Trade, Competitiveness and FDI

ISBN-13: 978-3-85209-068-9

Press Releases

Related Presentations

- Gut gewappnet für den globalen Wirtschaftsabschwung (press conference presentation in German)

- Braced for Fallout from Global Slowdown (press conference presentation in English)