Beneath the Veneer of Calm

Vasily Astrov, Alexandra Bykova, Rumen Dobrinsky, Selena Duraković, Meryem Gökten, Richard Grieveson, Doris Hanzl-Weiss, Marcus How, Gabor Hunya, Branimir Jovanović, Niko Korpar, Sebastian Leitner, Isilda Mara, Olga Pindyuk, Sandor Richter, Bernd Christoph Ströhm, Marina Tverdostup, Zuzana Zavarská and Adam Żurawski

wiiw Forecast Report No. Autumn 2023, October 2023

156 pages including 30 Tables and 52 Figures

Executive summary

by Branimir Jovanović

free download

Indicators 2021-2022 and Outlook 2023-2025

Premium Members only

Summary of key recent macroeconomic data for CESEE, and overview of new wiiw forecasts for 2023-2025 (Excel file)

1. Global overview: German and Chinese weakness weighing on CESEE outlook

by Richard Grieveson

The war in Ukraine is likely going to last for much or all of our forecast period. However, the direct economic fallout from the war for most of CESEE will be limited. The outlook for Germany in particular and for the euro area economy has deteriorated, and next year’s recovery will be weaker than we had previously expected. Inflation has peaked in the euro area and will trend downward. The ECB has finished its tightening cycle and will start to cut next year. The global economy is mixed, with China struggling, while the US remains impressively resilient to monetary tightening and external headwinds. For CESEE, the combined negative impact of weakness in the euro area and China is a major headwind for growth.

free download

2. Political risks in CESEE 2024-2024: Strategic outlook

by Marcus How

Over 18 months on from the start of the Russian invasion of Ukraine, its fallout continues to be the key driver of political risks in CESEE. Security aside, the cost to CESEE states of severing their various economic ties with Russia is proving high – especially for those that are EU members. The Russian and Ukrainian governments remain uncompromising on the possibility of a peace settlement. Military strategies remain attritional, as each of the two sides seeks to degrade the weaponry, logistics,

infrastructure and morale of the other. The Ukrainian counteroffensive continues but is grinding along only slowly. Political instability in the US represents a major risk to the Ukrainian war effort, while elections in Slovakia, Poland and Austria may lead the EU consensus surrounding sanctions and aid to begin to unravel. At the same time, the US and the EU have taken major steps to ensure that Ukraine continues to receive military support in the long term; this will sustain its defences, even if it cannot deliver victory.

free download

3. CESEE overview: Beneath the Veneer of Calm

by Branimir Jovanović

The economy of the CESEE region continues to outperform the EU average, but there are notable differences between the various sub-regions. The EU-CEE countries performed worse than expected, due to the recession in Germany. The Western Balkan countries performed better than expected, thanks to tourism, remittances and FDI. And the CIS countries and Ukraine also did better than anticipated, as they adapted to the new reality. Inflation is proving far more persistent than previously imagined; it is driven not just by global energy prices, but also by company profits, price rises in other sectors and, most recently, higher wages. The price increases are having a serious adverse effect on people’s living standards and poverty, and some indicators have worsened dramatically. Growth in 2024 and 2025 will be lower than previously expected, on account of the global

slowdown, the weak EU economy, the more persistent inflation, the tighter monetary conditions and less-supportive fiscal policy. Inflation will also be higher and will not return to 2% any time soon, as its dynamics have become far more complex and are no longer driven just by higher global energy.

free download

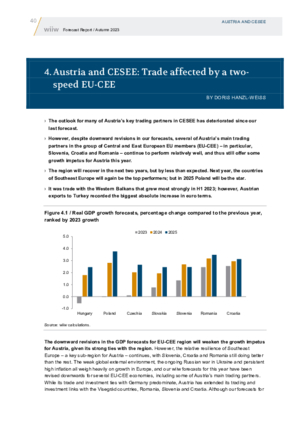

4. Austria and CESEE: Trade affected by a two-speed EU-CEE

by Doris Hanzl-Weiss

The outlook for many of Austria’s key trading partners in CESEE has deteriorated since our last forecast. However, despite downward revisions in our forecasts, several of Austria’s main trading partners in the group of Central and East European EU members (EU-CEE) – in particular, Slovenia, Croatia and Romania – continue to perform relatively well, and thus still offer some growth impetus for Austria this year. The region will recover in the next two years, but by less than expected. Next year, the countries of Southeast Europe will again be the top performers; but in 2025 Poland will be the star.

free download

5. Convergence Monitor: CESEE again proves its resilience

by Richard Grieveson

The years since 2019 have been tumultuous ones for CESEE, with the outbreak of the Covid-19 pandemic in 2020, followed by Russia’s full-scale invasion of Ukraine in 2022. In this context, over this period the continued per capita GDP convergence of almost all the CESEE countries with Germany has been remarkable. 21 of the 23 CESEE countries posted per capita GDP convergence with Germany in purchasing power standard (PPS) terms. The top performers were Turkey, Romania, Poland and Croatia, all of which increased their wealth levels versus Germany by 7 percentage points or more. However, while the positive per capita convergence performance is a welcome sign, it may have been helped by the region’s loss of population. Our new forecasts suggest that most countries of the region will continue to catch up with Germany, but there are major challenges to future convergence performance.

free download

You can also download separate country reports of this report

| No. | Title | Author | |

|---|---|---|---|

| 1 | ALBANIA: Economic growth supported by external demand | Isilda Mara | Free Download |

| 2 | BELARUS: Recovery gathering pace, but the future remains uncertain | Rumen Dobrinsky | Free Download |

| 3 | BOSNIA AND HERZEGOVINA: Economy stagnating, as political tensions come to the fore | Selena Duraković | Free Download |

| 4 | BULGARIA: Economic weakness likely to persist | Rumen Dobrinsky | Free Download |

| 5 | CROATIA: Tourism to keep economy afloat | Bernd Christoph Ströhm | Free Download |

| 6 | CZECHIA: In the slow lane | Zuzana Zavarská | Free Download |

| 7 | ESTONIA: No swift economic recovery on the cards | Marina Tverdostup | Free Download |

| 8 | HUNGARY: A bumpy road to recovery from the recession | Sandor Richter | Free Download |

| 9 | KAZAKHSTAN: Robust economic growth weakens slightly | Alexandra Bykova | Free Download |

| 10 | KOSOVO: Renewed tensions with Serbia jeopardising economic prospects | Isilda Mara | Free Download |

| 11 | LATVIA: Waiting for the tide to float the boats | Sebastian Leitner | Free Download |

| 12 | LITHUANIA: Stagnation to last longer than expected | Sebastian Leitner | Free Download |

| 13 | MOLDOVA: Emerging from depression | Gabor Hunya | Free Download |

| 14 | MONTENEGRO: Election results could offer fresh hope | Bernd Christoph Ströhm | Free Download |

| 15 | NORTH MACEDONIA: Same Old Story | Branimir Jovanović | Free Download |

| 16 | POLAND: Technically in recession | Adam Żurawski | Free Download |

| 17 | ROMANIA: How much fiscal consolidation? | Gabor Hunya | Free Download |

| 18 | RUSSIA: Resisting depreciation pressures | Vasily Astrov | Free Download |

| 19 | SERBIA: A lighter shade of grey | Branimir Jovanović | Free Download |

| 20 | SLOVAKIA: Automotive industry propping up growth, but for how long? | Doris Hanzl-Weiss | Free Download |

| 21 | SLOVENIA: Worst flooding in decades is the defining moment of the year | Niko Korpar | Free Download |

| 22 | TURKEY: A balancing act between growth and disinflation | Meryem Gökten | Free Download |

| 23 | UKRAINE: Economy showing resilience in wartime | Olga Pindyuk | Free Download |

The economy of the CESEE region continues to outperform the EU average, but there are notable differences between the various sub-regions. The EU-CEE countries performed worse than expected, due to the recession in Germany, while the Western Balkan countries performed better than expected, thanks to tourism, remittances and FDI. And the CIS countries and Ukraine also did better than anticipated, as they adapted to the new reality. Inflation is proving far more persistent than previously imagined; it is driven not just by global energy prices, but also by company profits, price rises in other sectors and, most recently, higher wages. The price increases are having a serious adverse effect on people’s living standards and poverty, and some indicators have worsened dramatically. Growth in 2024 and 2025 will be lower than previously expected, on account of the global slowdown, the weak EU economy, the more persistent inflation, the tighter monetary conditions and less-supportive fiscal policy. Inflation will also be higher and will not return to 2% any time soon, as its dynamics have become far more complex and are no longer driven just by higher global energy.

Reference to wiiw databases: wiiw Annual Database, wiiw Monthly Database, wiiw FDI Database

Keywords: CESEE, Central and Eastern Europe, economic forecast, Western Balkans, Visegrád group, CIS, Ukraine, Russia, Turkey, euro area, EU, convergence, Russia-Ukraine war, Russia sanctions, commodity prices, inflation, energy crisis, gas, renewable energy, electricity, monetary and fiscal policy, EU funds, purchasing power, poverty, real wages, remittances, FDI, imports, external debt, interest rates, banking sector, credit, impact on Austria, macroeconomic forecasting

JEL classification: E20, E21, E22, E24, E32, E5, E62, F21, F31, H60, I18, J20, J30, O47, O52, O57, P24, P27, P33, P52

Countries covered: Albania, Austria, Belarus, Bosnia and Herzegovina, Bulgaria, Central and East Europe, CESEE, CIS, Croatia, Czechia, Estonia, Euro Area, European Union, Hungary, Kazakhstan, Kosovo, Latvia, Lithuania, Moldova, Montenegro, North Macedonia, Poland, Romania, Russia, Serbia, Slovakia, Slovenia, Southeast Europe, Turkey, Ukraine, US, Western Balkans

Research Areas: Macroeconomic Analysis and Policy, International Trade, Competitiveness and FDI

ISBN-13: 978-3-85209-078-8

Press Releases

Related Presentations

- Unter dem Deckmantel der Gelassenheit (press conference presentation in German)

- Beneath the Veneer of Calm (webinar presentation in English)