Strong Growth Amid Increased Negative Risks

Amat Adarov, Vasily Astrov, Alexandra Bykova, Rumen Dobrinsky, Richard Grieveson, Julia Grübler, Doris Hanzl-Weiss, Peter Havlik, Philipp Heimberger, Mario Holzner, Gabor Hunya, Michael Landesmann, Sebastian Leitner, Isilda Mara, Olga Pindyuk, Leon Podkaminer, Sandor Richter and Hermine Vidovic

wiiw Forecast Report No. Autumn 2018, November 2018

181 pages including 37 Tables and 59 Figures

EXECUTIVE SUMMARY

free download

OVERVIEW 2016-2017 AND OUTLOOK 2018-2020

Premium Members only

Summary of key recent macroeconomic data for CESEE, and overview of new wiiw forecasts for 2018-2020 (Excel file)

1.1 Global and eurozone outlook: Heading into increasingly stormy weather

by Richard Grieveson

Despite a slightly less optimistic outlook than in the Spring, the global economy remains buoyant, powered above all by strong activity in the US. Global growth should remain fairly robust by post-crisis standards throughout the forecast period. However, the risks to the outlook have continued to rise, and are tilted heavily towards the downside. Tighter US policy, a possible Chinese slowdown, and uncertainty around Italy and the eurozone are the main things to watch.

free download

1.2 Eurozone reform: Lack of progress leaves bloc ill-prepared for next downturn

by Philipp Heimberger

It is very possible that a recession will hit the Eurozone within the next three years. If a downturn were to start, the bloc could be in big trouble. The ECB would have little room to cut further to support the economy, bond markets could sell off prompting a liquidity crisis, national governments have little room for manoeuvre in fiscal policy, and a sufficient counter-cyclical response at the EU level looks highly unlikely.

free download

1.3 European migration and refugee flows: Redrawing migration and asylum policy

by Michael Landesmann

The case for stronger EU-wide cooperation on migration policy is overwhelming. However, recent developments have been very disappointing, and the lack of tangible progress on addressing current issues has contributed to a backlash from voters. Formulating a pan-EU policy to deal with future challenges is essential, but will remain very difficult. However, while decisive steps continue to look unlikely, incremental efforts already under way could bear fruit in the long run.

free download

2.1 CESEE overview: Robust growth in the face of increased negative risks

by Olga Pindyuk

Across most of the region, growth will still be quite strong by post-crisis standards during the forecast period. Private consumption will remain the key growth driver as tight labour markets will further push up wages. High levels of capacity utilisation will spur increases in investment. However, the external environment has deteriorated, and growth will slow in most places by 2020.

free download

2.2 Why Western Balkan labour markets are different

by Hermine Vidovic

Unlike in much of EU-CEE, labour markets in the Western Balkans are not facing significant labour shortages. In the region, unemployment is generally high, employment rates low, and most countries have a particularly high share of youth and long-term joblessness. This reflects cultural factors, a reliance on remittances, and a high degree of informality.

free download

2.3 Have DCFTAs in Georgia, Moldova and Ukraine had an impact on trade and FDI?

by Peter Havlik

In 2014, the EU signed DCFTAs with Georgia, Moldova and Ukraine. So far, the results in terms of trade and FDI flows have been mixed at best.

free download

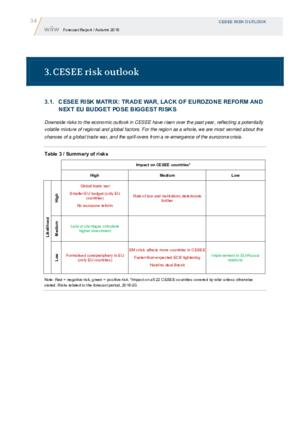

3.1 CESEE risk matrix: Trade war, lack of eurozone reform and next EU budget pose biggest risks

Downside risks to the economic outlook in CESEE have risen over the past year, reflecting a potentially volatile mixture of regional and global factors. For the region as a whole, we are most worried about the chances of a global trade war, and the spill-overs from a re-emergence of the eurozone crisis.

free download

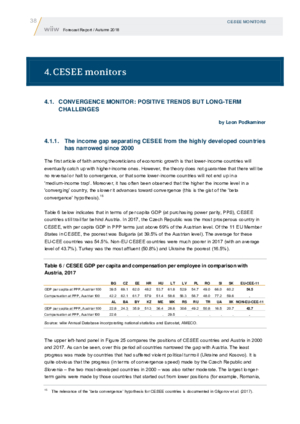

4.1 Convergence monitor: Positive trends but long-term challenges

by Leon Podkaminer

Recent convergence progress has been good in most of the region, but is more likely to reflect the stage of the business cycle rather than a fundamental increase in the speed of catching up. Convergence is a long-term matter, and it will take decades for most of CESEE to approach Western European income levels.

free download

4.2 Business cycle monitor: Overheating concern abate

by Alexandra Bykova and Richard Grieveson

Overheating concerns have abated since the Spring, reflecting strong policy responses in Turkey (monetary) and Romania (fiscal). Across the region, potential overheating is most evident in tight labour markets, higher external debt, elevated property prices, and negative real interest rates.

free download

4.3 Credit monitor: Cycle picking up as asset quality improves

by Olga Pindyuk

Credit growth is picking in most places, although more to households than to non-financial corporations. Asset quality has improved significantly almost everywhere. Potential concerns include high household credit growth in the CIS + Ukraine, and increasingly negative real interest rates for the eurozone countries and some other parts of EU-CEE.

free download

4.4 FDI monitor: Inflows down by almost a quarter in 2017

by Gabor Hunya

Despite strong economic growth in the region, inflows of FDI fell quite sharply in 2017, and a further decline could be on the cards this year. However, disinvestment by foreign investors is largely being replaced by national capital, particularly in the Visegrad countries. Trends in FDI indicate that countries such as Romania, Serbia and Macedonia are becoming increasingly integrated into the Central European manufacturing hub.

free download

5.1 What does China’s Belt and Road Initiative mean for CESEE, and how should the EU respond?

by Amat Adarov, Julia Grübler and Mario Holzner

China’s Belt and Road Initiative is important for the CESEE region, and especially for the Western Balkans. While it will bring much-needed infrastructure upgrading, the initiative is also associated with certain risks, including increased political and economic dependence on China, and a potentially unsustainable rise in public debt levels in some countries. The EU should respond with a ‘Big Push’ investment initiative of its own, framed as a complement to the Belt and Road Initiative, rather than as its competitor.

free download

You can also download separate country reports of this report

| No. | Title | Author | |

|---|---|---|---|

| 1 | ALBANIA: Growth led by rebound in electricity production and exports | Isilda Mara | Free Download |

| 2 | BELARUS: Recovery driven by external factors and policy stimulus | Rumen Dobrinsky | Free Download |

| 3 | BOSNIA AND HERZEGOVINA: Elevated political risk unlikely to derail growth | Richard Grieveson | Free Download |

| 4 | BULGARIA: Further moderation of growth | Rumen Dobrinsky | Free Download |

| 5 | CROATIA: Low absorption of EU funds holding back growth | Hermine Vidovic | Free Download |

| 6 | CZECH REPUBLIC: Balanced but moderating growth | Leon Podkaminer | Free Download |

| 7 | ESTONIA: Tight labour market without overheating | Sebastian Leitner | Free Download |

| 8 | HUNGARY: At the turning point of the business cycle | Sandor Richter | Free Download |

| 9 | KAZAKHSTAN: Further profiting from high oil prices | Olga Pindyuk | Free Download |

| 10 | KOSOVO: Plans for territorial swap with Serbia likely to be thwarted | Isilda Mara | Free Download |

| 11 | LATVIA: Construction pushes growth but some slowdown ahead | Sebastian Leitner | Free Download |

| 12 | LITHUANIA: Brisk domestic demand fosters growth | Sebastian Leitner | Free Download |

| 13 | MACEDONIA: Name disputes prolong uncertainty and delay hopes for growth-boosting connectivity | Peter Havlik | Free Download |

| 14 | MONTENEGRO: Doing well, but clouds on the horizon | Olga Pindyuk | Free Download |

| 15 | POLAND: Can strong growth supported by public sector spending continue much longer? | Leon Podkaminer | Free Download |

| 16 | ROMANIA: Slowdown continues | Gabor Hunya | Free Download |

| 17 | RUSSIAN FEDERATION: Sailing slowly between sanctions and high oil prices | Peter Havlik | Free Download |

| 18 | SERBIA: On the crest of a wave | Richard Grieveson | Free Download |

| 19 | SLOVAKIA: Growth fostered by automotive industry | Doris Hanzl-Weiss | Free Download |

| 20 | SLOVENIA: Another successful year | Hermine Vidovic | Free Download |

| 21 | TURKEY: Accepting reality and hoping for the best | Richard Grieveson | Free Download |

| 22 | UKRAINE: Lifeline from the IMF ahead of the elections | Vasily Astrov | Free Download |

The outlook for growth in CESEE remains generally positive, but downside risks have increased significantly since our last forecast. The main areas of concern are the developing US-China trade war and the potential for a renewed outbreak of the eurozone crisis.

Reference to wiiw databases: wiiw Annual Database, wiiw Monthly Database

Keywords: CESEE, economic forecast, Europe, Central and Eastern Europe, Southeast Europe, Western Balkans, new EU Member States, CIS, Russia, Ukraine, Poland, Romania, Czech Republic, Hungary, Turkey, convergence, business cycle, overheating, external risks, trade war, EU funds, private consumption, credit, investment, exports, FDI, labour markets, unemployment, employment, wage growth, unit labour costs, migration, inflation, savings rate, DCFTA, Belt and Road Initiative

JEL classification: E20, E32, F15, F21, F22, F32, F51, G21, H60, J20, J30, J61, O47, O52, O57, P24, P27, P33, P52

Countries covered: Albania, Belarus, Bosnia and Herzegovina, Bulgaria, Central and East Europe, CIS, Croatia, Czechia, Estonia, European Union, Hungary, Kazakhstan, Kosovo, Latvia, Lithuania, North Macedonia, Montenegro, New EU Member States, Poland, Romania, Russia, Serbia, Slovakia, Slovenia, Southeast Europe, Turkey, Ukraine, Russian Federation

Research Areas: Macroeconomic Analysis and Policy, Labour, Migration and Income Distribution, International Trade, Competitiveness and FDI, Regional Development

ISBN-13: 978-3-85209-063-4

Press Releases

Related Presentations

- Robustes Wachstum bei erhöhten negativen Risiken (press conference presentation in German)

- Robust growth in the face of increased negative ricks (press conference presentation in English)