Moving Into the Slow Lane

Vasily Astrov, Alexandra Bykova, Rumen Dobrinsky, Richard Grieveson, Doris Hanzl-Weiss, Peter Havlik, Mario Holzner, Gabor Hunya, Sebastian Leitner, Isilda Mara, Olga Pindyuk, Leon Podkaminer, Sandor Richter, Hermine Vidovic and Goran Vukšić

wiiw Forecast Report No. Spring 2019, March 2019

181 pages including 39 Tables and 68 Figures

EXECUTIVE SUMMARY

free download

OVERVIEW 2017-2018 AND OUTLOOK 2019-2021

Premium Members only

Summary of key recent macroeconomic data for CESEE, and overview of new wiiw forecasts for 2019-2021 (Excel file)

1.1 International economic environment

by Mario Holzner

Economic growth in the G20 and the eurozone peaked in the 3rd quarter of 2017 and has been decelerating ever since. Slowdowns in China and Germany are particularly notable, and important from the perspective of CESEE. Global monetary policy remains extraordinarily loose, and is likely to remain so. Despite increased global uncertainties – including Brexit, reduced global trade volumes and fears of a renewed euro crisis – our expectation is that eurozone growth will only decelerate slowly over the forecast period.

free download

2.1 CESEE overview: Slower growth is here

by Richard Grieveson

Growth in much of CESEE is still at or close to its best level since the global financial crisis, and the outlook for 2019-21 is reasonably positive for most. This reflects a combination of strong wage rises, low interest rates, and a generally good outlook for investment. However, growth has now peaked for CESEE, and most of the region’s economies will expand more slowly in 2019-21 than in 2016-18. The slowdown in key sources of final demand such as Germany and China will weigh on exports. Regionally, the main challenges are increasingly severe labour shortages, the impact of global developments on confidence, and the potential for lower EU funds inflows. Authoritarianism, state capture and interference in the independence of institutions are all on the rise, creating significant risks for growth in the medium and long term.

free download

2.2 What are the chances of new conditionality in the next EU budget?

by Sandor Richter

The negotiations on the next seven-year EU budget will reach a decisive stage this year and next. The main issues will be how to mitigate the impact of Brexit (whatever happens); a new conditionality related to respect for the rule of law and the fundamental values of democracy in beneficiary Member States; and, finally, the search for innovative solutions to reduce the risk of corruption related to EU transfers.

free download

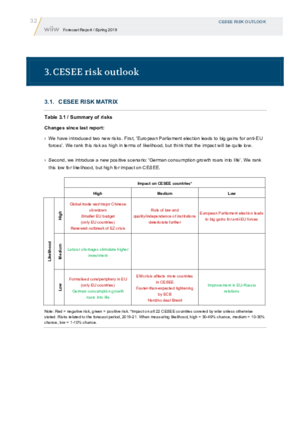

3.1 CESEE risk matrix

Downside risks to the economic outlook in CESEE are high, reflecting a potentially volatile mixture of regional and global factors. For the region as a whole, we are most worried about higher US tariffs on EU exports, and the spillovers from a re-emergence of the eurozone crisis.

free download

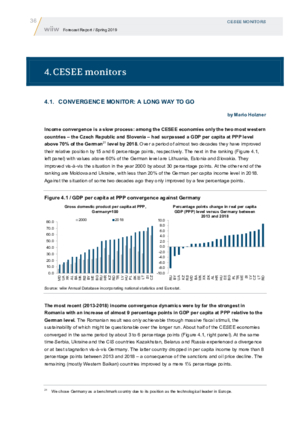

4.1 Convergence monitor: A long way to go

by Mario Holzner

Romania has posted the best convergence performance over the past five years, but this was only achieved through massive fiscal stimuli, the sustainability of which might be questionable over the longer run. Over the same period, Serbia, Ukraine, Kazakhstan, Belarus and Russia posted the worst convergence performance, experiencing at best stagnation relative to Germany.

free download

4.2 Business cycle monitor: Still watching labour markets and property prices

by Alexandra Bykova

Across the region, potential overheating remains most evident in tight labour markets, higher external debt, elevated property prices, and negative real interest rates. In this context, inflation remains notably weak.

free download

4.3 Credit monitor: Rapid household loan growth in CIS + Ukraine

by Olga Pindyuk

Household credit growth remains generally much stronger than that to corporates, although the latter is picking up in most places. Asset quality has improved significantly almost everywhere. Potential concerns include high household credit growth in the CIS + Ukraine, and negative real interest rates for the eurozone countries and some other parts of EU-CEE.

free download

4.4 FDI monitor: Inflows up in the EU-CEE11 and the Western Balkans; down in Russia

by Gabor Hunya

FDI inflows into CESEE fell by an estimated 9% in 2018, mostly on account of Russia, where inflows dropped by 35%. EU-CEE11 received about 4% more FDI in 2018 than the previous year, largely owing to fewer disinvestments in Poland. The Western Balkans received 6% more FDI in 2018, continuing the upward trend for the third consecutive year.

free download

5.1 Ten years after the global financial crisis: The state of the financial sector of the CESEE region

by Olga Pindyuk

Quantitative easing undertaken by the ECB was supposed to provide liquidity to the banking sector, in order to make it easier and cheaper for banks to extend loans to companies and households. It has had limited effect on the CESEE countries, as foreign banks have not restored their pre-crisis positions in the region. Non-financial corporations have increasingly come to prefer direct lending and private equity to bank loans as sources of funding. Both companies and financial corporations tend to pile up cash on their balance sheets. As a result, the efficiency of resource allocation has decreased in the economies of the region, while the risk of asset price bubbles has grown.

free download

You can also download separate country reports of this report

| No. | Title | Author | |

|---|---|---|---|

| 1 | ALBANIA: Growth will lose vigour | Isilda Mara | Free Download |

| 2 | BELARUS: Growth set to slow down | Rumen Dobrinsky | Free Download |

| 3 | BOSNIA AND HERZEGOVINA: Once again politics impede stronger growth | Goran Vukšić | Free Download |

| 4 | BULGARIA: Economy loses pace | Rumen Dobrinsky | Free Download |

| 5 | CROATIA: Weaker growth momentum | Hermine Vidovic | Free Download |

| 6 | CZECH REPUBLIC: Stability and (undue) caution | Leon Podkaminer | Free Download |

| 7 | ESTONIA: At full capacity – heading for a soft landing | Sebastian Leitner | Free Download |

| 8 | HUNGARY: Strong domestic demand driven growth on the back of EU transfers | Sandor Richter | Free Download |

| 9 | KAZAKHSTAN: Falling oil prices bring economic diversification to the fore | Olga Pindyuk | Free Download |

| 10 | KOSOVO: 2019 a decisive year for relations with Serbia | Isilda Mara | Free Download |

| 11 | LATVIA: Beyond peak, but growth further bolstered by investment | Sebastian Leitner | Free Download |

| 12 | LITHUANIA: Domestic demand keeps growth buoyant | Sebastian Leitner | Free Download |

| 13 | MOLDOVA: Solid growth with prospects with elevated risks | Gabor Hunya | Free Download |

| 14 | MONTENEGRO: Gradual growth deceleration expected | Goran Vukšić | Free Download |

| 15 | NORTH MACEDONIA: Solving name dispute to boost investor confidence | Olga Pindyuk | Free Download |

| 16 | POLAND: Slower growth a real possibility | Leon Podkaminer | Free Download |

| 17 | ROMANIA: Who pays the bill for fiscal loosening? | Gabor Hunya | Free Download |

| 18 | RUSSIA: GDP growth will fall back after an unexpected uptick in 2018 | Peter Havlik | Free Download |

| 19 | SERBIA: Slowdown ahead after a strong 2018 | Richard Grieveson | Free Download |

| 20 | SLOVAKIA: Strong growth at stake? | Doris Hanzl-Weiss | Free Download |

| 21 | SLOVENIA: Solid growth | Hermine Vidovic | Free Download |

| 22 | TURKEY: A tough adjustment and a challenging year ahead | Richard Grieveson | Free Download |

| 23 | UKRAINE: Growth slowdown on the horizon | Vasily Astrov | Free Download |

Growth in much of CESEE will remain healthy by post-crisis standards, but has passed its peak. We expect most economies to slow from here, reflecting weaker external demand and domestic capacity constraints. Global trade tensions, structural weakness in the eurozone and Brexit all pose downside risks to our forecasts.

Reference to wiiw databases: wiiw Annual Database, wiiw Monthly Database

Keywords: CESEE, economic forecast, Europe, Central and Eastern Europe, Southeast Europe, Western Balkans, new EU Member States, CIS, Russia, Ukraine, Romania, Czech Republic, Hungary, Turkey, Serbia, convergence, business cycle, overheating, external risks, trade war, EU funds, private consumption, credit, investment, exports, FDI, labour markets, unemployment, employment, wage growth, unit labour costs, migration, inflation, savings rate, financial crisis, financial markets, direct lending, leverage, central banks

JEL classification: E20, E31, E32, F15, F21, F22, F32, F51, G21, H60, J20, J30, J61, O47, O52, O57, P24, P27, P33, P52

Countries covered: Albania, Belarus, Bosnia and Herzegovina, Bulgaria, Central and East Europe, CIS, Croatia, Czechia, Estonia, European Union, Hungary, Kazakhstan, Kosovo, Latvia, Lithuania, North Macedonia, Montenegro, New EU Member States, Poland, Romania, Russia, Serbia, Slovakia, Slovenia, Southeast Europe, Turkey, Ukraine, Moldova

Research Areas: Macroeconomic Analysis and Policy, International Trade, Competitiveness and FDI

ISBN-13: 978-3-85209-064-1

Press Releases

Related Presentations

- Wachstumsverlangsamung kündigt sich an (press conference presentation in German)

- Moving Into the Slow Lane (press conference presentation in English)