Assessing the impact of Trump´s tariffs on the region

Vasily Astrov, Alexandra Bykova, Selena Duraković, Mahdi Ghodsi, Meryem Gökten, Richard Grieveson, Maciej Grodzicki, Ioannis Gutzianas, Doris Hanzl-Weiss, Marcus How, Gabor Hunya, Branimir Jovanović, Niko Korpar, Dzmitry Kruk, Sebastian Leitner, Benedetta Locatelli, Isilda Mara, Emilia Penkova-Pearson, Olga Pindyuk, Oliver Reiter, Sandor Richter, Marko Sošić, Bernd Christoph Ströhm and Marina Tverdostup

wiiw Forecast Report No. Spring 2025, April 2025

152 pages including 30 Tables and 48 Figures and 4 Boxes

The current report is only available to members. Past issues become freely available online when the next report is released. Several individual sections of the report are freely available to download now (see below).

Executive summary

by Richard Grieveson

free download

Indicators 2023-2024 and Outlook 2025-2027

Premium Members only

Summary of key recent macroeconomic data for CESEE, and overview of new wiiw forecasts for 2025-2027 (Excel file)

1. Global overview: Downgrade due to tariffs

by Richard Grieveson

US tariffs on the rest of the world will be considerably higher than before Donald Trump took office for the second time. Germany’s fiscal U-turn is serious and will have material positive economic spill-overs for CESEE, mainly from 2026. The war in Ukraine will not end soon, but will gradually move towards at least a ceasefire during the forecast period.

2. Political risk: Endgame scenarios for the Ukraine war and their impact on CESEE

by Marcus How and Benedetta Locatelli

The Trump administration's push for a peace settlement in Ukraine raises concerns about European agency and sustained Western support, with three scenarios under consideration—a US-imposed deal, a Ukrainian collapse, or a prolonged conflict—each posing distinct risks for Ukraine and the CESEE region. The baseline outlook assumes continued warfare over the next two years, though shifting geopolitical dynamics may alter levels of support. CESEE remains vulnerable not only to direct spillovers from the war but also to Russian hybrid threats and internal political instability. A settlement favouring Russia or a Ukrainian collapse would allow Moscow to regroup, heightening the risk of conventional conflict in CESEE over the 2–5 year horizon. While Europe is advancing strategic autonomy through defence investments, aid to Ukraine, and industrial shifts—especially in Germany—progress is uneven, and reliance on US capabilities casts doubt on Europe's ability to solidify its role amid growing geopolitical pressures.

free download

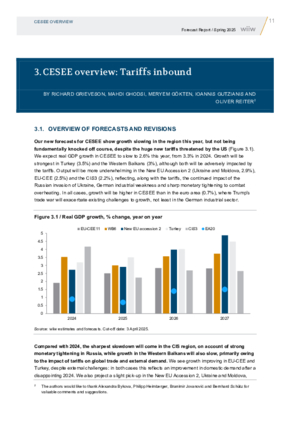

3. CESEE overview: Tariffs inbound

by Mahdi Ghodsi, Meryem Gökten, Richard Grieveson, Ioannis Gutzianas and Oliver Reiter

CESEE faces a more challenging economic landscape in 2025, due primarily to the fallout from the new US tariffs. Although the CESEE economies remain resilient, regional GDP growth will slow to 2.6%, down from 3.3% in 2024. Growth has been revised downward for 19 of the region’s 23 countries. The sharpest slowdowns are expected in the CIS sub-region (due to monetary tightening) and the Western Balkans (due to weakened external demand). While CESEE’s direct trade exposure to the US is limited, its heavy dependence on the EU – particularly on Germany – renders the region vulnerable to indirect shocks, thus amplifying the negative effects of the trade war and the related financial market volatility. Inflation pressures remain high in much of CESEE, owing to rising food prices, energy price deregulation and wage growth, though trends vary significantly from country to country. Fiscal policy across the region reflects a balancing act between consolidation pressures and the need for increased public and defence investment.

The global economy is set to suffer from new US tariffs, which will remain above pre-2025 levels and drive trade disruptions, financial volatility, and a downgrade in euro area GDP this year. In CESEE, the tariffs and their spillover effects from the EU, especially Germany, will slow regional growth to 2.6% in 2025. Private consumption and investment continue to support growth, but exports will struggle amid the US-led trade war. Political instability, unresolved conflicts, and ongoing risks from the war in Ukraine—compounded by the potential for an unfavourable settlement or Ukrainian collapse—pose additional threats to CESEE’s economic outlook and regional security.

Reference to wiiw databases: wiiw Annual Database, wiiw Monthly Database

Keywords: CESEE Central and Eastern Europe, economic forecast, Western Balkans, CIS, Ukraine, Russia, Turkey, EU, business cycle, economic sentiment, euro area, convergence, labour markets, unemployment, Russia-Ukraine war, commodity prices, inflation, price controls, trade disruptions, renewable energy, gas, electricity, monetary policy, fiscal policy, impact on Austria

JEL classification: E20, E21, E22, E24, E32, E5, E62, F21, F31, H60, I18, J20, J30, O47, O52, O57, P24, P27, P33, P52

Countries covered: Albania, Austria, Belarus, Bosnia and Herzegovina, Bulgaria, Central and East Europe, CESEE, CIS, Croatia, Czechia, Estonia, Euro Area, European Union, Hungary, Kazakhstan, Kosovo, Latvia, Lithuania, Moldova, Montenegro, North Macedonia, Poland, Romania, Russia, Serbia, Slovakia, Slovenia, Southeast Europe, Turkey, Ukraine, US, Western Balkans

Research Areas: Macroeconomic Analysis and Policy, International Trade, Competitiveness and FDI

ISBN-13: ISBN 978-3-85209-081-8